83% Of Americans Cut Back On Spending As Economy Careens Towards Crisis , Poll Finds

US consumer sentiment and confidence have deteriorated for households amid slowing economic growth and persistently high inflation that suggests stagflation.

A new study lends credibility to the current souring macroeconomic backdrop of high inflation and shortages, altering consumer lifestyles, behavior changes, and expectations, all of which show “Bidenomics” could be one greatest failures since the Carter administration of 1977-1981.

Provident Bank, based in New Jersey, found that 83% of respondents slashed personal spending due to soaring prices of food and gasoline, with 23% indicating they had to make “drastic changes” to their spending for financial survival.

According to the survey results of 600 adults, 10.5% of respondents eliminated all non-essential purchases, and nearly 72% said they made at least some changes to personal travel habits.

While some consumers have cut back on some non-essential spending, like dining out and unnecessary travel, others reported much more drastic changes such as skipping meals, conserving water, and eliminating meat from their diets. People are feeling an immense amount of financial pressure right now. Unfortunately, this is not surprising after the Labor Department reported earlier this month that the United States Consumer Price Index (CPI) hit a 40-year high in May. — Provident Bank

Respondents said rising prices of groceries and gas had put the most significant dent in their pocketbooks. According to the survey results, 53% said they now spend between $101 – $500 more per month on groceries, and 32% spend between $101 – $250 more on gas. They also said that skyrocketing prices of baby products, meat, utilities, household goods, milk, and alcohol have led to economic discomfort.

There’s no question this survey outlines consumers are being squeezed by negative real wage growth and inflation at 40-year highs. Many folks have maxed out credit cards and drained personal savings. Much of this economic despair has sent consumer sentiment crashing:

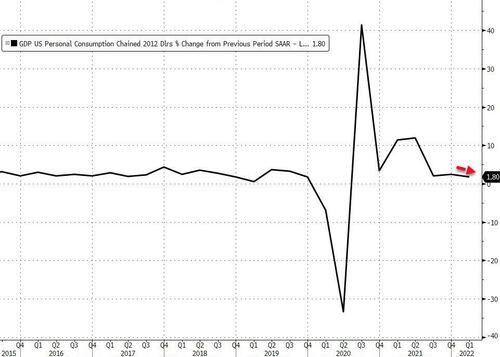

The third reading of Q1 GDP on Wednesday said it all: personal consumption growth has collapsed.

High inflation plus a rapidly slowing economy could be the emergence of stagflation, a dangerous economic environment that the Federal Reserve doesn’t want to see. Already, the souring environment is altering lifestyle patterns and expectations of the vast majority of Americans struggling to survive Biden’s “Build Back Better” economy.

Suppose the consumer is tapping out under the weight of inflation, maxed out credit cards, collapsed personal savings, and negative real wage growth. In that case, it is an ominous sign the consumer-driven economy is careening toward a crisis.

Even more shocking is how a very underreported tidal wave of evictions could be imminent as millions of Americans can’t pay rent.

History doesn’t repeat itself, but it certainly rhymes with the stagflation era of the 1970s. Back then, former President Jimmy Carter was a one-term president.

Tyler Durden

Wed, 06/29/2022 – 14:25

via ZeroHedge News https://ift.tt/fE3t24Q Tyler Durden