Chinese Stocks Surge After Beijing Vows New Tools, Policies To Spur Growth

Another day, another solemn promise by China to prop up its careening economy and crashing markets.

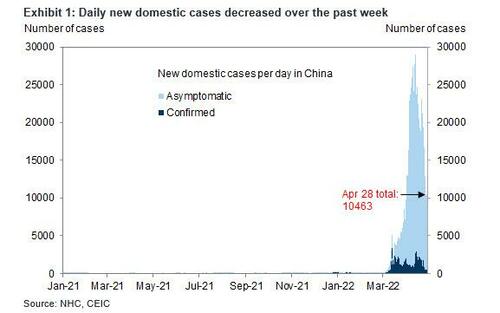

On Friday, China’s top leaders – after pushing a doomed deleveraging campaign for the past two years, one which crippled the country’s housing sector and nuked Chinese stocks – promised (again) a series of new policy promises to boost economic stimulus to spur growth and vowed to contain the country’s worst Covid outbreak since 2020, which is threatening official targets for this year, yet one whose intensity is already fading as the chart below shows.

“We should waste no time in planning more policy tools and enhance the strength of adjustment in due course,” the Communist Party’s Politburo said this morning, according to a meeting readout by state broadcaster China Central Television.

Authorities should efforts be made to ensure economy grows in reasonable range and i) strengthen macro adjustments, ii) support healthy growth of platform companies, iii) plan for incremental policy tools, iv) make efforts to boost domestic consumption and v) boost healthy development of the property market. While officials repeated the phrase that “houses are for living in not for speculation,” the government said it would also work to meet the demand for better quality housing and “optimize” the supervision on developers’ income from project pre-sales.

Leaders also vowed to guarantee “supply chains in key sectors” and smooth transport logistics, pledging to “positively respond” to demands from foreign-invested companies for a smoother business operating environment.

The latest stimulus promise comes just days after China’s president Xi highlighted infrastructure as a big focus for the government as growth comes under pressure, a pledge reiterated by the leadership meeting today.

Top leaders also nodded to the recent rout in financial markets. The Politburo said the government would steadily facilitate the reform of registration-based initial public offerings, actively introduce long-term investors and maintain the stable operation of capital markets.

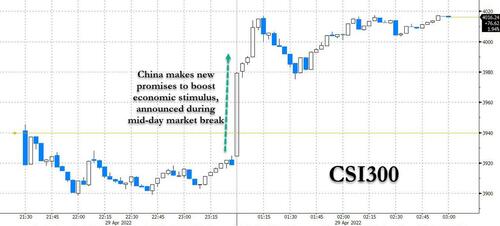

The midday timing of the announcement was unusual – Bloomberg notes that Politburo readouts are typically made public late in the afternoon or during the CCTV’s flagship evening news program – but this one clearly was meant to impact the market. This is how Bloomberg’ April Ma explained it:

The statement came during the market mid-day break, just as rumors of more support for tech and the economy started to brew. This was an exception to the norm of the release after market hours, closer to 6pm or 7pm. It wouldn’t have taken much for authorities to hold the statement for the evening. But then that would be missing the opportunity to spur afternoon gains just ahead of a five-day break from trading.

Triggering a pop with a subtle turn in the official line, mentioning support for economic goals and drawing a conclusion to crackdowns, would do sentiment a fair amount of good. Letting the craziness of the past week end on a slightly more positive note, and then making sure that confidence sinks in and spreads during the break, might be just what the market needs. This is far more efficient than a release at the traditional hour that would then get buried or forgotten after a holiday.

Sure enough, a lunchtime announcement gave markets an opportunity to react: The benchmark CSI 300 Index rose to its session high after trading resumed in the afternoon, gaining as much as 2.5%.

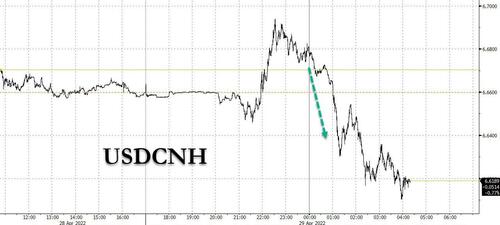

The offshore yuan reversed its earlier weakness to strengthen as much as 0.65% at 6.6166 per dollar.

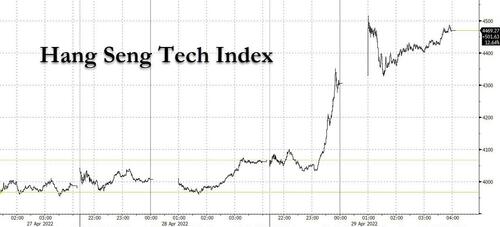

The bullish wave quickly spread across Asia, where stocks climbed for a second day with the MSCI Asia Pacific Index advancing as much as 1.7%, with Tencent and Alibaba among the biggest gainers.

As Bloomberg notes, there was also a small shift in language on internet platform businesses, a sign of possible easing of a regulatory crackdown on the industry. China’s top economic official Liu He in March called on regulators to “steadily advance and complete as soon as possible the rectification of large platform companies”. The Politburo vowed to “complete the special rectification of the platform economy,” without giving a timeline but dropping the phrases “steadily advance” and “as soon as possible.”

Separately, China was also said to discuss allowing on-site audit checks of New York-listed Chinese companies to comply with U.S. law. As a result, the Hang Seng Tech Index soared more than 10%, rebounding from earlier losses…

… and helped push US equity futures near session highs after slumping earlier following disappointing earnings from Amazon.

While the statement didn’t hold any “big surprise on the upside,” it wasn’t disappointing either, according to UBS economist Tao Wang said.

“It made clear on where policy support are needed,” she said. “Property, infrastructure and platform economy are highly concerned by the market, and they are also sectors that can have an multiplier effect to drive economic growth.”

Beijing has set a growth target of about 5.5% for the year, a goal that’s becoming difficult to reach amid a wave of coronavirus infections and Beijing’s strict adherence to its Covid Zero strategy. Economists forecast gross domestic product to grow just 4.9% this year. The Politburo gave no sign, though, that the country would back down from Covid Zero.

“The contradiction now is they will stick to Zero Covid policy. That’s a big constraint,” said Chen Long, an economist at Beijing-based consultancy Plenum. Home sales, for example, did not rebound despite property restrictions being relaxed in many cities, he added.

Of course, this is not the first time Beijing has made promises only to disappoint in deeds. Chinese officials have promised greater support for the economy in recent weeks. Before the Politburo statement, those pledges culminated in a call from Xi on Tuesday for an “all out” infrastructure commitment to bolster growth, including construction in fields such as transport, energy and water conservation.

“These are good words, the question is how they will deliver,” Chen said of the Politburo statement, but added that“we need to see action in the next few weeks.” Markets, which for the time being have again given Beijing’s jawboning the benefit of the doubt surely agree.

Tyler Durden

Fri, 04/29/2022 – 04:30

via ZeroHedge News https://ift.tt/aBTKtlD Tyler Durden