Bonds & The Dollar Bid As Recession Risks Rise, Black Gold & Breakevens Battered

An ugly third look at Q1 GDP – higher inflation, lower growth and consumption – just added to the current malaise in growth fears (and forecasts from sentiment surveys) today and the recession trade was back on with oil and stocks sold and bonds bid (and the dollar rallied perhaps more on safe haven liquidity needs into quarter-end). And all this right before PCE prints tomorrow which is expected to pick up… and initial claims which could be about to explode higher.

The end-result is that rate-hike expectations have stalled (i.e. the market no longer believes The Fed will be hiking as aggressively as it did) as recession fears are brought forward, and more notably subsequent rate-cut expectations have surged (now pricing in more than 3 rate-cuts)….

Source: Bloomberg

And more notably, Rate-cuts are now starting to be priced in for the Dec 2022 to March 2023 time-frame…

Source: Bloomberg

Bonds were bid across the entire curve with the belly outperforming (2& and 30Y -6bps, 5-7Y -8bps). Yields are all lower on the week with the long-end outperforming…

Source: Bloomberg

10Y Yields fell back below 3.10%…

Source: Bloomberg

Notably Market-Implied Inflation Breakevens are tumbling (recession/growth fears dominating inflation narrative)…

Source: Bloomberg

Stocks were mixed with Small Caps getting hammered as the rest of the majors clung to unchanged (balance between recession fears impact on earnings and pre-empting the post-recession QE response surgefest )…

Energy and Consumer Discretionary are signaling ‘recession’ trade…

Source: Bloomberg

The dollar extended gains back up to last week’s highs….

Source: Bloomberg

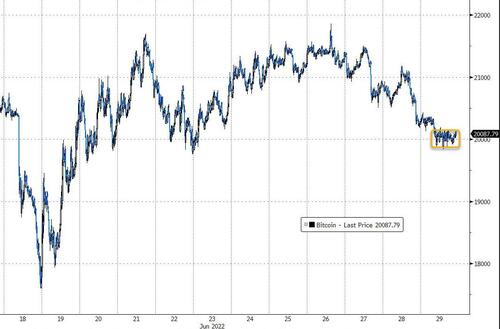

Crypto was weaker with Ethereum underperforming Bitcoin, which fell back to $20,000 and oscillated there all day…

Source: Bloomberg

Oil tanked on the day – not helped by signs of gasoline demand destruction, higher US crude production, and rising product inventories – after an overnight gain on the back of reports that Iran nuke deal talks had failed (again)…

US NatGas also tumbled today (continuing to track WTI’s oil-barrel-equivalent price)…

Gold pumped (on recession fears and potentially renewed easing sooner than later), but was slapped back to earth as the US cash equity market opened…

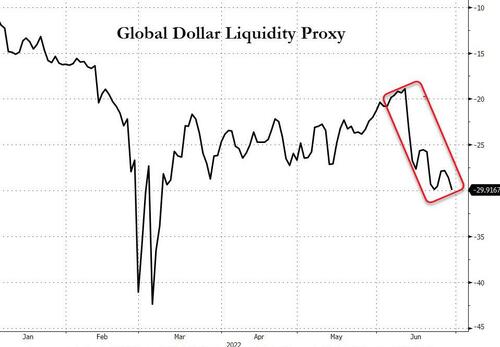

Finally, we note that there are signs of stress in the plumbing of the financial markets as our proxy for global dollar liquidity is starting to accelerate…

Source: Bloomberg

There could be pressure from month- and quarter-end so we will have to see how this rolls, but it is worth keeping an eye on cross-currency basis swap levels.

Tyler Durden

Wed, 06/29/2022 – 16:00

via ZeroHedge News https://ift.tt/KgasI46 Tyler Durden