Worst-Case Market Scenario Begins To Materialize

By Michael Msika and Jan-Patrick Barnert, commentators at Bloomberg Markets Live

Until recently, many strategists had assumed central banks would prefer to live with rising inflation rather than put economic growth at risk. Events in the last few days are causing them to rethink that.

“More hawkish central banks last week reminded us that inflation is their prime concern, while activity/growth and markets are lesser considerations,” say Barclays strategists including Matthew Joyce.

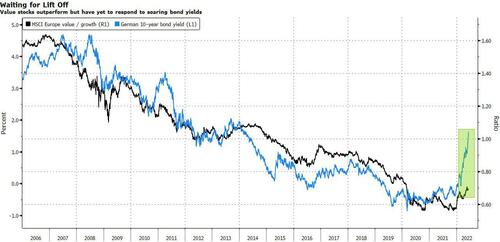

It’s such concerns that are behind the latest selloff in equities, both in Europe and beyond. Joyce and his colleagues say plunging consumer confidence may indicate a direct impact on growth from the inflation situation, and recommend keeping an overweight on defensive stocks, as well as on value shares.

These worries have been lingering for some time. During an informal Bloomberg survey in December, investors named a hasty policy shift by central banks to tame rising prices as the biggest potential downside risk for global stocks. Back then, most investors saw US inflation of 4% to 6% as high enough to derail markets, and it’s now topped 8% for three consecutive months.

No wonder then that investor sentiment has been crushed, while volatility has awakened to a risk that’s been embedded in credit spreads for several weeks.

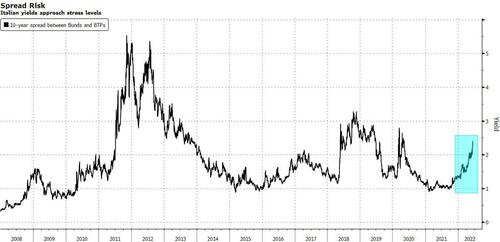

The biggest issue for stocks might be that fast-paced rate hikes pose multiple challenges at once: higher borrowing costs for companies, a weaker consumer, lower growth and uncertain outlooks. Now with bond yields rising across the curves, some might wonder if the next sovereign-debt crisis is creeping in.

“Dormant sovereign risk is starting to wake up,” say Goldman Sachs strategists led by Peter Oppenheimer. The spread between Italian and German debt isn’t yet at levels seen at the height of the last crisis, but the higher the rates, the tougher it is for a government to sustainably pay its debts, according to Goldman economists. At current rates, Italy is already in the “danger zone,” they say.

With the chances rising of bigger and faster rate increases, equities may need to start paying less attention to central-bank guidance, which in the past had helped gauge their intentions.

“The problem as we enter the next couple of Fed and ECB meetings is that the central banks haven’t quite been able to let go of forward guidance and are a little trapped,” says Deutsche Bank macro strategist Jim Reid. “Providing clarity is admirable, but in the wake of another shocking US CPI print on Friday, should a 75bps hike not be a serious consideration?” And some strategists are now floating the possibility of a 100 basis point hike on Wednesday.

And it’s not just that unsettling equities. According to Patrick Linden, managing director at Clartan Associes in Germany, inflationary pressures are being amplified as the side effects of the Ukraine invasion and Chinese Covid-19 restrictions make it harder to revive post-pandemic logistics chains.

“All together this fuels the vulnerability of the markets,” Linden says.

Tyler Durden

Tue, 06/14/2022 – 09:25

via ZeroHedge News https://ift.tt/uJ2SQUF Tyler Durden