$2 Billion Hedge Fund Loses Nearly Half After Carvana Plummets 75% In 2022

For a vivid example of a hedge fund that prospered and grew, expanding relentlessly with the blessings of the Fed’s ZIRP and QE but now that QE is on idefinite hiatus and the Fed’s put is gone and successful “investing” actually requires more skill than just putting cash into high beta names and praying that the Fed will keep BRRRRing, is imploding look no farther than CAS Investment Partners, a Westport-based hedge fund which had “grown” more than 1000% sine its inception in October 2012 yet which has lost nearly half of its assets in just the past four months, thanks to a heavily concentrated portfolio of stocks, but mostly novelty used care dealer Carvana.

CAS – which is based on the initials of its 40-year-old founder, Clifford Sosin – had built up a huge (for a smallish hedge fund) 3.3 million share stake in Carvana in 2019 and early 2020, one which grew to over $1 billion in August 2021 when CVNA stock topped $350 and accounted for a quarter of the fund’s AUM as of March 31. However, since then things have gone from bad to worse, and after dropping to $250/share by year-end, Carvana has plunged another 75% in 2022, before tumbling another 10% on Friday as traders grow concerned that the company equity may be worthless and a debt-for-equity swap is inevitable (and there is a lot of debt to be swapped) especially if the used car market is just now starting to crack.

The crash in CVNA shares, and the resulting collapse in the CAS hedge fund, must have prompted a barrage of angry and or concerned investors phone calls, which culminated on Friday in a 25-page letter (attached below) written by Sosin, in which he writes (over and over) that Carvana’s troubles are transitory and that all will be well soon: “Carvana’s challenges, especially when coupled with the precipitous decline in its stock price, clearly seem terrifying,” Sosin wrote in the Friday’s letter. However, “I believe that in due time we will look back at them as bumps in the road on the company’s path to success.”

Sosin, who started his career in the Houlihan Lokey restructuring group in 2004, then worked at Silverpoint and UBS before starting off on his own in 2012 – declined to comment to Bloomberg.

Carvana, which was once a pandemic darling, has since fast fallen out of favor. Its first-quarter results revealed a deepening cash burn, stemming from surges in used-vehicle prices and capital spending. Meanwhile, after peaking a few months ago, used car prices appear set to plunge in the coming months now that the US consumer is fully tapped out.

Used car prices. pic.twitter.com/O6R6iLHRH8

— zerohedge (@zerohedge) April 12, 2022

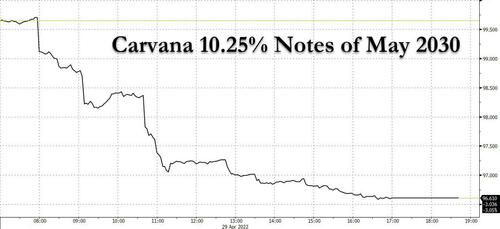

Adding insult to injury, earlier this week Carvana struggled to raise $3.3 billion in the junk bond market and had to revamp a junk-bond offering, adding a bankruptcy-friendly make whole provision.

Not looking good for CVNA https://t.co/itWOMmB6as

— zerohedge (@zerohedge) April 27, 2022

Those new bonds tumbled to 96 cents on the dollar in their first day of secondary trading even after Apollo Global swooped in to buy roughly half of the sale…. or rather because Apollo swooped in, in a move many speculate is a signal Apollo will control the fulcrum security, and thus the post-reord equity, in the coming Chapter 11 filing.

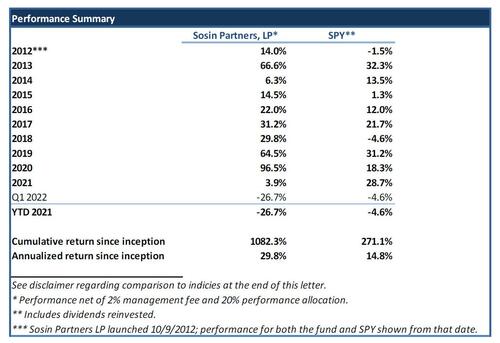

And while we wait for the (used) wheels to come off the Carvana bullish narrative, we go back to what we said at the top, namely how this story may be indicative of the reversal of fortune for “hedge” funds who never actually had to hedge, or do any work for that matter in a world where the Fed did all the work for them, and how now that the Fed is no longer there holding hands, how everything is imploding. Indeed, as Bloomberg notes, “for CAS, 2022 is a stark contrast to its previous performance. Its fund hasn’t had a down year since launching in October 2012, and in 2020 it returned a record 96.5%.”

Desperate to avoid a flood of redemptions, in his 25-page letter Sosin focused entirely on Carvana, and acknowledged its weak unit volume, but said it should accelerate when the industry normalizes (which may take a while since the US economy is only just now entering a recession). He added that the company should generate profits of $100 million annually from its acquisition of Adesa Inc.’s U.S. car-auction business, which was financed with this week’s debt offering. Then again there is the $600 million in interest expense:

“While the company’s $600 million of annual interest expense is largely fixed, and a certain level of fixed/ overhead costs are necessary to run the company, the company’s growth investments are under the management’s control.”

Still, Sosin refuses to cut and run, writing that “Carvana has a great deal of latent margin potential,” and adding that “this potential should allow the company to pursue its growth ambitions, albeit at a slower pace of expansion, without meaningfully accessing the capital markets or counting on a significant used-vehicle industry recovery.”

For now, the market clearly disagrees.

But if Sosin fast and furious reversal of fortune is bad, it’s nowhere near as bad as the billionaire father-son duo behind the Phoenix-based Carvana. Ernie Garcia II and Ernie Garcia III have lost almost $14 billion combined so far this year, according to the Bloomberg Billionaires Index. The younger Garcia, the company’s chief executive officer, has lost about 73% of his net worth since the start of 2022.

The senior Garcia began selling Carvana shares in late October 2020 as they climbed to around $200 each from their pre-pandemic level of about $90. The stock closed Friday at $57.96.

“If Carvana works out as well as it could, they might be among the richest people on the planet,” Sosin told Bloomberg in a 2019 interview. Three years since that remark, he said the company still has a bright future.

“I am not immune to mistakes, and I promise that when I eventually make a doozy I will put it here at the top of this letter,” Sosin wrote. “In this case, however, I do not believe I have.”

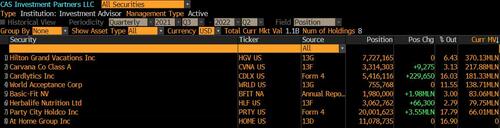

For those who disagree, here is a list of CAS’s holdings: if and when the margin calls and forced selling comes, these are the names that Sosin will rush to liquidate to avoid a collapse of his hedge fund. Which is why others may decided to sell them first.

Sosin’s full Carvana letter is below.

Tyler Durden

Sat, 04/30/2022 – 18:00

via ZeroHedge News https://ift.tt/V7FxMq0 Tyler Durden