Futures, Bonds Rise Ahead Of Critical CPI Print As Chinese Covid Fears Fade

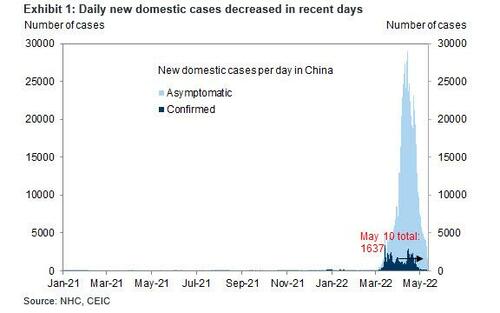

US index futures and European stocks were set to extend their recovery from the longest streak of weekly declines since 2011 ahead of an inflation report that was expected to show prices cooled in April, while falling bond yields supported battered tech stocks; Asian equities also advanced, halting a seven-day slide, as new Covid cases tumbled in Shanghai with the local government saying there was basically no COVID community spread in 8 of 16 districts, and the Chinese covid scare appears set to fade.

S&P 500 futures were trading at session highs, up 1.2%, and Nasdaq 100 futures were up 1.4%, while Europe’s Stoxx 600 climbed for a second day. The dollar fell and Treasury yields slumped, with the 10Y trading a 2.91%, a 30 basis points slide in the past three days, providing further support for high duration tech names. US-listed Chinese stocks rallied in New York premarket trading after the Asian nation reported easing Covid cases. Tech stocks also climbed in Hong Kong and Europe on Wednesday.

In less than an hour, investors will be analyzing the latest US consumer price index reading, due out at 830am ET, which is expected to show price gains moderated in April, for clues on the Federal Reserve’s pace of monetary tightening (full preview here).

“A soft inflation read will come as a relief that the Fed doesn’t need to get much more aggressive to bring inflation back towards its 2% policy target,” said Swissquote Bank’s Ipek Ozkardeskaya. “If however, inflation hasn’t pulled lower as expected — and worse, if we see a higher figure than last month print — we would see another big wave of selloff.”

The “bar is low” for a surprise from the US data amid ebbing consumer sentiment, according to Brent Schutte, chief investment strategist at Northwestern Mutual Life Insurance Co. “Things are going to be just a bit better at the margin,” he said. “The Fed overall is going to tighten less. That will lead to a market that begins to find its feet and move higher in coming quarters as inflation does come off the boil.”

Technology shares have been leading the selloff as higher interest rates mean a bigger discount for the present value of future profits, hurting frothy growth stocks that have been among the past years’ best performers. Even though the Nasdaq 100 rose yesterday, it was trading near its November 2020 low and is down 24% this year.

In premarket trading, Coinbase shares plunged as much as 18% after posting revenue for the first quarter that fell short of estimates. Occidental Petroleum shares were up after adjusted earnings per share for the first quarter beat the average analyst estimate. US-listed Chinese stocks gained as declining Covid cases in Shanghai lifted hopes for a ease in lockdown measures, boosting risk appetite. Embark Technology shares jumped 31% in US premarket trading, after the self-driving truckmaker reported a smaller net loss per share for the first quarter, with KeyBanc saying the firm is seeing “steady progress.”

Here are the biggest premarket movers today:

- Occidental (OXY US) shares rise 1.7% in US premarket after adjusted earnings per share for the 1Q beat the average analyst estimate. The company demonstrated its ability to deleverage its balance sheet, analysts said

- Chinese stocks rose in premarket trading as declining Covid cases in Shanghai lift hopes for an ease in lockdown measures, boosting risk appetite. Alibaba (BABA US) was up 2.7%, JD.com (JD US) +2.5%, Pinduoduo (PDD US) +2.9% and Baidu (BIDU US) +3.6%.

- Embark Technology (EMBK US) shares jump as much as 31% in premarket, after the company reported a smaller net loss per share for the 1Q, with KeyBanc saying the firm is seeing “steady progress”

- Exicure (XCUR US) shares rise 48% in US premarket after the early-stage biotechnology company announced a $5m sale of common stock in a private placement at a premium to the last close

- Peloton (PTON US) shares up 3.3% premarket after closing at its lowest level since going public in September 2019. Analysts slash price targets as they expect the turnaround process to take time, but they maintained their recommendations on the stock

- Unity Software (U US) shares slump as much as 30% in U.S. premarket trading, after the 3D game-development company reported its 1Q results and gave a 2Q revenue forecast that was weaker than expected

