“Just Another Bear Market Rally”: Mike Wilson Spoils The Bulls Party, Sees Just 5% More Upside

With the S&P tumbling as low as 3,800 just over a week ago, briefly triggering a bear market, before exploding higher in yet another furious bear market rally, one may think that Wall Street’s (second) most bearish strategist (after BofA’s Michael Hartnett), Michael Wilson, is content with the market collapsing in line with his weekly prophecies of doom and gloom, and is finally calling for a bounce. No such luck: in fact, in his latest weekly note (available to pro subs in the usual place), Wilson first takes yet another victory lap writing that “consensus is now more in line with our bearish outlook”, and using that as his basis, asks rhetorically “what’s the bull case?” His answer: “outside of a peace agreement in Ukraine, it’s difficult to construct a case for more than a bear market rally” which according to Wilson could at best push stocks another 5% higher, and the main reason for his downbeat view – his gloomy view on the state of the US consumer who “remains focal point for whether recession is coming” (and as we discussed last week, it is).

Let’s go over his arguments, starting at the top, namely Wilson’s contention that “over the past few months, many clients, competitors and commentators have moved into our more bearish camp” i.e., that Wilson he was ahead of everyone, claiming that his “competitors” have even adopted a ‘Fire’ and ‘Ice’ narrative—i.e., Fed tightening into a growth slowdown—for their less optimistic outlooks.

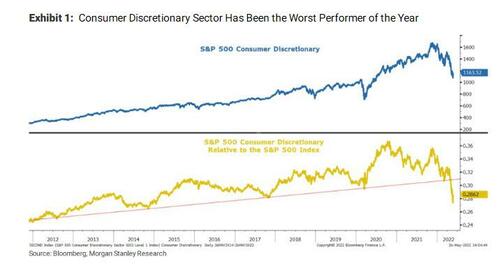

As Wilson noted last week, and as we first discussed in April, while sentiment has cratered and is extremely bearish (or as we first called it, “apocalyptic“) positioning remains extended for asset owners, perhaps on the assumption that sooner or later the Fed will step in and bail everyone out. Repeating what he said last week, Wilson says that he remains firmly in the bear market camp but relief rallies can happen at any time, and it appears we are now in the midst of one. Specifically, consumer discretionary stocks are exhibiting a strong tactical rally as shorts scramble to cover what has been one of the best one-way trades of the year.

Not only is the sector the worst performer YTD (-25%) but it’s broken a 10-year uptrend relative to the S&P 500. In other words, Wilson says that we were due for a rally in the sector, but at the end of the day, “it’s nothing more than a bear market rally that will eventually fade.”

The other sector having the most trouble this year is FAAMG (i.e., Technology and Comm Services ): neither has broken down as much as Discretionary but both have also rallied sharply over the past week. Here, Wilson’s view remains the same: both are vulnerable to a payback in demand and/or a cancellation of orders in the case of tech hardware and semiconductors.

The bottom line, according to Wilson, is that the market “achieved” his near- term minimum downside target of 16.5x EPS and 3800 on the S&P 500 so it’s not surprising we are now seeing some relief given how oversold the market had become as investors began to contemplate the growth/recession scare part of our narrative.

So the only question worth asking here, according to the Morgan Stanley strategist, is whether this could be more than a bear market rally, could the lows be in, and what’s the upside? If so, then market leadership is likely to change too from the extreme defensiveness exhibited all year.

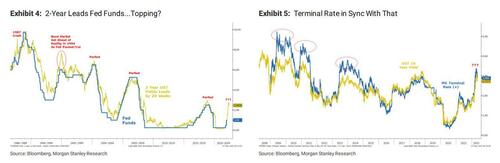

Echoing what we said last week, namely that the proximal reason behind the surge is that investors are growing increasingly confident that Powell will pause rate hikes in September, Wilson says that “the Fed may be contemplating a pause in September as several governors have recently hinted.” Wilson does not agree: “While we don’t claim to have any great insight to what the Fed will ultimately do, we do not think they are anywhere close to achieving their goal of getting inflation under control.“

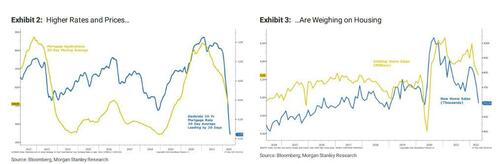

That said, the MS strategist says that he has been in the camp that the bond market may have overpriced how much hiking the Fed will need to do to get inflation back to a more reasonable level or to avoid a meaningful slowdown/recession in the overall economy. To Wilson, the best argument is the decline already registered in financial markets and the dramatic slowdown in housing activity.

