The Market Is “On The Edge Of A Huge Collapse”

Submitted by QTR’s Fringe Finance

This week I had a chance to interview my friend Andy Schectman, President & Owner of Miles Franklin Precious Metals, a company that has done more than $5 billion in sales.

Andy is a world-renowned expert in the field of precious metals and took the time to answer some pressing questions I had about the global economic picture, metals and markets in general.

This interview is not an advertisement; I sought out Andy’s opinion because I believe him to be a thought-leader in the space of metals and monetary policy.

Here is my unedited conversation with Andy from this week:

Hi, Andy. First off, what do you make of China shutting itself down again for Covid this recent time. They may be starting to lift restrictions now, but is there any chance they are doing this on purpose and it’s unrelated to Covid, in your opinion?

Well that would certainly add to the price inflation in the west and perhaps force the hand of the Fed a bit faster, but I would like to think they are not that stupid.

You can see the massive unrest and anger from their population being forced to lock down. It seems that the Chinese probably created Covid in the Wuhan lab but I am not sure they deliberately released it.

As you can see, once let out of the bottle, it goes everywhere, even through lockdowns.

Regardless, when do you think China will return to some normalcy?

Normalcy? Not sure we will ever see normalcy as long as the communist party runs the show. However, Covid will burn itself out and the lockdowns will end but it could take months.

But when looking at things through this prism, it is easier for me to believe that the Chinese potentially had ulterior motives with the lockdowns. In other words, a little bit of pain in the short term for a long term substantial gain.

You know what they say Chris: there is a very fine line between conspiracy and reality.

What do you make of the ruble’s recent move to highs against the dollar?

The US and Europe are behind the sanctioning of Russia, but together only represent 15% of the world’s population. Countries representing 85% of global population, including China, India, Africa and South America are still trading with Russia.

Much of the world needs Russian oil, natural gas, and fertilizer.

And as you can now clearly see, sanctions don’t work, they just shift the markets Russia sells to and the currencies in which they settle in. Russia smartly now accepts rubles and gold for their commodities, which have only served to strengthen the Ruble.

Is gold consolidating now in anticipation of the Fed eventually easing again, or does it have further to fall?

Ask the PPT or the Fed or JP Morgan. Gold will rise or fall at their discretion.

There is currently no price discovery for gold or any market for that matter. Chris Powell from the Gold Anti-Trust Action Committee often says: “there are no free markets anymore, just manipulations.” And I agree!

The betting money says that the fed will have to ease again, as soon as their interest rate hikes and asset sale policies cause a crash in the stock, bond and real estate markets. Easing will only work temporarily, because inflation will ramp up even faster when they cross the “QE to infinity bridge”. At that point the Fed will be completely exposed as impotent and out of options. Death by hyperinflation or death by depression, take your pick.

It does seem like $1,850 has some strong support, so any dip below $1850 ought to be very short-lived.

Along the same lines, how far do you think the Fed can make it before reversing course? Can they withstand a recession and a continued drop in stocks?

I expect that if the 10 year treasury moves anywhere near 4% or higher, the markets will rapidly start to meltdown and that is when the fed will be forced to reconsider if not sooner.

Are you seeing any opportunities in risk assets, like tech stocks, yet? If so, where?

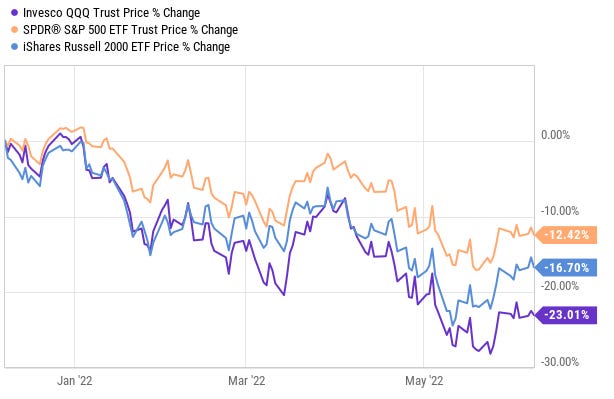

If I had to guess, any opportunities will be for short-term traders with big balls. The entire stock market is on the edge of a huge collapse, so trying to outsmart the market for short-term gains is strictly for the pros.

As for me, I prefer to watch things unfold from the sidelines and build up cash so I can jump in when there is real value to be had and there will be values, but that is not now.

How much further do you think the market has to fall?

Some very smart people who know more than I do speak in terms of an 80% drop in the S&P and the Dow. For the last 30 years I have felt that eventually the Dow and gold will reach a one to one or two to one ratio.

Currently that ratio is 18 to 1 meaning that 18 ounces of gold will buy the Dow. Arguably, that speaks to massively overvalued stocks and stupidly undervalued gold. And yes, it has happened before, twice in fact.

In 1980 gold was $850 and the Dow was 850 and in the early 30s gold was $35 and the Dow was $35. So, I would not be shocked to see something like gold and the Dow both priced at 5,000 or gold at $5,000 and the Dow at 10,000.

What sectors do you think are becoming attractively priced relative to others on this pullback?

Stocks are like a plastic toys floating on the surface of the water in a bathtub. When the plug is pulled and the water goes down the drain they all fall. if I had to be in one sector it would be commodities which are the most undervalued relative to the other sectors.

What’s the worst case and best case scenario for equities, and what collateral damage could be there be from each scenario?

Honestly, I do not see many good scenarios for equities other than very short-term and then, only if the powers that be continue to buy the indexes to keep the stocks from tumbling.

That is very hard to do as inflation and prices keep rising at close to 20% (Shadowstats) while at the same time, the majority of Americans can’t pay for food, energy and gas without diving deep into their credit card limits. Equites could easily lose as much as 80% or more and the odds of that happening are much greater than the odds of the stock market rising by 15-20%. For my money, the risk-reward says stay out of stocks until the economy stabilizes and inflation falls. But don’t hold your breath, that is a big ask.

–

Zerohedge subscribers can get 50% off a subscription to Fringe Finance all summer by clicking here.

–

More About Andy Schectman

Prior to starting Miles Franklin, Ltd. in 1989, Andrew became a Licensed Financial Planner, specializing in Swiss Franc Investments and alternative investments. At Miles Franklin Ltd., a company that has eclipsed $5 billion in sales, Andrew has developed an operation that maintains trust, collaboration, and ethical behavior, superior customer service and satisfaction to better serve their clients. He is responsible for overseeing the firm’s operations and business functions; including strategy and planning, account management, finance, and new business.

Any of my subscribers interested in contacting Andy can reach him personally at andy@milesfranklin.com, as long as you noted that you were given that e-mail address by me.

DISCLAIMER:

I own tons of metals equities, miners, etc. that will all go up if gold and silver go up. None of this is a solicitation to buy or sell securities. It is only a look into my personal opinions and portfolio. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe.

MORE DISCLAIMER:

These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot. If I am here listing things I got right or things I think will happen in the future, note that there are likely twice as many things I got wrong over the same period of time. I’m not a financial advisor, I hold no licenses or registrations and am not qualified to give advice on anything, let alone finance or medicine. Talk to your doctor, talk to your financial advisor or your therapist. Leave me a alone and do your research elsewhere. If you can find somewhere to rate this Substack one star, please do so as to save future readers from the misery of my often wholly incorrect prognostications.

Tyler Durden

Tue, 06/14/2022 – 06:30

via ZeroHedge News https://ift.tt/ZUcwvbt Tyler Durden