After Yesterday’s “Peak Hawkishness”, Traders Cornered By Fed Event Risk & Huge OpEx

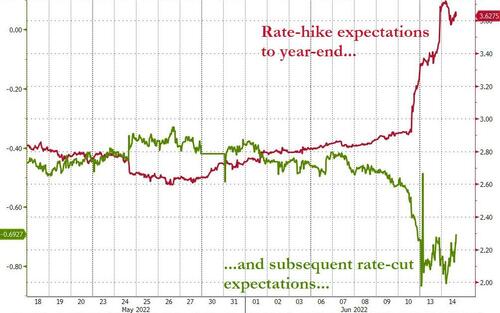

Yesterday’s capitulatory “hawkish left tail” surge to a 4.00% terminal by Spring 2023 sparked tightening in financial conditions and carnage across all asset classes.

As Nomura’s Charlie McElligott notes, the market is now pricing in around 3 rate-cuts after March 2023 on the eventual “collateral damage” unwind/cleanup.

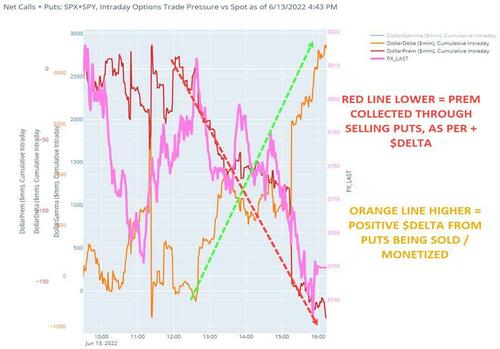

Most notably, the Nomura chief strategist points out that yesterday had the smell of ‘peak hawkishness’ as those funds who’ve gotten it right this year (all the trend trades: bearish USTs / hawkish Rates, short Eq in particular) looked to again monetize their short-dated downside, as they have traded it and profited from it all year (sell hedges on down days, slap on downside again on rallies).

That said, McElligott notes we did see Skew steepen finally, Vol finally outperform Spot, and Vol of Vol get really spicy on the obvious “FCI Tantrum” of said “hawkish left tail” repricing which shows that market continues tilted towards “hard landing >> Recession”.

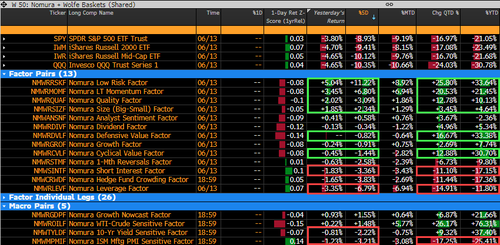

Additionally, he suggests the equities risk prem / thematic / factors continue to evidence one-way trading for US economic “Contraction” – with same performance dynamics continuing on massive “Low Risk” / “Quality” / “Momentum” (which is “Value” and “Defensives” over “Expensive” / “High Vol / High Beta” to a large extent).

However, the week’s tensions are only just beginning as McElligott notes that massive Delta- and Gamma- size is set to roll-off into this week’s huge quarterly Op-Ex, so the risk remains that this is gonna have to be traded before Friday, but traders face a tight window around the Fed meeting and any additional “hawkish” guidance.

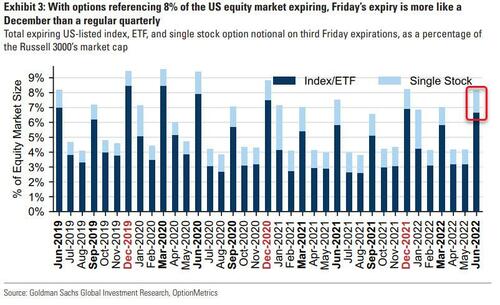

As Goldman’s Rocky Fishman notes, while there is no shortage of fundamental news for investors to process in the coming days, and this week’s $3.4tln option expiration adds a layer of positioning complexity.

The total is closer to a December expiration1 than to a typical quarterly, reflecting extremely high trading volume while realized volatility surged in May. The spot SPX sell-off leaves most of the open interest at strikes somewhat above the current index level; the biggest concentration of open interest is in the 4000-4500 strike range.

