Faith In ‘Fed Put’ Falters As Bostic Walks Back “Pause” Comments

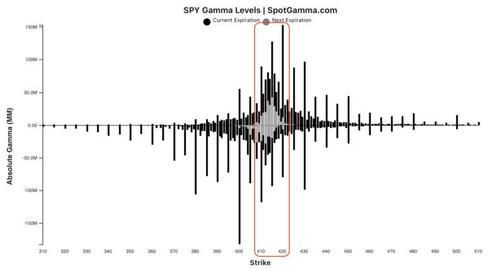

Mark June 15th (VIX exp.) & June 17th (options exp. OPEX) as a key turning point due to very large expirations and the FOMC (6/15).

Until then, SpotGamma warns, rallies should be categorized as “short covering” and subject to failure.

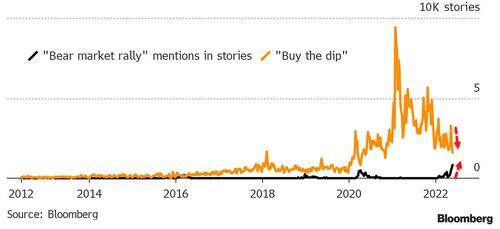

It turns out, as Bloomberg reports, that distrust of any tentative rebound in global stocks is at the highest in a decade.

News story mentions of “bear market rally” are at the most since at least 2012, while those containing “buy the dip” have slumped to the lowest since 2020. That’s according to articles from all sources that have appeared on the Bloomberg Terminal.

And fundamentally-speaking, one leg of the false-hope-stool for a Fed Put just got kicked out this morning as Nomura’s Charlie McElligott notes that it now seems that Fed’s Bostic has been messaged to walk-back his prior “pause” commentary, clarifying in an interview last night with Dow Jones MarketWatch that his suggestion last week of a September “pause” should NOT be construed as a “Fed Put”.

As McElligott details, yes, “peak hawkishness” is very likely past us, killed-off by Powell’s early May comments which effectively ended the 75bps hike “hawkish left tail” scenario, which then meant that the “peak Rate Vol” highs were in as well as that “shock path” was removed…And yes, “peak inflation” is also likely behind us at this juncture now as well

However, McElligott continues to have bunches of reasons why Fed “hawkishness” and Rate Vol have scope to remain persistently “higher” for some time

-

Yes, the Fed is getting results which they’d been hoping-for from their aggressive, front-loaded tightening: we have seen continued signs that Housing is softening (more misses today in Mortgage Apps, Purchases and Refis), that Labor is showing signs of moderating, and critically, Survey data is getting accordingly “hammered,” with Inflation Breakevens then “cratering” off recent highs, as the implications of the FCI tightening begin to evidence a hard “slowdown” dynamic…

-

BUT THAT IS THE POINT, because this is exactly what the Fed needs to pinch “demand”…so you do not stop prematurely, especially as we have yet to see a credible explanation for just how the Fed gets back to a 2% inflation target with jobs still printing 400k+ a month and with Atlanta Fed Wage Growth Tracker printing 6% and at all-time highs (since the series began in ’97)…we should start by watching the next SEP projections in two weeks at the Fed mtg

-

Rate Vol abroad, as the ECB is trapped right now, with pressure to act after this week’s inflation data forcing their hand into a “hawkish” liftoff, with July hike and plans to end asset purchases very early in July as well, with ECB staff projections certain to show core inflation dynamics above target and for longer, which will keep a “50bps hike” potential on the table now too

-

Crude Oil’s latest spasm back near March highs off the back of the new EU / Russia ban, US peak “driving season” commencing, China’s gradual reopening (*BEIJING CITY COVID SITUATION EFFECTIVELY CONTROLLED: OFFICIAL) and daily record new-highs for Gasoline and Diesel in US, with little SPR optionality at this juncture, give real “delta” to a left-tail trade here

-

QT begins today—which matters per 2018 “scar tissue” as “less Cash available to absorb more Collateral,” will impact Repo rates and bleed-into “Spread product” widening, despite being so obviously socialized and anticipated

-

Finally, Chair Powell’s own words: the current environment is “not a time for tremendously nuanced readings of inflation”—i.e. the Fed is simply reactively managing to the data reality upon us

Ex Fed Dudley opined on Bloomberg this morning, and iterated a few observations above, with this paragraph of particular note:

Second, Fed officials and market participants continue to underestimate the level of short-term rates that will be necessary to tighten financial conditions sufficiently to push inflation back down to 2% from the most recent year-over-year reading of 6.3%. If, in the long run, a neutral short-term rate is 2.4% (the FOMC’s median estimate) when inflation is 2%, then the neutral rate should be higher to compensate for the fact that inflation is higher.

In addition, given that the Fed’s enlarged $8.9 trillion balance sheet is still providing stimulus – the balance sheet won’t become “neutral” until it shrinks to its desired level in about three years – the neutral short-term rate needs to be higher in the meantime.

Net / Net, there is a scenario in 4Q22 where we *DO* see the Fed downshift from 50s to 25s, which will likely be taken as a “greenlight” by Equities that the light at the end of the tunnel is there – but we are not there yet, and until we see the Fed’s preferred measure of Core PCE begin to dip from current 4.9% probably down sustainably below 4.0 into the mid 3s and evidencing “escape velocity,” I believe we should plan on 50bps hikes continuing.

Finally, McElligott points out – confirming SpotGamma’s earlier comments – that the current “signals” from the Options side are NOT showing a lot of “believers” or high-conviction that this is any sort of a “paradigm shifting rally,” instead treating this recent rally as yet-another “bear market oversold bounce” and remaining skeptical.

There is one group of ‘dip-buyers’ though. As we detailed previously, corporate insiders are buying as institutional money exits.

As The FT reports, despite retail investors pulling out of the stock market and the looming threat of a slowdown or recession, “corporate insiders are holding a non-consensus view across most sectors and [are] actively buying the dip”, analysts at JPMorgan said in a May 27 note.

Strong insider buying “has historically been a pretty good sign of market bottoms”, said David Giroux, portfolio manager at T Rowe Price.

“Insiders are saying ‘we don’t see a massive event coming’ . . . [that] these are really good buying opportunities,” he added.

“This is just another confirming data point that should be positive for the market over six to 12 months if not longer.”

Starbucks’ Interim Chief Executive Officer Howard Schultz and Intel CEO Patrick Gelsinger are among corporate insiders who scooped up their own stock amid the latest market rout that took the S&P 500 to the brink of a bear market.

However, with their share prices plunging, we can’t help but wonder if this ‘buying’ is mere virtue-signaling so that the board won’t fire them for their absymal loss of market cap?

Tyler Durden

Wed, 06/01/2022 – 11:05

via ZeroHedge News https://ift.tt/FYMh79o Tyler Durden