- View (VIEW US) shares tumble 54% in premarket trading after the company delayed its 10-Q filing and said it expects to disclose substantial doubt about its ability to continue as a going concern

- Coinbase (COIN US) shares plunged as much as 18% in premarket after posting worse-than-expected revenue for the 1Q, with analysts pointing to drops in crypto prices impacting the firm’s earnings and outlook

- Roblox (RBLX US) shares were down 1.6% in premarket as its user growth in North America was slightly negative for the second straight quarter, KeyBanc analyst Tyler Parker says, adding that he continues to see significant growth internationally

Despite the gains, sentiment remains fragile as investors seek evidence that price pressures are peaking in the global economy. US data later Wednesday may show inflation moderated in April but stayed above 8%. Traders will use this information to weigh whether the Fed can continue with its half-point hikes as expected or will need to opt for a three-quarter-point increase (or reverse hiking once the US slides into recession). In other words, there’s a lot riding on the inflation figure, Esty Dwek, CIO at Flowbank SA, said in an interview with Bloomberg TV. Still, “the Fed is going to need to see a number of months of lower inflation before they start to even consider taking their foot of the pedal.”

In Europe, the Stoxx 600 Index was 1.2% higher, with consumer products and mining stocks leading the gains. The CAC outperforms, rising as much as 2% back to Monday’s best levels. Health care stocks underperformed as Roche Holding slumped as its cancer medicine billed as a potential blockbuster failed in a study on patients with the most common form of lung cancer. Here are some of the biggest European movers today:

- Compass shares gain as much as 12% after the catering company reported 1H results that beat estimates, increased its FY revenue forecast and announced a buyback.

- European tobacco stocks rise after Philip Morris offered to buysmokeless tobacco company Swedish Match in a $16b transaction. Swedish Match +9%, Imperial Brands +1.3%, BAT +1%

- European luxury stocks outperform as investors anticipate improving demand from easing virus cases in China.

- Kering +3.4%, Hermes +2.8%, Swatch +5.1%

- Pirelli gains as much as 3.6% in Milan trading after posting what Deutsche Bank called a “good” 1Q with a very strong price/mix.

- HomeServe rises as much as 14% amid a Bloomberg report that Brookfield Asset Management is near a $5 billion deal for the emergency household repairs provider.

- Roche falls as much as 7.2% on news that the Skyscraper-01 trial for the lung cancer drug tiragolumab missed co-primary endpoints.

- Bayer slides as much as 7.6% after the Biden administration recommended the US Supreme Court reject a California Roundup appeal.

- Alstom declines as much as 11% to erase gains made earlier in the session after full-year results.

- K+S falls as much as 7% after the potash producer’s 1Q free cash flow was hit by cash out on CO2 certificates, and negative factoring effect, Baader says.

Earlier in the session, Asian equities advanced, halting a seven-day slide, as new Covid cases fell in Shanghai and global appetite for risk improved. The MSCI Asia Pacific Index rallied 0.4% as tech giants Tencent and Alibaba climbed alongside consumer discretionary shares. China’s CSI 300 Index led gains in the region after Shanghai reported fewer daily infections Tuesday and zero cases found in the community. Shanghai Reports No Community Spread as Infections Halve Asia’s benchmark is set to end its longest losing streak since March 2020. The gauge has lost more than $2 trillion in value since a January peak, amid concerns over China’s Covid-Zero stance, inflation and U.S. interest rates. “Asia and EM equities are entering the late stages of a bear market that has traversed valuation, regulation, geopolitics and supply chain pressures,” Morgan Stanley strategists including Jonathan Garner wrote in a report. The firm prefers Japanese shares, due to their return ratios, and Southeast Asian stocks that benefit from higher inflation. Asia’s equity gauge reversed a 0.5% loss as investors awaited the release of U.S. consumer-price index data due later today. Benchmarks in the Philippines and Singapore were among the worst performers in the region.

India’s key equity gauges declined for a fourth day as quarterly earnings showed surging inflation eroding profit growth of top companies. The S&P BSE Sensex fell 0.5% to 54,088.39 in Mumbai to stretch its 4-day decline to 2.9%. The NSE Nifty 50 Index lost 0.5% on Wednesday. The key gauges have declined in all but one session this month. Fifteen of the 19 sector sub-indexes compiled by BSE Ltd. retreated, led by gauges of capital goods and information technology stocks. Of the 28 Nifty 50 companies that have announced results so far, 11 missed estimates and 17 matched. Cipla and Asian Paints were the latest to report profits below the consensus view after market hours on Tuesday.

