The Year’s Worst Month Awaits Shaky Equity Markets

By Sagarika Jaisinghani, Bloomberg Markets Live analyst and reporter

Investors hoping for a rally in European stocks this month may be disappointed, if history is any guide.

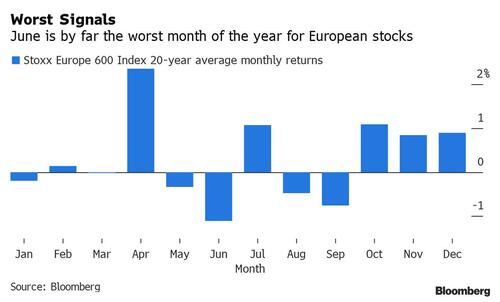

June has been the worst month of the year for the Stoxx 600 Index over the last two decades, showing an average decline of 1.1% and rising just eight times out of 20, the least of any month.

With the gauge having fallen in four of the first five months of the year, investors enter the new one in cautious mood. The European benchmark has tried to bounce back in recent weeks, as cheaper valuations tempted some, but with inflation hitting a record high, the European Central Bank turning hawkish and fears of a recession abounding, nerves remain frayed.

“This market is still weak and financial conditions will most likely continue to tighten, which could turn this summer into a nail-biter,” says Peter Garnry, head of equity strategy at Saxo Bank.

Many of Wall Street’s top strategists also see more downside for stock markets. Bank of America projects that the Stoxx 600 will trade around 410 by the fourth quarter — more than 7% below current levels — amid slower growth and declining bond yields. And BlackRock Investment Institute recently cut its rating on developed-market equities, including Europe, to neutral.

According to Barclays strategists, a full capitulation from real money is still elusive while the consumer outlook remains weak, meaning there is now more scope for shares to fall rather than rise.

Additionally, historically important technical indicators suggest European stocks have room to decline further before hitting key support levels. The Stoxx 600 is still about 6% above its 200-week moving average, a level that the index crossed during all major bear markets.

A further challenge this month may come from a shift in sectoral trading style as value stocks lose favor with strategists following recent outperformance. Energy and bank stocks posted solid gains in May, outshining all other European sectors, as rising interest rates dented appetite for so-called growth shares. But strategists including those at Bank of America and Credit Suisse recently cut their ratings on the group, with the latter saying cheaper equities are “very overbought” right now.

On the other hand, Liberum’s Joachim Klement sees value in European cyclical sectors, particularly in industrials and consumer stocks.

“Investors have priced in an immediate recession,” Klement says. “We think this is too pessimistic and has led to large selloffs in cyclical sectors. These are the stocks and sectors that we would expect to bounce the most as investor sentiment normalizes.”

Tyler Durden

Wed, 06/01/2022 – 09:25

via ZeroHedge News https://ift.tt/iFtKxb2 Tyler Durden