Russell Clark: Buy The Dip Or Sell The Rip – Part 4

By Russell Clark of the Capital Flows and Asset Markets Substack,

Last time I wrote one of these was March, and the conclusion was sell the rip, which has broadly proven correct. So time to update.

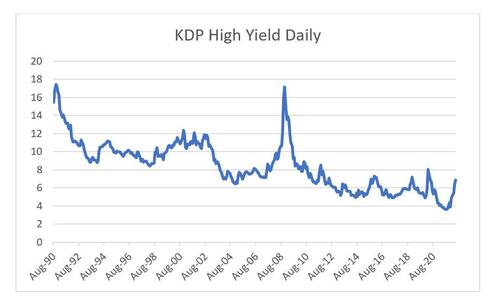

First things first, you have finally had high yield credit sell off to a level where it has paid to buy risk assets. With high yield now just shy of 7%, you are at levels where it made sense to buy in Q4 2018, and during Covid. So, this suggests its time to buy the dip.

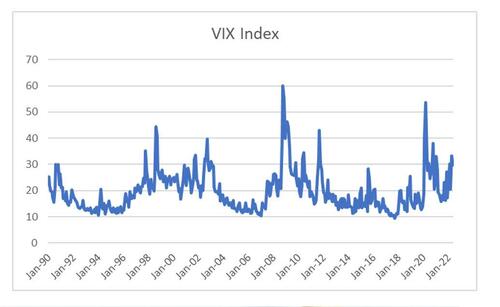

You also have the VIX at 30, which is typically a good time to think about buying the dip.

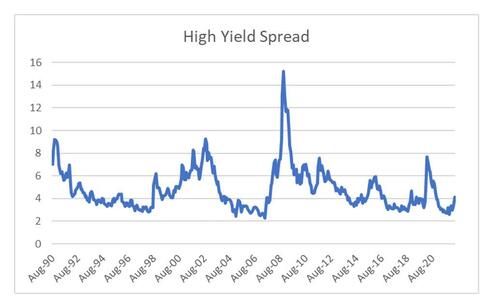

However, the problem with that view is that the sell off in high yield has been accompanied by a sell off in all bonds, including treasuries. So the spread you are earning over treasuries still looks low.

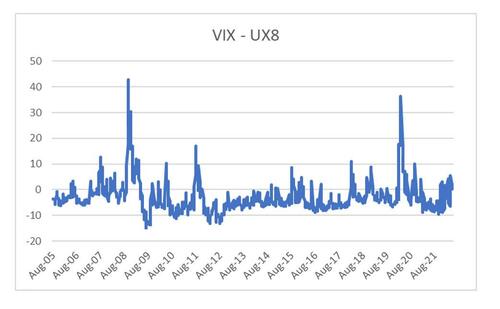

The other problem is that long dated VIX has been rising, so what we find is VIX curve is flattish, which is neither very bullish of very bearish.

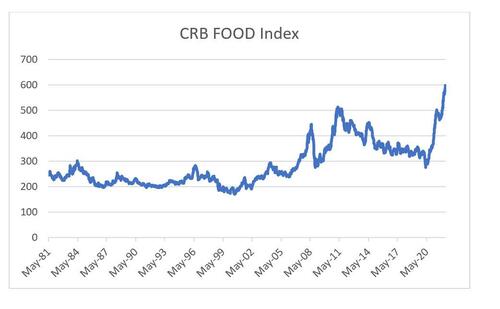

It must be said that its the same spread we got to in Q4 2018, which in hindsight turned out to be a good buying opportunity. However, that particular point, the Federal Reserve engaged in a pivot, allowing liquidity to re-enter the market. However at that time, food inflation was low allowing central banks to take a relaxed attitude to central bank policy. This is not the case now.

Market positioning is not that bearish, and inflationary pressures are still strong. Looks to me that its a market to sell the rip, if we get one.

Tyler Durden

Tue, 05/31/2022 – 13:40

via ZeroHedge News https://ift.tt/zAs7hYo Tyler Durden