“Lack of fresh positive cues is forcing investors to dump equities and switch to safer havens like gold,” according to Shrikant Chouhan, an analyst with Kotak Securities. He expects a sharp pullback in key indexes as they are already trading in oversold territory and sees 16,000 as a key support level for the Nifty 50 index. Infosys contributed the most to Sensex’s decline, decreasing by 1.7%. Out of 30 shares in the Sensex index, nine rose and 21 fell.

In FX, the Bloomberg Dollar Spot Index fell after trading near a recent two-year high as the greenback weakened against all of its Group-of-10 peers. Risk-sensitive Scandinavian and Antipodean currencies led gains as traders positioned ahead of the US inflation data. Treasuries rallied, sending yields up to 7bps lower. The euro traded in a narrow range around $1.055 and European bonds rallied, with the periphery outperforming the core. Australian and New Zealand dollars were bought to reduce short positions against the greenback. Australia’s consumer confidence index fell 5.6% from a month ago to 90.4, the lowest since Aug. 2020, according to a report.

In rates, Treasuries rallied for a second day ahead of today’s CPI print and 10Y TSY auction. Yields were richer by as much as 6bp in belly of curve which bull-steepened, and tightened the 2s5s30s fly by 4bp on the day to lowest levels since late March; 10-year yields around 2.925%, outperforming bunds and gilts by 3.5bp and 3bp. The front-end lags with 2-year yields richer by ~3bp on the day, flattening 2s5s, 2s10s spreads by ~3bp. The US auction cycle resumes with $36b 10-year at 1pm ET, following well-bid 3-year Tuesday. WI 10- year yield ~2.92% is above auction stops since late 2018 and ~20bp cheaper than April’s, which tailed the WI by 3bp. In Europe, the fixed income rally also extended with 5y Germany richening ~6bps. Peripheral and semi-core spreads narrow with 10y Bund/BTP near 195bps. Gilts bull-flatten slightly with 2s10s narrowing back near 50bps.

In commodities, Crude futures advanced; WTI rose over 3% and back on to a $102-handle. Base metals are mixed; LME nickel falls 2% while LME copper gains 1.3%. Spot gold rises roughly $13 to trade near $1,851/oz. Bitcoin rises above $31,000.

Bitcoin has stabilised somewhat above the USD 30k mark after the recent bout of stablecoin induced pressure.

Looking to the day ahead now, and the main highlight will be the aforementioned US CPI reading for April. Otherwise, central bank speakers include ECB President Lagarde, as well as the ECB’s Nagel, Vasle, Makhlouf, Knot, Centeno, Muller and Schnabel, and the Fed’s Bostic. Finally, earnings releases include Disney.

Market Snapshot

- S&P 500 futures up 1.2% to 4,047

- STOXX Europe 600 up 0.9% to 423.91

- MXAP up 0.2% to 160.15

- MXAPJ up 0.4% to 525.66

- Nikkei up 0.2% to 26,213.64

- Topix down 0.6% to 1,851.15

- Hang Seng Index up 1.0% to 19,824.57

- Shanghai Composite up 0.8% to 3,058.70

- Sensex down 0.7% to 54,011.37

- Australia S&P/ASX 200 up 0.2% to 7,064.68

- Kospi down 0.2% to 2,592.27

- German 10Y yield little changed at 0.98%

- Euro up 0.2% to $1.0555

- Brent Futures up 2.8% to $105.34/bbl

- Gold spot up 0.5% to $1,847.30

- U.S. Dollar Index down 0.28% to 103.62

Top Overnight News from Bloomberg

- ECB President Christine Lagarde said a first interest-rate increase in more than a decade may follow “weeks” after net bond-buying ends early next quarter, joining a growing crowd of policy makers signaling a move as soon as July

- ECB Governing Council member Joachim Nagel says the exit from very accommodative monetary policy should be “swift enough to affect the price path and to prevent second-round effects and a de- anchoring of inflation expectations”

- ECB Executive Board member Frank Elderson said policy makers can begin looking at raising interest rates from record lows in July, downplaying the risk of a euro-area recession as the war in Ukraine saps growth and fuels already record inflation

- The UK escalated its threats over the post-Brexit deal for Northern Ireland, saying the European Union’s latest proposals on trading arrangements won’t work and signaling it’s prepared to take unilateral steps unless a new agreement can be negotiated