Speaking of pricing in the Fed’s tightening, Wilson believes that the bond market has already done a lot of the Fed’s job even before the Fed actually makes more progress on its rate hike path and shrinks the balance sheet. This is traditionally the way it has been, particularly since the Greenspan Fed and the practice of forward guidance. At the same time, Wilson believes that there is one major difference between this Fed and the Volcker Fed that Powell appears now to be trying to emulate to fight inflation— according to the MS strategist, this Fed is somewhat beholden to the idea that they can’t surprise the markets too much. Perhaps that has changed a bit with Chair Powell’s recent congressional testimony during which he expressed the Fed’s resolve to quash inflation, but as even Wilson admits, “the Fed is still unlikely to go cold turkey” and pretty much everyone on Wall Street agrees. That said, investors may be underestimating the Fed’s willingness to shock markets if necessary to achieve its inflation goals, according to Wilson, who however seems to ignore the collapse in housing, and reports of peak inflation and the upcoming crash in the labor market.”

In any case, Wilson’s bottom line is that “inflation remains too high for the Fed’s liking and so whatever pivot investors might be hoping for will be too immaterial to change the downtrend in equity prices, in our view. However, that’s not to say it can’t get animal spirits moving higher in the short term

So in case it wasn’t clear enough, Wilson again warns that “it’s hard for us to construct an upside case from here. In fact, the probability of our bull case target of 4450 12 months out is looking less likely than when we published it just 3 weeks ago.” That said, one event that could increase those odds is a meaningful and lasting cease fire between Ukraine and Russia. If such a cease fire were to happen and could be sustained, “it would relieve a lot of pressure on global growth and commodity prices, thereby improving the outlook for equities.”

However, not even a (highly improbable) ceasefire would eliminate the core risk of Wilson’s ‘Fire’ and ‘Ice’ narrative, which is now too far developed to reverse. In other words, “inflation and growth risks are so embedded at this point, it’s going to be difficult to remove them.” Perhaps it might take some of the recession risk off the table but growth is still bound to slow, particularly for earnings where margins are now the biggest risk.

The other positive development for growth, of course, is China’s decision to move away from zero Covid, albeit gradually. The problem for markets, Wilson again spoils the party, “is that this may exacerbate inflationary concerns and keep the pressure on the Fed to remain max hawkish. Nevertheless, it is one of the other external shocks that could lead to a more sustainable rally than we are currently expecting.”

In conclusion, Wilson’s base case is that “last week’s strength will prove to be another bear market rally in the end” and Morgan Stanley sees “maximum upside near 4250-4300 in S&P 500 terms” with Nasdaq and small caps likely to rally more on a percentage basis as is typical during such rallies, “i.e., more heavily shorted areas do the best.”

In terms of catalysts, Wilson is confident that “the turning point for the next leg of the bear may coincide with the next Fed meeting where it will likely be clear they are far from dovish” and while that may be the case for June and even July, we would counter that by September we will have the infamous Jackson Hole pivot and the Fed will be fully dovish again. In any case, Wilson stands by his call that the S&P 500 will trade close to 3400 by the end of 2Q earnings season — i.e., mid August.

One final point, and this goes beyond merely the day to day whims of the Fed, Wilson addresses the fundamental reason behind his bearish view, which now focuses on slowing growth (but apparently not slow enough to spark a recession and crippled inflation), and his view that earnings estimates are too high: “some of this is due to the payback in demand that transpired during the lockdowns while the other risk is related to profitability and the negative operating leverage many companies are now facing as cost inflation is rising faster than end market pricing. None of this assumes an economic recession which will only make the downside worse.”

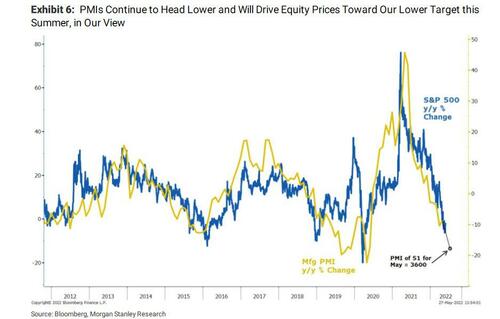

On that score, Wilson notes that regional PMIs have come in well below expectations this month and point to lower ISM readings that will be out later this week. How low? Based on the regional PMIs, our economists estimate the May manufacturing PMI to come in at 50.8 or -4.6 points from April’s reading of 55.4. Using Wilson’s remarkable chart correlation and goalseek skills, the y/y change in the S&P 500 is projected to drop to a level of approximately 3600.”

Of course, this is really just a charting exercise and Wilson admits as much, saying he doesn’t know how the ISM will come in (it has held up better so far than the regional PMIs) but ultimately Wilson speculates that “it’ss likely to catch down.” In other words, if not this month, it will likely be July or August, and based on the relationship shown below, it’s just another reason why Wilson still believes that markets can trade toward our 3400 target in the short term. And while this argument is valid, the only problem we have with this line of thought is that as Wilson admits in his very first sentence, his bearish cases is now consensus, and if anything we are far more likely to see a continuation of the bear market rally, one where a few more percent of upside will become a self-fulfilling prophecy that the bear market is now over.

More in the full note available to professional subs.

Tyler Durden

Tue, 05/31/2022 – 15:25

via ZeroHedge News https://ift.tt/vUP3jEs Tyler Durden