Goldman Predicts That EV Battery Metals Are In For A “Sharp Correction”

Of all the commodities in the midst of a raging bull market, Goldman Sachs thinks the run in the battery metals is over and done with. The firm said this week that cobalt, lithium and nickel prices will drop over the next two years, according to a recap by Bloomberg.

Goldman analysts Nicholas Snowdon and Aditi Rai wrote in a note over the weekend: “Investors are fully aware that battery metals will play a crucial role in the 21st century global economy. Yet despite this exponential demand profile, we see the battery metals bull market as over for now.”

While future demand looks strong, “investor exuberance has led to an oversupply”, the report says.

The analysts said there has been “a surge in investor capital into supply investment tied to the long term EV demand story, essentially trading a spot driven commodity as a forward-looking equity. That fundamental mispricing has in turn generated an outsized supply response well ahead of the demand trend.”

Goldman is predicting a “sharp correction” in the prices of lithium, the report also says. The firm predicts lithium will average under $54,000 a ton this year and that Cobalt will drop to $59,500 a ton.

The bank concluded: “This phase of oversupply will ultimately sow the seeds of the battery materials super cycle over the second half of this decade. Then the demand surge will more sustainably overcome current supply growth.”

In April we noted that Chinese EV manufacturers were grappling with the continued rising cost of all input materials. Remember, we just wrote days prior to that piece that Japanese automakers were also grappling with the skyrocketing cost of raw materials and a shortage of semiconductors.

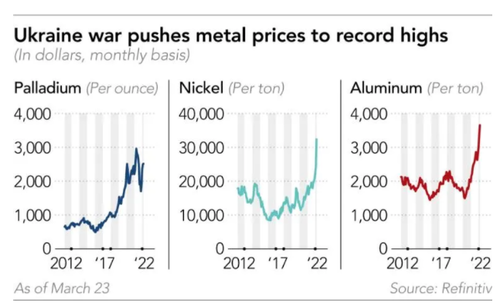

Even as some parts have become unavailable, raw materials for other parts have skyrocketed in price. For example, palladium, nickel and aluminum have all surged to record highs this month. The metals are used in automobile catalytic converters, batteries and other car parts.

The price hikes are likely due to the fact that 40% of palladium production comes from Russia, Nikkei noted last week. This has forced auto manufacturers to abandon buying from Russia and seek out alternative sources.

Back in February we broke down the cost of an EV battery here.

Tyler Durden

Tue, 05/31/2022 – 21:20

via ZeroHedge News https://ift.tt/HdWFxBK Tyler Durden