As G7 Quietly Shelves Russian Oil Price Cap Idea, Biden Will Beg Mideast Allies To Pump More

To be honest we haven’t spent much time discussing the timesink idiocy of the Biden/G7 “Russian oil price cap” idea because well, it is idiotic as Rabobank explained…

The ‘oil cap’ is simple in theory: the G7 will refuse to provide insurance to any vessel that carries Russian oil unless the cargo is sold with an agreed price cap. Yet it won’t work and will just push oil prices higher. Russia will never agree. China and India will never agree either. Russia and China may offer their own underwriting services, which would force the West into physically blocking cargoes and confronting China – as a Russian-oil carrying ship is stopped in the US, says the Wall Street Journal. Plus, the G7 are already not taking Russian oil: they are taking Russian oil from India and China that is being on-sold.

… and it appears that finally even the dumbest people on earth, i.e. career politicians and economics, have figured it out.

Reuters reports that according to EU officials, the biggest price cap proponents – the governments of Germany and other European Union countries – voiced “caution” in a closed-door meeting about price caps on Russian oil, a day after the Group of Seven economic powers agreed to urgently start work on the matter,

Here is the truncated timeline for those who missed it: on Tuesday G7 leaders agreed to explore “the feasibility of introducing temporary import price caps” on Russian fossil fuel, including oil, and tasked ministers to evaluate the proposal urgently.

But just one day later, Germany’s envoy to the EU told his counterparts in a restricted meeting that the world should be “realistic” about the proposal, which he said was added to the G7 statement after “intense pressure” from Washington, according to one official who attended the meeting.

And then, the envoy also said an agreement on whether to apply caps was not expected to come anytime soon… or any time for that matter as it is impossible.

Then there are the holdouts: Hungary and Belgium also raised concerns at the meeting about the G7 statement on sanctions, the official said, with Hungary explicitly backing Berlin’s caution on oil price caps. A second EU official familiar with the talks confirmed that Germany and others had expressed wariness about oil price caps.

A German government official said on Thursday that “success of this plan depends on international cooperation”, which is precisely what we said. Of course, neither China nor India will ever agree to cooperate with the G7 if it means losing out on access to extremely cheap oil (the alternative is Russia just halting exports and sending the price of oil to $200+).

Stefano Sannino, secretary general of the EU’s diplomatic service said on Thursday that a price cap would only be effective if universally applied, and so agreement would be needed across the G20 countries, not just the G7.

“You need to be sure you do not have distortion of trade and then the only thing that is happening is that essentially oil goes to other places with other carriers and insured by other companies – and so the price remains the same,” Sannino told an EU-UK Forum conference.

Hilariously, the world’s most powerful – and stupid – people are still trying to come up with a price cap idea even as they are all facing an even worse fate in just 6 months: under already passed EU sanctions that will become effective in December, insurance and other financial services crucial for Russian oil shipments will be banned worldwide. Critics of this fear it could lead to higher global oil prices because of the key role EU companies play in shipping insurance, bringing a benefit to Moscow.

A cap, if agreed, would effectively make it possible for companies to trade Russian oil, instead of facing a total ban. However, the EU sanctions on Russian oil, which took weeks to agree, would have to be tweaked and reopening the debate on this measure could be controversial, officials said.

Indeed, as Rabobank cynically concluded, instead of buying Russian oil directly, European nations will instead buy Russian oil from India and China paying a much higher price in the process.

Meanwhile, realizing that his latest attempt to finally outsmart Putin has just gone up in a puff of crack cocaine smoke and his brilliant energy plan – perhaps concocted by Ukraine energy expert Hunter Biden – this morning Joe Biden turned his attention away from the economically impossible and toward diplomacy instead, and has set his sights on a promise of higher production from Gulf allies.

As discussed previously, Saudi Arabia and the United Arab Emirates are the only countries with significant spare capacity to pump crude, although as Reuters’ John Kemp wrote, “it is unlikely to be much more than around 1 million barrels per day (bpd) based on historic production rates.” Bloomberg added the following:

Aramco’s maximum capacity is a mystery because it hasn’t ever been tested for an extended period. In April 2020, Riyadh reported its highest ever monthly average, at 11.55 million barrels a day. Back then, Aramco briefly — for a few days, I hear — pumped 12 million barrels a day. Aramco executives, including Chief Executive Officer Amin Nasser, took selfies in front of a giant screen wall showing production hitting the record level. At one point, it surged to 12.3 million barrels. Smiles all round.