- The EU’s executive arm is set to bolster renewables and energy savings goals as part of a 195 billion-euro ($205 billion) plan to end its dependency on Russian fossil fuels by 2027

- For many of Sweden’s highly indebted consumers, the Riksbank’s sudden interest-rate increase at the end of April marks the start of a new squeeze that officials have long fretted about

- Czech policy maker Ales Michl, a vocal opponent of the central bank’s aggressive campaign to increase interest rates, was appointed to take over as the bank’s governor as the country struggles to contain its worst inflation in almost three decades

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the choppy performance on Wall Street. ASX 200 was subdued and briefly fell below the 7,000 level with sentiment dampened by weak Consumer Confidence data. Nikkei 225 swung between gains and losses with the biggest movers driven by recent earnings releases. Hang Seng and Shanghai Comp were both initially lacklustre as property developer Sunac faces its grace period deadline for a dollar bond interest payment and with participants digesting the latest firmer than expected CPI and PPI data from China, although Chinese markets then strengthened amid speculation of policy easing in Q2 and positive signs from the COVID situation in Shanghai.

Top Asian News

- Why China Is Sticking With Its Covid Zero Strategy: QuickTake

- Gray Market Hints at Tepid Trading Debut for Biggest India IPO

- Malaysia Surprises With Rate Hike to Head Off Inflation

- Defense Official Says Curfew May Be Lifted: Sri Lanka Latest

European bourses are firmer across the board, Euro Stoxx 50 +1.4%, with the exception of the SMI -0.2% given the performance of heavyweight Roche, -6.5%. Stateside, futures are bolstered though with gains marginally more contained going into today’s inflation data, ES +1.0%. China April vehicles sales -47.6% YY (-11.7% in March), according to the Industry Association; January-April -12.1% YY (prev. +51.8%). On Tuesday, CPCA says China sold 1.062mln passenger cars were sold in April which was -35.7% Y/Y. China’s Auto Industry Association says the industry’s development situation is gradually improving, firms are seeing May and June as the window to make up for lost sales and production.

Top European News

- Lagarde Joins ECB Officials Signaling July as Liftoff for Rates

- Siemens Energy Slides Amid Mounting Losses at Wind-Turbine Unit

- Ukraine, Russia Gas Clash Raises Threat to Europe’s Supply

- Bayer Drops After Supreme Court Urged to Reject Roundup Appeal

FX

- Greenback grounded in advance of US CPI as Treasury yields recede and curve re-flattens, DXY slips further below 104.00 and sub-103.50 vs fresh 2022 peak at 104.190 on Monday.

- Aussie rebounds with iron ore and other commodities, shrugging off a drop in consumer confidence along the way; AUD/USD back on 0.7000 handle, albeit just and AUD/NZD around 1.1050 even though Kiwi relieved with full NZ reopening at the end of July and NZD/USD rebounds towards 0.6350 in response.

- Franc and Yen appreciate the less bearish bond climate, Euro underpinned as ECB President Lagarde joins others in guiding towards July rate hike; USD/CHF sub-0.9000, USD/JPY under 130.00 and EUR/USD circa 1.0575 at best.

- Loonie and Nokkie boosted by crude recovery, Swedish Crown supported by sharp rise in 1 year CPIF money market expectations; USD/CAD below 1.3000 and closer to hefty option expiry interest at 1.2950 (1.9bln vs 1.7bln at the round number).

- Yuan on firmer footing after stronger than forecast Chinese inflation data, but Czech Koruna floored as President confirms appointment of a known dove to govern CNB; USD/CNH around 6.7400, EUR/CZK near 25.4000.

Fixed Income

- Latest recovery leg in debt lifts Bunds, Gilts and 10 year T-note to new WTD peaks, at 153.61, 119.69 and 119-09+ respectively.

- Solid covers at 10 year German and 7 year UK auctions given recent yield retreat, but some metrics show signs of investor reticence.

- Min focus ahead, US CPI data, but also USD 36bln T-note leg of refunding.

Commodities

- WTI and Brent are bolstered in excess of USD 3.00/bbl in a paring of recent losses alongside a positive turn in China’s COVID situation.

- Currently, WTI Jun resides around USD 103/bbl (vs low USD 98.20/bbl) whilst Brent Jul trades around USD 105.50/bbl (vs low USD 101.30/bbl)

- US Energy Inventory Data (bbls): Crude +1.6mln (exp. -0.5mln), Gasoline +0.8mln (exp. -1.6mln), Distillates +0.7mln (exp. -1.3mln), Cushing +0.1mln.

