“This Feels Like A Slow-Motion Train Wreck”

By Ven Ram, Bloomberg Markets Live reporter and analyst

If you climb a tall flight of stairs, came back down and repeated the experiment, say, a dozen times, you will be pretty drained by the time you are done. Yet, if you ask a physicist the upshot of the experiment, they might just shrug their shoulders and say your net displacement was zero.

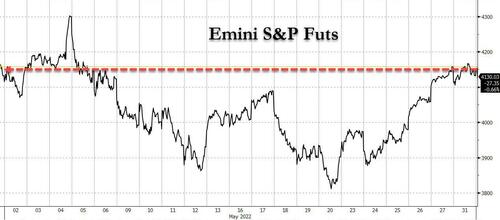

The story of US stocks last month was much in the same vein. The S&P 500 Index made a handful of multi-standard deviation moves, enough to send it screaming below 3,900, only to end the month pretty much where it had started. The Nasdaq 100 basket, which had slumped more than 13% in April, hiccuped — but not too much more.

Despite the late recovery during May, this feels like a slow-motion train wreck. While overnight indexed swaps were starting to slide back on Fed pricing for the remainder of the year, we are now back to factoring in 190+ basis points of tightening. So by the time we are prepared to turn the page over on the calendar, we may be looking at a Fed funds rate of 2.75%, weighing on stocks like gravity on an astronaut.

And then there are concerns about slowing growth to contend with. We began the year with economists estimating US GDP growth of about 3.8%, give or take. Now we are talking about something in the region of 2.6%. Much of that is likely to have an impact on USA Inc., so stocks will not only have to factor in a higher discount rate, but also a smaller numerator in terms of corporate earnings.

That may explain why, despite successive attempts, buying the dip hasn’t quite worked well so far this year. What does that leave us with? Calculations suggest we still face enough downside that could take the S&P 500 to circa 3,600 and Nasdaq to about 10,750. If that proves right, we may have to brace ourselves for more noise from Wall Street.

Tyler Durden

Wed, 06/01/2022 – 19:25

via ZeroHedge News https://ift.tt/uUi1IhV Tyler Durden