“Worst 5-Month Loss Since 1970”: Here Are The Best And Worst Performing Assets In May And YTD

In the latest monthly performance review note from Deutsche Bank, strategist Henry Allen writes that after a very poor start to the year, May marked the first time so far in 2022 that a majority of the non-currency assets in the bank’s main sample were in positive territory (if not by much). That was helped by a combination of factors, including the prospect of less aggressive hikes from the Federal Reserve as well as an easing of Covid restrictions in China.

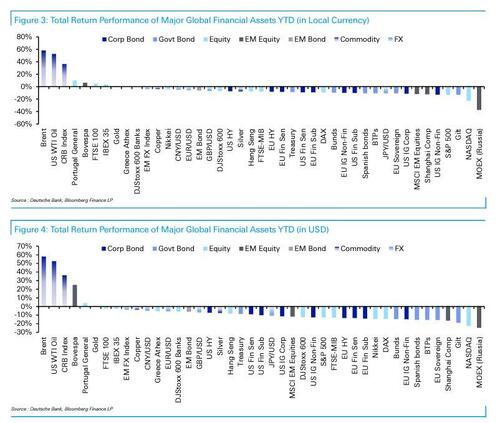

That said, as Allen notes, it’s important not to get ahead of ourselves, since the risk of recession is growing by the day, and the S&P 500 had just experienced its biggest YTD loss after 5 months since 1970. Furthermore, 29 of the 38 non-currency assets in the sample are still beneath their levels at the start of the year, and if it remains like that at year-end, that would be the second-worst annual performance since 2008.

The biggest market shift in May was the changing narrative from inflation risks to growth risks, as investors grappled with ongoing monetary tightening, the continued zero-Covid strategy in China, as well as Russia’s invasion of Ukraine. A number of weak data releases didn’t help matters either, particularly on US housing, and at one point on an intraday basis the S&P 500 actually fell into bear market territory, before recovering towards the end of the month.

Of course, now that bad news is once again good news, concerns about growth meant that investors began to price in a less aggressive pace of monetary tightening from the Fed over the coming months. In fact, there was a particular milestone in May since it was the first month in 10 that Fed funds futures had downgraded the implied rate by the December 2022 meeting, with a -12bps move lower to 2.74%.

Furthermore, the speculation about a potential 75bps rate hike at the start of the month was pushed back, and Fed Chair Powell strongly signaled that there would be two further 50bp rate hikes at the June and July meetings. In turn, the prospect of a less aggressive Fed proved supportive for US fixed income, with US Treasuries snapping a 5-month losing streak to eke out a +0.03% gain.

Finally, while growth risks were increasingly in focus over May, it’s important to note that inflation concerns are far from disappearing. Indeed oil prices were the top monthly performer in DB’s sample of assets once again after China moved to ease Covid restrictions and EU leaders reached a deal that would ban the majority of oil imports from Russia. That meant that Brent Crude (+12.3%) advanced for a 6th consecutive month, which is its longest run of gains since 2011, with the advance taking it back above $120/bbl again.

Given the continued rise in a number of key commodities, this will make it more difficult to see significant falls in the year-on-year non-core inflation prints, and May brought yet further upside surprises on that front. On the last day of the month, the flash CPI print for the Euro Area in May rose to +8.1%, which was the fastest since the single currency’s formation. And although we saw the year-on-year rate tick lower in the United States in April, falling back from +8.5% to +8.3%, that was still above the +8.1% reading expected by the consensus.

In Europe, those continued upside surprises contributed to growing pressure for the ECB to hike rates as early as July, which is something that ECB President Lagarde has increasingly signaled over the course of the month. Looking at the amount of hikes priced in by the December meeting as well, overnight index swaps have gone from pricing 88bps worth at the start of May to 119bps by the end, so consistent with at least four 25bp hikes from July. That’s meant that European sovereign bonds have struggled more than US Treasuries in May, with EU sovereigns down another –2.0% over the month, marking their 6th consecutive monthly decline

Which assets saw the biggest gains in May?

- Oil: Brent (+12.3%) and WTI (+9.5%) were at the top of DB’s monthly leaderboard yet again, with this month’s gains meaning that Brent has risen for 6 consecutive months for the first time since 2011. Easing Covid restrictions in China contributed to the rise, as did the move by EU leaders towards a ban on most Russian oil imports.

- US Fixed Income: The prospect of a less aggressive hiking cycle from the Federal Reserve proved supportive for US fixed income. Treasuries (+0.03%) posted their first monthly gain since November, when concerns about the Omicron variant first surfaced. US Credit also put in a decent performance, with both US IG non-fin (+0.9%) and US HY (+1.0%) posting their first monthly gains so far this year.

Which assets saw the biggest losses in May?

- European Fixed Income: Unlike in the US, investors continued to dial up their expectations of a more aggressive hiking cycle from the ECB amidst higher-thanexpected inflation. That hurt sovereign bonds, with bunds (-1.8%), OATs (-1.9%) and BTPs (-2.1%) continuing their run of losses in every month so far this year. EUR credit also struggled, with EUR IG non-fin (-1.4%) and EUR HY (-1.2%) losing ground too.

- US Dollar: Having experienced a strong run of gains so far this year, the US Dollar’s outperformance started to reverse in May, with the dollar index down -1.2%. That said, it remains the top-performing G10 currency on a YTD basis.

- Metals (both precious and industrial): While some commodities such as oil saw strong gains, it wasn’t such a good performance for metals in May. Gold (-3.1%) and silver (-5.4%) both lost ground in May for a second month running. Industrial metals including copper (-2.3%) struggled too, and on the London metal exchange aluminium (-8.7%), tin (-13.9%), nickel (-10.6%), zinc (-4.7%) and lead (-3.5%) were all in negative territory for the month

Finally, here is the full return of tracked assets, first in May on both a USD and local currency basis…

… and the same, however on a YTD basis.

Tyler Durden

Wed, 06/01/2022 – 17:45

via ZeroHedge News https://ift.tt/NMbfEaC Tyler Durden