- Libyan PM Bashagha announces the success of efforts to reopen the ports and oil fields in Libya, according to Sky News Arabia.

- Brazilian truck drivers are considering a strike from May 21st to stop a 9% rise in diesel prices by Petrobras, according to Estadão.

- Spot gold and silver are firmer and benefitting from the USD’s continuing pullback to fresh WTD lows, albeit, the yellow metal is steady around USD 1850/oz pre-inflation.

Central Banks

- ECB’s Lagarde says we have not yet precisely defined the notion of “some time”, but I have been very clear that this could mean a period of only a few weeks. After the first rate hike, the normalisation process will be gradual. Judging by the incoming data, my expectation is that the (asset purchase programme) should be concluded early in the third quarter. Click here for analysis

- ECB’s Muller says APP should end early July or a few weeks earlier; rate hike must not be far behind; appropriate for rates to be in positive territory by year-end, moves should be in 25bp increments. Rise in spreads is consistent with the changed ECB policy outlook; current policy is inappropriately easy, given high inflation.

- ECB’s Elderson says they can start considering normalisation of the policy rate in July.

- ECB’s Vasle says that inflation is becoming more broad-based and the policy response must follow the changed circumstances; supports further and faster action.

- Czech President Zeman has appointed Central Bank member Michl as the new governor, as expected; Czech President Zeman says does not wish to see a large decrease in interest rates but does not see a reason for additional increases.

- CBRT cuts its RRR for financing companies until May 13th, will be implemented at 0.00% until this point, according to the Official Gazette.

US Event Calendar

- 07:00: May MBA Mortgage Applications, prior 2.5%

- 08:30: April CPI YoY, est. 8.1%, prior 8.5%

- April CPI MoM, est. 0.2%, prior 1.2%

- April CPI Ex Food and Energy YoY, est. 6.0%, prior 6.5%

- April CPI Ex Food and Energy MoM, est. 0.4%, prior 0.3%

- April Real Avg Hourly Earning YoY, prior -2.7%, revised -2.6%

- April Real Avg Weekly Earnings YoY, prior -3.6%, revised -3.5%

- 14:00: April Monthly Budget Statement, est. $220b, prior – $225.6b

DB’s Jim Reid concludes the overnight wrap

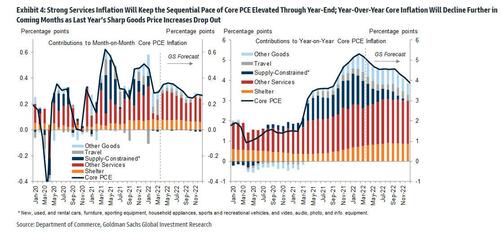

Markets have begun to stabilise over the last 24 hours following Monday’s rout, but there’s no doubt that risk appetite is still very subdued as worries about a potential recession gather pace. The S&P 500 eventually managed to post its first gain in 4 sessions (+0.24%) but only after spending half the day in the red. Today we get the all important US CPI report for April. This will be a very important one for markets and the Fed, since although policymakers have strongly signalled that they’re inclined to continue hiking by 50bps at the next couple of meetings, there is still 25/50/75bps to play for after those meetings. Today’s report will help shape the early read into this and has an ability to move markets in a large manner if diverging from consensus too far.

On that theme, we heard from an array of Fed speakers yesterday. The main takeaway was that +50bp hikes for the next few meetings is the preferred path, while at the margins the door was opened to consider larger hikes after that. For instance, Cleveland Fed President Mester (a voter this year) said that 75bps increases couldn’t be ruled out forever, and that the Fed could have to speed up in H2 if inflation didn’t ease, which coincided with the move into the red for US equities. Discussing another tool to help speed up that fight, she also noted the Fed could start selling asset holdings instead of letting them mature on their own which is currently the base case. Elsewhere Atlanta Fed President Bostic left the door open, saying that “everything is on the table”, but reinforced +50bp hikes were his preference for the next two or three meetings. Separately, New York Fed President Williams openly discussed the prospect that unemployment could rise as part of the Fed’s “soft landing”, saying that he “would not define a soft landing as unemployment staying at 3.6%”. He also mirrored the tone from Fed Chair Powell last week, who referred to a “softish” landing, which is certainly implying it might not be quite as smooth as they’d like in an ideal world, and speaks to the growing risks on the horizon.

Elsewhere on inflation, President Biden gave a speech on this hot topic, saying his administration is weighing whether to cut tariffs which have been in place since the Trump Presidency in order to help fight rising prices, but no decisions have been made.

