ECB To Launch “First Line” Of Bond Crash Defense On Friday, Same Day QE Ends

For all those curious what the ECB’s “anti-spread tool”, meant to bring soaring Italian yields tighter in a time of rising rates and QT even as Europe scrambles to offset record inflation by tightening financial conditions (as discussed most recently in “The ECB Has A Huge Dilemma: Price Stability Or Bail Out Nations“), we got a small update earlier today when ECB President Christine Lagarde said that the central bank will activate one part of the bond-purchasing firepower it’s earmarked as “a first line of defense” against a possible debt-market crisis this coming Friday… which just “coincidentally” happens to be the day the ECB’s QE ends!

“We have decided to apply this flexibility in reinvesting redemptions coming due in the PEPP portfolio as of 1 July,” Lagarde said Tuesday in a speech in Sintra, Portugal, where the ECB is holding its annual retreat.

“We will ensure that the orderly transmission of our policy stance throughout the euro area is preserved,” she said. “We will address every obstacle that may pose a threat to our price-stability mandate.”

As Bloomberg notes, the availability of pandemic reinvestments has been touted as an initial crisis-fighting tool since December, though the ECB didn’t choose to resort to that option until an emergency meeting on June 15 that followed a surge in Italian yields.

Unfortunately, that’s as much detail as we are going to get, because once again there was generous use of the word flexibility”, this time in the context to how reinvestments from the ECB’s €1.7 trillion ($1.8 trillion) pandemic bond-buying portfolio are allocated, and which will be aimed at curbing unwarranted turmoil in government bonds as interest rates are lifted from record lows to curb unprecedented inflation.

How many more months will the @ecb take before “revealing” just what its “anti-spread” tool is, how it is different from a deflationary QE in a time of inflationary QT… and sending Italian yields soaring.

— zerohedge (@zerohedge) June 21, 2022

In other words, just as we jokingly suggested some time ago, the ECB will do QT on even days, QE on odd ones.

*LAGARDE SAYS TOOL WOULD KICK IN IF SPREADS GO TOO FAR, TOO FAST

QT on slow and gentle days

QE on fast and furious days— zerohedge (@zerohedge) June 16, 2022

Meanwhile, adding to the QE now, QT tomorrow confusion, net buying under the ECB’s original asset-purchase program is also set to end on Friday, exposing the euro zone’s more-indebted nations to speculative attacks by investors, similar to the blowout in Italian yields already observed at the start of June.

But wait, there’s more, because while Europe is desperate for deflationary gale force winds to blow away the runaway inflation that has put an end to the ECB’s various easing deus ex machinas, many are convinced that the ECB is hiking into yet another recession which will be triggered by Russia which continues to cut off energy supplies, while there are also doubts in the ECB’s ability to avoid investor panic as it raises rates for the first time in a decade.

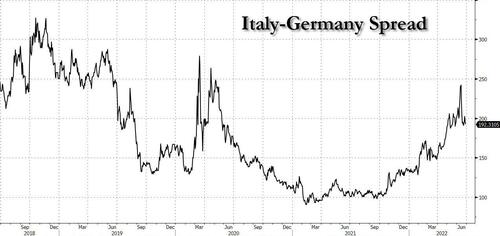

Following Lagarde’s statement, Italian bonds trimmed declines, narrowing the 10-year yield premium over its German counterpart — a key gauge of risk in the region — by six basis points to 192 basis points, the lowest since Thursday.

The ECB is also working on a new bond-buying instrument to tackle the same issue — known as fragmentation — and is expected to announce something in the coming weeks. Lagarde said the tool will allow rates to rise “as far as necessary,” complementing efforts to stabilize inflation at the 2% target — a quarter of the current level.

Of course, that will never happen and instead the moment the details of the “anti-fragmentation” mechanism are revealed and the market realizes just how powerless the ECB is, yields and spreads will blow out to multi-year highs.

Addressing the same event in Portugal, Governing Council member Martins Kazaks said he thinks “sterilization” to nullify the stimulative effect of bond purchases “should be part of the instrument.” The tool “should be a backstop,” used only when urgently needed, he said.

However, since there is no such thing as a deus ex machina, the moment the ECB unveils the specifics and details is when the next crisis begins, and the ECB knows that very well.

Separately, while describing the risk of a recession in the 19-member euro area as “non-trivial,” Kazaks said rates can be raised “quite quickly” and called front-loading hikes — including a possible July move beyond the planned quarter-point — “reasonable.”Lagarde backed the ECB’s base case for next month, but stressed the path for steady rate increases could be accelerated if price pressures worsen.

What the ECB should be worried about is how fast it will cut rates after its rate hikes spark the next recession and whether rates will hit a new record negative yield one year from today/

Tyler Durden

Tue, 06/28/2022 – 12:00

via ZeroHedge News https://ift.tt/WBAwagu Tyler Durden