Stocks, Bonds, & Bitcoin Dumped As Dimon Doubles-Down On Dour Outlook

Jamie Dimon’s pessimistic shift from “storm clouds” last week to a “hurricane is down the road”, prompted market weakness shortly after the open…

“That hurricane is right out there down the road coming our way,” he added.

“We just don’t know if it’s a minor one or Superstorm Sandy. You have to brace yourself.”

It appears Dimon went full ‘Leeroy Jenkins’ with his flip-flop…

Which makes sense since US Macro conditions have notably worsened in the week since he last commented…

Source: Bloomberg

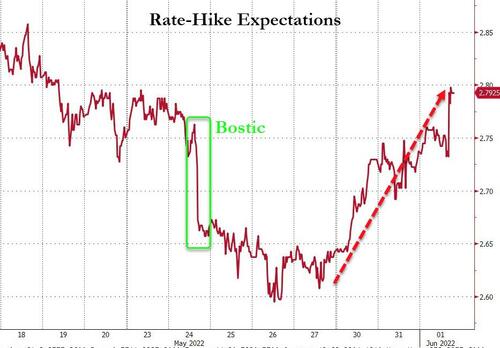

… but other FedSpeak didn’t help with Bostic first…

Atlanta Fed President Raphael Bostic, in an exclusive interview with MarketWatch, said his suggestion that the central bank take a September “pause” in its push to raise interest rates should not be construed in any way as a “Fed put,” or belief that the central bank would come to the rescue of markets.

Then Daly…

“I certainly am comfortable to do what it takes to get inflation trending down to the level we need it to be,” Daly said Wednesday in an interview on CNBC.

“What the Fed needs to do — and this is how I am thinking about the economy — is remove the accommodation, but then be open to the data, be data-dependent.”

Then Bullard, repeating his desire to see rates at 3.5%:

“The current U.S. macroeconomic situation is straining the Fed’s credibility with respect to its inflation target,” Bullard said.

“This situation is risking the Fed’s credibility with respect to its inflation target and associated mandate to provide stable prices in the U.S.”

“The Fed still has to follow through to ratify the forward guidance previously given, but the effects on the economy and on inflation are already taking hold.”

So, after all that, rate-hike expectations surged back higher (erasing all of Bostic’s dovish dive). So, right now, the market sees three more 50-bp rate hikes, with the first slowdown back to 25 bps coming in November…

Source: Bloomberg

…and that meant stocks, bonds, bitcoin, and banks were all battered lower (in price).

But as always, a magical bid appeared in US equities after Europe closed ramping all the US majors back to unchanged. The Nasdaq went from -0.5% overnight to +1.5% just after the cash open to -1.5% at the European close, all the way back up to unchanged only to fade lower in the last few minutes…

As Goldman’s Chris Hussey noted, peeking under the hood of the S&P 500 today reveals another set of contradictions. Financials are trading lower despite the rise in rates and Health Care and Consumer Staples – two traditionally ‘defensive’ sectors – are also selling off suggesting that investors are not exactly seeking shelter. Conversely, Tech and Consumer Discretionary stocks are outperforming.

Source: Bloomberg

Bond yields and stocks converged today from their post-FOMC Minutes decoupling…

Source: Bloomberg

Treasuries were clubbed like a baby seal today with the short-end drastically underperforming (2Y +12bps, 30Y +4bps)…

Source: Bloomberg

The yield curve flattened significantly…

Source: Bloomberg

The dollar shot higher today amid chaos in the Loonie and a plunge in the euro, testing last week’s highs before sliding back

Source: Bloomberg

Having topped $32k yesterday, Bitcoin was monkeyhammered back down below $30k today…

Source: Bloomberg

Amid the dollar’s spike, gold was chaotic, dumping overnight, then ramping back above $1850…

Oil prices rallied today with WTI erasing the losses from yesterday’s OPEC+ headlines before fading back towards the lows of the day…

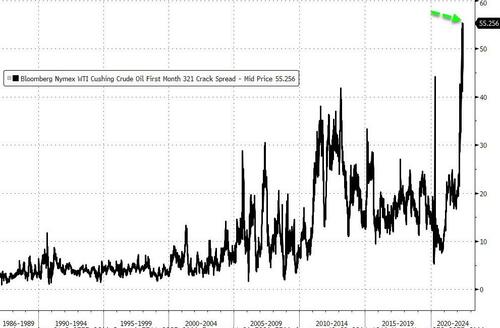

The 3-2-1 crack, which approximates turning crude into gasoline and diesel, soared to a new record high of $55.26 today…

Source: Bloomberg

With Gasoline, Diesel, and Jet Fuel all recoupling (at extremes relative to crude) again…

Source: Bloomberg

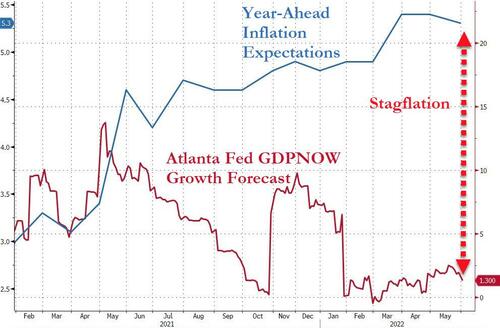

Finally, the Manufacturing Surveys this morning both screamed ‘stagflation’, and The Atlanta Fed’s own GDP forecast was revised down to just +1.3%… as inflation expectations remain at multi-decade highs…

Source: Bloomberg

Get back to work Mr.Powell!

Tyler Durden

Wed, 06/01/2022 – 16:00

via ZeroHedge News https://ift.tt/fJQKFWi Tyler Durden