Biden Throws Powell Under The Bus For Soaring Inflation

It appears that not even progressive democrats are dumb enough to believe Biden’s glorious lie that Putin is to blame for the explosive inflation of the past year, best encapsulated by the farce that is this quote…

How about now? https://t.co/GDF1z9qVJY

— zerohedge (@zerohedge) May 30, 2022

… and so on Tuesday, the President – looking more dazed and confused than ever – used a rare meeting with Fed Chair Jerome Powell to declare that he’s “respecting the central bank’s independence” as if he would say anything else in public although everyone knows what really takes place in these private tete-a-tetes…

This is what happens when presidents meet with Fed chiefs in private https://t.co/2im2bCqJgC pic.twitter.com/UDnKFLAyNm

— zerohedge (@zerohedge) May 31, 2022

… while simultaneously taking this latest opportunity to shift responsibility for taming decades-high inflation ahead of the November midterms.

Biden seized on the Oval Office session to argue that while fighting price increases is his top priority, that work was primarily the purview of the Federal Reserve.

“My plan is to address inflation. That starts with a simple proposition: respect the Fed, respect the Fed’s independence, which I have done and will continue to do,” Biden said.

According to Bloomberg, it was Biden’s third in-person session with Powell since taking office, and recalls the stakes when Ronald Reagan met with then-Fed chief Paul Volcker almost four decades ago as he sought re-election amid galloping price pressure.

Biden has been attempting to show he’s maximizing efforts to curb the hottest inflation in 40 years – sparked by the Fed’s record money-printing and Biden’s stimmy-printing – heading into November midterms, in which Democrats are facing a historic avalanche.

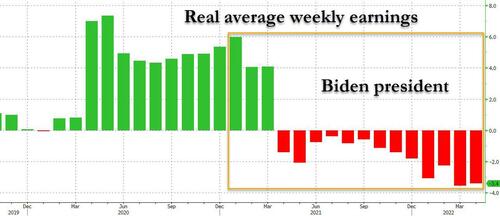

As Bloomberg also notes, the White House – realizing it is fighting a losing battle in a country where real wages have been negative for almost all of Biden’s tenure…

… has increasingly sought to shift the burden for battling prices to the Fed in public comments, as polls show rising costs are voters’ top concern. In an op-ed published Monday in the Wall Street Journal, Biden said the Fed has “a primary responsibility to control inflation.” A Gallup poll found that 18% of Americans – the most since the early 1980s – found inflation to be the most important problem facing the US.

Biden said Tuesday that his his role as president is to give the Fed “the space they need to do their job, adding, “I’m not going to interfere with their critically important work” while also implying that if the Fed fails to tame inflation, it’s not his fault either.

Biden set the stage for today’s meeting with Powell by writing an at-times surreal WSJ op-Ed in which he sought to draw a contrast with Trump – who regularly slammed the central bank, arguing it should have been more aggressive in cutting interest rates and praised it every time the market rallied – writing that his predecessor “demeaned the Fed, and past presidents have sought to influence its decisions inappropriately during periods of elevated inflation. I won’t do this.”

The president’s message to the Fed in Tuesday’s meeting was that he “plans to stay out of their way,” Cecilia Rouse, chair of the Council of Economic Advisers, told Bloomberg Television.

“The President wants to say, go forth and do what you need to do,” Rouse said, leaving open the question what the meeting was called for in the first place.

White House economic adviser Brian Deese defended Tuesday’s meeting, saying it was “standard practice for presidents and chairs of the Federal Reserve to meet from time to time to share views on the economy.”

Biden will use his session to stress that he’s giving the central bank “space to operate” independently to address the inflation crisis, Deese, who attended the meeting along with Treasury Secretary Janet Yellen, said in an interview with Bloomberg Television earlier Tuesday.

And while Trump flatly ignored past practice and regularly castigated Powell for raising interest rates, calling him “clueless” and asking if he was a “bigger enemy” than Chinese President Xi Jinping, it is true that neither inflation rose under his admin.

And while it is certainly the case that Biden’s helicopter money stimulus has been behind much of the inflation impulse, it is also true that Powell is not blameless: the Fed chair, who erroneously called inflation transitory for much of 2011, and as has been criticized for being too slow in confronting inflation, has also called taming inflation his top priority and has launched the most aggressive tightening campaigns in decades.

At the same time, nobody will call Powell the second coming of Volcker either: as Morgan Stanley’s chief strategist Michael Wilson said earlier, he believes that there is one major difference between this Fed and the Volcker Fed that Powell appears now to be trying to emulate to fight inflation— this Fed remains beholden to the idea that they can’t surprise the markets too much.

Perhaps that has changed a bit with Chair Powell’s recent congressional testimony during which he expressed the Fed’s resolve to quash inflation, but as even Wilson admits, “the Fed is still unlikely to go cold turkey” and pretty much everyone on Wall Street agrees. That said, investors may be underestimating the Fed’s willingness to shock markets if necessary to achieve its inflation goals, according to Wilson, who however seems to ignore the collapse in housing, and reports of peak inflation and the upcoming crash in the labor market.

As for whether Biden’s “strategy” of punting all responsibility for everything that goes wrong with the economy onto others, first Putin and now Powell, works we’ll just have to wait until November to find out. Here’s an advance look:

Tyler Durden

Tue, 05/31/2022 – 17:20

via ZeroHedge News https://ift.tt/CJhZmtr Tyler Durden