The Economics Of Kart Racing

By Russell Clark of The Capital Flows and Asset Markets substack

As mentioned previously, stepping away from managing money has allowed me more time with other parts of my life. But these different areas have also opened my mind to various other ideas, so I would like to share some details. One area that takes up an awful lot of my time is my son’s karting career (Instagram : jarrettclark55 – please follow. It brings him untold joy to have more followers!). There are many, many stories that I could tell you about karting, but I am just going to focus just on the economics, as I think it illustrates many of the potential flaws with many “quality” stocks.

Jarrett is competing in the British Championships Honda Cadet Class this year. Many of the current Formula 1 drivers have competed in British Karting Championships. It is highly competitive, with races held all over the UK. You can see below, the chassis, tyres and engine are all specified.

To try and make karting fair, all of the equipment is regulated. Race tyres have to bought from the organiser on the day and a set costs £150 or so, and chassis can be bought from a number of different providers with a new one costing around £2,500. Engines however are far more variable. If, like me, you knew nothing about karting before starting, you might have googled 160cc 4-stroke engine to get an idea of how much that costs, and then estimated the cost of an engine at around £250 to £400.

However, the reality is that there is a lot of variation in the power of the Honda engines when the leave the factory, some have good “bottom” (i.e. good acceleration) while some have good “top” (i.e. a very fast top speed). What in practice happens, is that engines with a proven history of winning trade a large multiple of their ex-factory price. Think of a number and triple it, and you will be closer. You also need three to four engines – one wet engine, one dry engine, and one practice engine. You may ask if people will really pay that much money for an engine? The way I explain it to people, is imagine the most insane football mum or dad you have ever seen, the one who is shouting non-stop at the ref, and their own kids and is totally emotionally committed to their child making it in football. Now imagine if you came up to them and said, “Hey I have magic football boots which means your child will be competitive with the best kids in the country. Would you like them?”. If you can imagine that conversation, then you can understand why competitive karting engines are so expensive. Almost all karting parents are totally emotionally committed to their child making it, so demand is very strong.

However, the value of the engines are subject to changes in regulations. A few years ago the British Karting Championship was run under a pooled engine system, which meant every driver had to rent an engine at random on the day of the event. The pooled engines were all adjusted to be roughly the same level, but there will still be some variation. And there is a alternative karting championship which is run under those rules, but the British Karting Championship is the official competition and has the largest participation and gets the best racers. In some European countries in some racing classes, karting regulations are such that the winner of a kart race must sell their engine to anyone that wants it at fixed price. This acts to keep a ceiling on engine prices.

There are some advantages to not regulating engines. The Honda Cadet is an entry level for karting, so many novice karters begin racing at this level, and by making fast engines expensive allows the older more experienced karters to battle it out far away from the novices. It also acts as a barrier to entry, to reduce competition. Hence like most regulation, it benefits insiders at the detriment to outsiders.

UK Motorsport are contemplating changes to karting for next year, which has caused us to be underwater on our own engines on a mark to market basis. We may end up being forced sellers at a loss, but having talked to some more experienced people than myself, there is a chance that no changes will occur and the engines will bounce back in value, as this is exactly what happened a few years ago. I was told off one specific engine fell to 80% in value, before fully recovering.

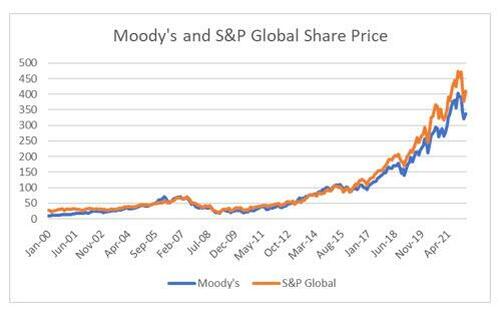

There are other expenses and considerations, and if there is demand for a post purely on the costs of being a karting parent, I will try and oblige. But the point of this story is to show how regulatory schemes create “undeserved” value. Does this happen in markets? Of course it does. The best possible example of this, are the rating agencies, specifically Moody’s and S&P. I will go into detail of how bad these companies are at their core business, but first of all you should be aware that from a financial perspective, both business are high “quality” and have been 10 baggers since 2010.

However, the reality of their key service, providing ratings for fixed income securities is that they largely produce a pointless and typically bad product. The rating agencies were the root cause of the global financial crisis, by giving investment grade ratings to CDO and other structured finance products, when in fact they were worthless. However, in the move away from investment banks to clearinghouses, the rating of a bond by the rating agencies became even more important to markets, not less important.

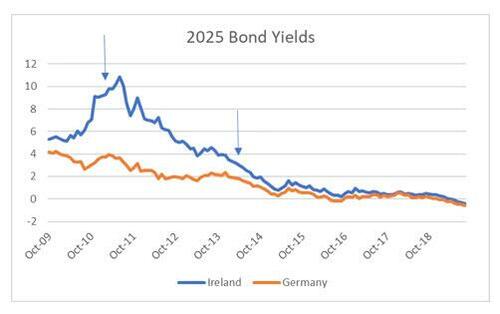

If the subprime was a one off, perhaps this would be excusable, but rating agencies typically downgrade bonds at the worst time, and upgrade too late. A classic example of this was the Eurocrisis. In 2010, the first arrow indicated when Irish bonds were downgraded to junk. The second arrow indicates when the rating agencies upgraded Ireland to investment grade. That the rating agencies follow market action, rather than have any predictive power is well known by market participants. Or to put it another way, the market does a far better job than the rating agencies – but regulators requires bond issuers to have a rating from a rating agency, despite the market doing a far better job of pricing risk.

The rating agencies have a dream business. Government regulations create forced buyers of a substandard product. I would argue that clearinghouses are in very similar position, doing a substandard job, but with regulations creating forced buyers of their substandard services.

I have used the karting analogy for two reasons.

-

Firstly, I want to make the point that politics, as expressed through regulation is a very powerful force in market. The ability to influence regulation is a very powerful value creator for many businesses, particularly in America. Healthcare, aerospace, utilities, finance and recently semiconductors are all deeply influenced by regulation and politics, and area that I have previously ignored.

-

The second reason is that future posts are going to refer to some investment ideas that I have gleaned from travelling around the country as I help my son with his karting career. I thought if I suddenly start talking about market observation I picked up at a Premier Inn in Sunderland, the most immediate question would be why was there, rather than the merit of an investment idea.

And my next post will indeed be about an investing observation I made while on a karting trip to Sunderland.

Tyler Durden

Fri, 04/29/2022 – 19:00

via ZeroHedge News https://ift.tt/gOx5Hsy Tyler Durden