So against that backdrop, all attention will shift over to the US CPI report for April today. Back in March, the year-on-year measure rose to a 4-decade high of +8.5%, but our US economists write in their preview (link here) that’s likely to have been the peak in the year-on-year measure, with today’s reading marking the start of a gradual move lower over the coming months. They see the year-on-year measure coming in at +7.9% as base effects from last year’s surge in used car prices begin to roll off. Meanwhile they see the month-on-month measure at just +0.05% thanks to modest declines in gasoline prices after their near 20% run-up in March. It’ll be important to keep an eye on whether inflationary pressures remain broad-based, so the housing components like rent will be ones to watch.

As discussed at the top, US equities stabilised ahead of the print, with the S&P 500 gaining +0.24%, thus bringing its YTD decline to -16.05%. However, tech stocks outperformed thanks to a decline in yields, with the NASDAQ (+0.98%) and the FANG+ index (+1.42%) seeing bigger gains. And Europe also put in a stronger performance, with the STOXX 600 up +0.68% to end a run of 4 consecutive daily declines.

For sovereign bonds it was a different story for the most part, as the prospect of a recession brought down inflation expectations and led to a decline in yields across multiple countries. Yields on 10yr Treasuries were down -4.3bps on the day to 2.99%, whilst those on 10yr bunds (-9.5bps), OATs (-9.9bps) and BTPs (-15.0bps) all saw sizeable moves lower as well, in spite of Bundesbank President Nagel’s endorsement of a July rate hike from the ECB. The main exception were front-end Treasury yields, with the 2yr yield ticking up by +1.2bps in light of the renewed chatter around 75bp hikes this cycle and a slightly more risk on day. This shift was also reflected in Fed funds futures, where the rate priced in by the December meeting rose +3.5bps yesterday, paring back a small amount of the -15.5bps decline on Monday.

Overnight in Asia, major stock markets are mostly higher, with the Shanghai Composite (+1.63%) and the Hang Seng (+1.78%) racing ahead of the Nikkei (+0.44%) and the KOSPI (-0.05%). Chinese markets got a boost after Shanghai reported zero community cases and a halving of new infections. Optimism on covid powered stocks despite upside beats on both the CPI (2.1% vs 1.8% expected) and the PPI (8.0% vs 7.8% expected) overnight. Elsewhere, S&P 500 futures (+0.37%) are also in the green and the US 10y yield (-0.4bps) is edging lower.

Oil has been volatile over the last 24 hours. Brent crude came down a further -3.28% yesterday, which means that it had lost just under $10/bbl over the two days so far this week whilst WTI (-3.23%) slipped back beneath $100/bbl. However this morning the two contracts are back up +2.85% and +1.75% respectively. The EU are continuing to work on further sanctions, and French President Macron spoke about energy security yesterday with Hungarian PM Orban, whose government have been resistant to stronger energy sanctions on Russia.

Here in the UK, we had the State Opening of Parliament yesterday where the government outlined its legislative agenda. One potential area to watch out for is on the Brexit side, since there have been reports that legislation will be proposed that overrides parts of the Northern Ireland Protocol, which is the part of the Brexit deal that avoids a hard border between Northern Ireland and the Republic of Ireland, but instead puts an economic border in the Irish Sea between Great Britain and Northern Ireland. The government’s own explanatory notes to the Queen’s Speech yesterday said that “the Protocol needs to change”, but there was a distinctly lukewarm reaction from the EU to this prospect, with Commission Vice President Šefčovič saying in a statement that “Unilateral action by the UK would only make our work on possible solutions more difficult” and that “renegotiation is not an option”.

On the data side, Germany’s ZEW survey for May saw the expectations indicator unexpectedly rise to -34.3 (vs. -43.5 expected), up from its 2-year low in April. However, the current situation measure fell by more than expected to -36.5 (vs. -35.0 expected), reaching its lowest level in a year. Elsewhere, Italian industrial production was unchanged in March (vs. -1.5% expected).

To the day ahead now, and the main highlight will be the aforementioned US CPI reading for April. Otherwise, central bank speakers include ECB President Lagarde, as well as the ECB’s Nagel, Vasle, Makhlouf, Knot, Centeno, Muller and Schnabel, and the Fed’s Bostic. Finally, earnings releases include Disney.

Tyler Durden

Wed, 05/11/2022 – 07:52

via ZeroHedge News https://ift.tt/43cVSbi Tyler Durden