Record Airfares And Soaring Food Prices: What’s Behind Today’s Surprise CPI Beat

Now that we’ve had the time to digest it, here is what we learned this morning.

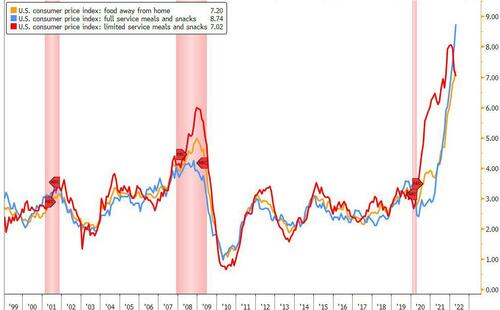

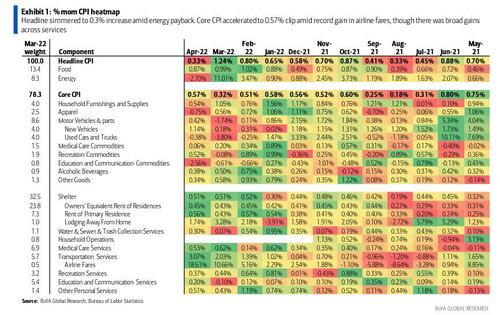

The BLS reported that headline CPI prices eased down to a 0.3% (0.33% unrounded) M/M clip from a blowout 1.2% print last month, though this was higher than expectations for a 0.2% gain. Energy prices slid 2.7% M/M as a pullback in retail gasoline prices led to a 5.4% drop in energy commodities, which was partially offset by a 1.3% increase in energy services (look for energy prices to jump again in May, now that gasoline is back to all time highs). Looking at the other notable components, food stayed hot as food at home climbed 1.0% mom and food away from home rose 0.6% mom.

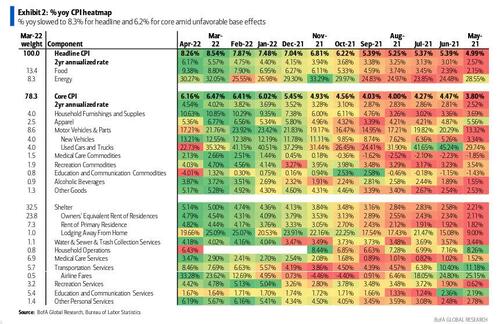

Coupled with negative base effects, Y/Y headline CPI slowed to 8.3% from 8.5% in March, with the latter month likely reflecting the peak in inflation even if the annual print was stronger than the 8.1% expected. Core CPI was an even stronger beat, rising 0.6% (0.57% unrounded) mom versus consensus at 0.4%. This led to the Y/Y rate dropping to 6.2% from 6.5%, reflecting the aforementioned unfavorable base effects.

A remarkable statistic from Brean Economics shows just how widespread the inflation was: “Of the 95 CPI components we can track back to 1998 (which cover 98% of the CPI) 63% show year-over-year price gains of 6% or more in April, which is the highest share on record.”

One of the main drivers of the upside surprise was a record 18.6% increase in airline fares, which added 13bp to core CPI alone and reflects a boost from reopening pressures. This contributed to a broader transportation services increase of 3.1% mom, with car truck rental and motor vehicle insurance prices also both rising 0.8% mom. Adding to the reopening theme, lodging gained 1.7% mom.

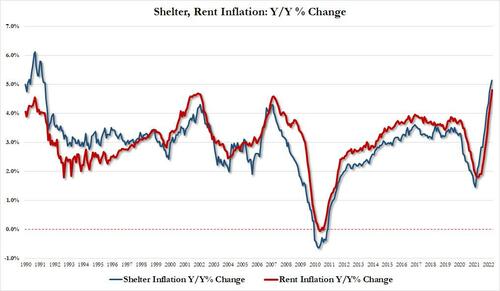

Even outside of the reopening-related categories, there were notable broad based gains across services amid tight labor markets and accelerating wages. OER rose 0.45% mom and rent of primary residence accelerated to 0.56% mom.

Medical care and other personal services both gained 0.5% mom, and recreation was up 0.4% mom. Water/sewer/trash and education/communication services both rebounded from negative readings in March to 0.3% mom and 0.2%, respectively.

Core goods was more mixed. On one hand, new cars rose 1.1%—the new methodology discussed earlier likely contributing to a stronger reading this month — household furnishings/supplies and recreation goods both rose 0.5%, alcohol was up 0.4% mom, other goods rose 0.3% mom, and medical goods edged up 0.1% mom.

On the other hand, education/communication collapsed 2.6% mom, apparel slid 0.8% mom, and used cars fell 0.4% mom. There have been mixed signs of progress on supply chains in the US, which can help explain the more mixed readings across goods.

Looking ahead, Bank of America notes that the Russia/Ukraine conflict and China lockdowns remains risks to commodity prices and global supply chain conditions, which could lead to further choppiness.

Overall, expect strong – if declining – core goods inflation through this year, around 5% by year-end. Overall, this was a noisy report given the move in airline fares, so some of the strength should be faded. That said, underlying inflation pressures remain elevated—and BofA recommends keeping an eye out on trimmed-mean/median later this morning—which should leave the Fed comfortable maintaining their front-loaded rate hiking path. The risks of a 75bps rate hike are low given the noise, but this report adds to the debate on the margin.

Finally, here is the visual breakdown of CPI on a monthly basis…

… and Y/Y.

Tyler Durden

Wed, 05/11/2022 – 10:35

via ZeroHedge News https://ift.tt/SEZoLex Tyler Durden