Behind closed doors, however, things were more complicated. In private, Saudi oil industry executives describe that effort as a real challenge and express concern about having to sustain that output. It’s one thing to briefly hit the target, quite another to keep pumping and pumping at that level for a year, the internal thinking goes.

In any casem without a pledge from the two OPEC members to boost production, the president would lose what may be his last tool for alleviating the economic and political pain caused by high fuel prices. That is, of course, unless Biden does the obvious thing and encourages more domestic production. But since the 79-year-old is being handled by a bunch of “green” puppetmasters, this has zero chance of passing.

As such, the coming trip to Saudi Arabia puts Biden in an awkward position, especially after he vowed during his campaign to make the kingdom a “pariah” over its human rights record. The president said he wouldn’t specifically ask Saudi King Salman or Crown Prince Mohammed Bin Salman to raise oil production when he sees them on July 16. The broader Gulf Cooperation Council, a forum of largely oil-rich countries along the Persian Gulf, is a more appropriate setting for such a request, he said.

“All the Gulf states are meeting. I have indicated to them that I thought they should be increasing production,” Biden said Thursday at a news conference in Madrid following a NATO summit. “I hope we see them, in their own interest, concluding that makes sense to do.”

REPORTER: If you were to see the [Saudi] Crown Prince…would you ask them to increase oil production?

BIDEN: No…all the Gulf states are meeting. I’ve indicated to them that I thought they should be increasing oil production generically, not to the Saudis particularly. pic.twitter.com/VpHlWnXTVD

— JM Rieger (@RiegerReport) June 30, 2022

And as noted above, even if Saudi Arabia and the UAE are willing to assist the US – which they aren’t since the coming recession will likely send oil prices sharply lower – just how much extra oil the two countries could provide has been questioned by this week by Shell Plc Chief Executive Ben van Beurden and French President Emmanuel Macron. While official data indicates the duo have almost 3 million barrels a day of spare production capacity, deploying this would require them to pump at levels rarely sustained before, if ever.

To avoid humiliation, Biden has repeatedly said that his Mideast trip is about more than energy – he cited concerns over the war in Yemen, among other issues. But everyone knows what’s the primary goal: the surge in gasoline prices in the US has added pressure on the president and Democrats heading into the November mid-term elections. In Madrid, Biden reiterated his view that the price increase is entirely due to “Russia, Russia, Russia” as a result of the war in Ukraine.

Biden said he sees a number of ways to alleviate some of those increases, including through a temporary repeal of the federal gas tax, a measure that would need congressional approval. But he also said that Americans may have to continue enduring higher-than-usual fuel prices for a time.

Separately, as reported earlier, on Thursday OPEC+ ratified their plan to boost oil production by a further 648,000 barrels a day in August, completing the return of supplies halted during the pandemic. The group, which is led by Saudi Arabia, deferred discussions about its next move for another day, with the next meeting scheduled for Aug. 3.

True to form, the US sees the OPEC+ supply hikes, which were expanded by 50% at the group’s previous meeting on June 2, as a first step that will be followed by a further production increase, Amos Hochstein, the State Department’s senior adviser for energy security, said in a Bloomberg Television interview on Wednesday. “Announcing additional supplies a few weeks ago was step one,” Hochstein said. “I’m very hopeful that you and I can have this conversation about step two sometime in the near future.”

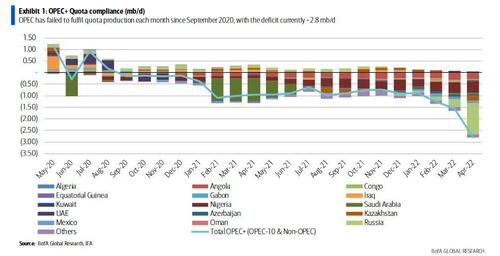

The problem, however, as the chart below shows is that OPEC+ is simply incapable of pumping as much as it used to in the recent past due to lack of capital spending.

Oil fell after Biden’s comments, with West Texas Intermediate futures sinking 3.9% to $105.50 a barrel around 11am. We expect oil to resume its surge in the coming days.

Tyler Durden

Thu, 06/30/2022 – 12:45

via ZeroHedge News https://ift.tt/9uRVQ2g Tyler Durden