Wall Streeters’ Demand For Hamptons Rental Market Hit With Abrupt Chill As Recession Risks Flash

It’s been a brutal year for some on Wall Street. There’s been no corner of the market to hide in the first five months of the year, and stocks, bonds, and cryptocurrency markets have been clubbed like a baby seal. Poor performance in markets comes as the rental market in the Hamptons, also known as a playground for Wall Streeters during the summer months, faces an abrupt chill ahead of summer.

Jonathan Miller, CEO of real estate firm Miller Samuel, reports the median rental price in the first quarter slumped 26%. Brokers are reducing prices by as much as 39% to attract renters before the summer begins.

“There is a tremendous amount of inventory and people are not renting it. And it’s across all segments, from the very low to the very top of the market,” Enzo Morabito of Douglas Elliman told CNBC.

After two years of booming markets (2020-21) and asset prices soaring to the moon as the Federal Reserve expanded its balance sheet and lifted all tides for Wall Streeters, those days are long gone as the monetary wonks in Eccles reversed policy to remove liquidity from markets, sending asset prices spiraling lower this year. This means that Wall Streeters are feeling the pain, and perhaps some have pulled back from splurging their bonuses on luxurious beachfront rental properties on eastern Long Island.

Morabito said one beachfront mansion was asking $70,000 a month. Just weeks before summer, there are still no takers. He said one potential renter offered just $45,000.

“We were hoping the renter would split the difference, but it’s a different market right now,” he said.

“There are a lot of questions in the air, about the economy, both locally and nationally,” said Harald Grant with Sotheby’s International Realty. “It all affects the market.”

Median rents for May are 46% higher than the same month in 2019. Given the plunge in stocks and crypto prices, the dwindling demand of Wall Streeters, balking at the high rental prices, is an ominous sign of the cloudy economic outlook.

Samuel and Douglas Elliman said many renters who spent their summers in the Hamptons bought homes during the pandemic and have become permanent residents or second homes.

“The buyers removed themselves from the rental market,” Morabito said. “Now, all of the sudden the people who bought want to rent it and the renters aren’t there. So you have this huge surplus.”

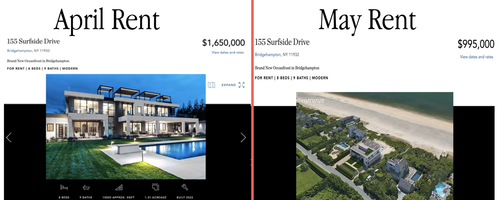

The days of renting a beachfront mansion for $1.65 million per month appear to be over. Check out the massive reduction in rent for 155 Surfside Drive.

The cooling of the Hamptons rental market is a sign of the slowdown in the economy as recession risks flourish.

Tyler Durden

Tue, 05/31/2022 – 22:00

via ZeroHedge News https://ift.tt/NOrXo5P Tyler Durden