Inflation-Deniers Are Finally Admitting They Were Wrong

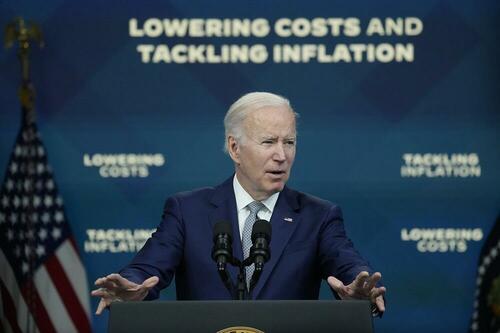

We heard it for the past couple of years – Inflation is merely “transitory.” Government and central banking officials as well as the Biden White House were in full spin mode on rising prices and the decline in the dollar’s buying power while the mainstream media backed them every step of the way. As a result, the public was grossly misinformed on the dangers ahead.

The alternative financial media called the establishment out on their lies and we provided an endless array of evidence to support the position that an inflationary crisis was in fact imminent. We were called “conspiracy theorists” and “doom mongers” in response. Now comes the time of reckoning. We were right, they were wrong, but they’ll still try to convince the masses that THEY are the proper people to solve the problem even though they used to deny it even existed.

Former Fed Chairman and Biden Treasury Secretary Janet Yellen finally admitted this month what most of us already knew – The inflation crisis is not transitory. She follows a long line of banking elites who are suddenly feeling like being honest about our fiscal prospects, with JP Morgan CEO Jamie Dimon and Goldman Sachs President John Waldron both openly voicing concerns about economic disaster. This was on top of admissions from globalist institutions such as the IMF, BIS, World Bank and the UN that global food shortages would be coming this year.

Yellen’s announcement is specifically concerning because administration economists are usually the last to admit economic mismanagement or mistaken predictions, because their jobs depend on the public remaining uninformed. Yellen is also in a unique position of being unable to deny personal involvement; as a former Fed official she directly presided over some of the most egregious inflationary actions in the central bank’s history. If she is admitting that she was wrong, then the system must be on the verge if an epic downturn.

The problem with such admissions is that they are often followed up with disinformation. The current narrative is to blame Russia for the majority of our economic ills. This is a lie. While sanctions against Russia will certainly contribute to supply chain problems in the future, the inflationary/stagflationary crisis started well before the invasion of Ukraine. In December of last year the CPI had already hit 40 year highs and gasoline prices where skyrocketing through 2021.

There are a couple of realities that governments and central banks will NEVER admit to: First, they will never admit that government deficit spending and central bank stimulus measures are the overall causes of inflation. Tens of trillions of dollars created from thin air to support various QE programs as well as a bloated government is now resulting in the exact thing we warned about for years – a loss of buying power in our currency as well as too many dollars chasing too few goods. The Ukraine event is nothing in comparison.

Second, they will never admit how bad the crisis is going to get. They will continue to use softball words like “recession” and they will continue to mislead the public on the gravity of the threat. This is what they do; string people along with false perceptions of safety until the bottom drops out completely from the economy. Then, as the public stumbles about in pure shock, these same officials swoop in to offer their “solution” to the the calamity. Usually the solution involves giving them more power.

This is exactly what they did during the Great Depression, it’s exactly what they did after WWI and WWII, and it’s exactly what they did after the credit implosion of 2008. The media was even calling central bankers “heroes” after they dumped trillions in fiat bailouts and QE into the economy. And yes, they will try to do the same thing again.

We have to ask ourselves, why should we take the advice of the people who got it all wrong? Either they were too stupid to see the impending disaster right in front of their faces, or, they knew exactly what was about to happen and they lied to the population about it. Either way, these banking officials and puppet politicians cannot be trusted.

Perhaps a better model would be to ignore them completely and remove the power from their hands to make any decisions. Perhaps it’s time to punish such people for being consistently wrong or being consistently dishonest. Why should it be that they are allowed to fail so often while continuing to enjoy positions of influence and authority? Perhaps it is time to throw these con-men to the gutter where they belong?

The overarching danger of inflation/stagflation is that it tends to become a feedback loop in which every new action only exacerbates the problem. One thing that is almost never tried though is the removal of the bankers and leaders that caused the instability in the first place. A considerable economic decline is already baked into the cake and there is not much that can be done to slow it down at this stage, but at the very least we could take measures to ensure that such a catastrophe doesn’t happen again. However, this will require actually holding the deniers of fiscal crisis accountable.

Tyler Durden

Tue, 06/14/2022 – 09:05

via ZeroHedge News https://ift.tt/jczd20L Tyler Durden