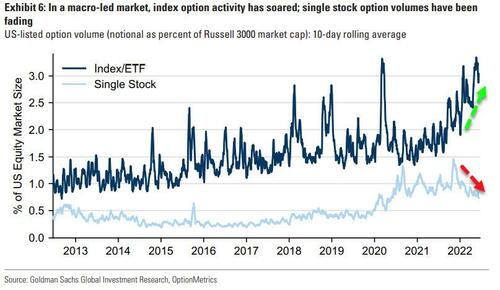

Additionally, as single stock option activity has slowed, index option volumes have been strong. A macro-led market has led to soaring index option volumes while single-name volumes tend to correlate closer to younger-retail traders, via Robinhood and others, that have seen their risk appetites (and budgets) shrink notably now The Fed no longer has their back…

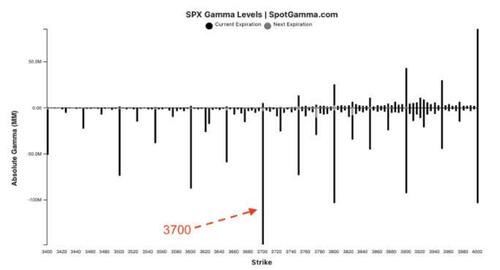

Tactically, SpotGamma highlights that 3700 remains the monster of a June 17th expiration strike and the level at which we’d watch for support into Wednesday. This strike could fuel a lot of movement after the Fed, particularly if the S&P is <=3700.

Note, too, there is hardly any call gamma (positive bars on the plot below) up until 3900, which indicates to us that prices will remain quite fluid <=3900 which could come into play post-FOMC.

Tomorrow at 9AM ET is VIX expiration, but today is the last day to trade 6/14 VIX index options. SpotGamma notes the sharp rallies that have occurred on the Tuesday prior to the last two VIX expirations, but here they quite frankly don’t see a clear edge.

Overall as SpotGamma details in the video below (due to start at 1400ET), continues to think that the strongest options influence arrives into that window after FOMC and into Fridays OPEX. The put positions expiring on 6/17 are quite sizeable and we remain of the opinion that it will induce a short-cover rally.

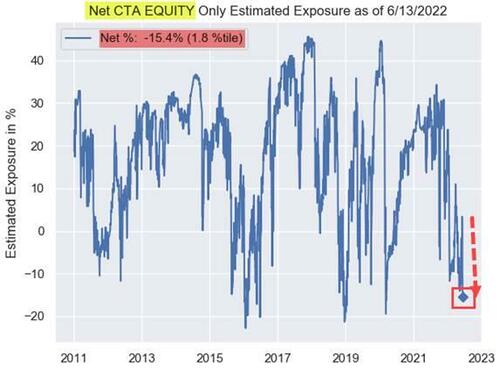

And, as Charlie McElligott also highlights, Nomura’s QIS CTA Trend model shows equity “shorts” growing precipitously…

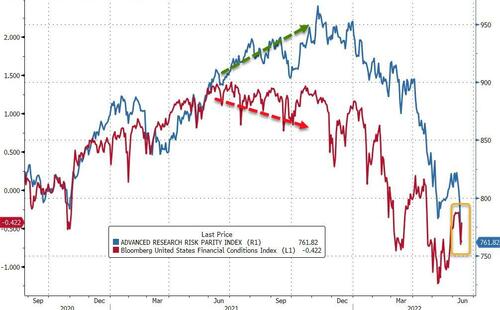

However, while all the ammo is there a short-squeeze (short-term), Risk-Parity fund flows (outflows) are increasingly notable amid a broad reduction of exposure across all asset-buckets in the short-term against the persistent volatility uptick from the FCI tightening “regime change”

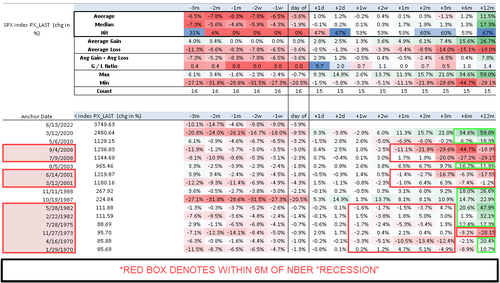

But what happens over a less tactical timeframe is still anyone’s guess as McElligott writes that you really need to look at the “flavors” of the particular returns to see just how bifurcated they are following a ‘recession’…because it tells a far more nuanced story

That the forward state either goes full-blown Recession with more downside ahead (10 of the 15 prior triggers hit within 6m of previous NBER “recession” windows)…or conversely, saw some sort of recovery / “soft landing” and a BIG risk bounce as we moved out…with really no in-between.

Tyler Durden

Tue, 06/14/2022 – 13:45

via ZeroHedge News https://ift.tt/hoAcNlB Tyler Durden