First-Half FUBAR: Stocks Worst In 60 Years, Bonds & Bitcoin Worst Ever

It appears the world’s investors were ‘over-stuffed’ full of liquidity just as 2021 ended…

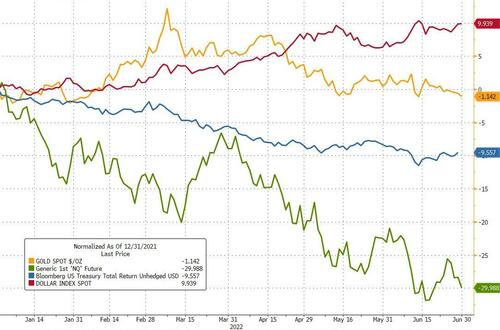

…which meant the first half of 2022 was a bloodbath for most. Stocks were clubbed like a baby seal, bonds were battered, there was carnage in crypto as the dollar soared and gold was steady…

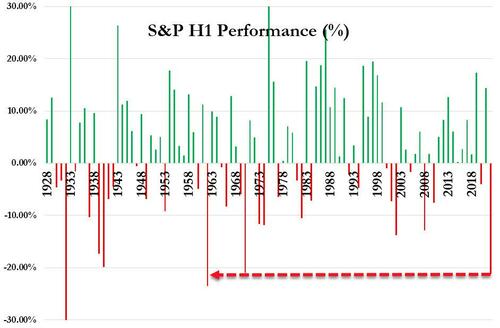

S&P was down 21.01% in 1970 H1, we are currently down 21.22% H1… so, according to Bloomberg data, this would be worst since 1962… 60 years ago

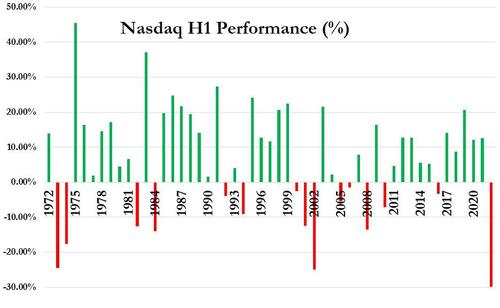

Nasdaq Composite is down 30% to start the year – that is the worst start to a year ever, worse than the H1 2002 collapse.

Year-to-date, US stocks have been hammered lower with 3 small BTFD efforts…

Only the energy sector is green year-to-date with Consumer Discretionary the worst horse in the glue factory…

Source: Bloomberg

Of course, the ugly quarter has prompted many calls for a rebound based on history… the question is – how many of those times saw stagflationary pressures as large as the current quagmire…

This series goes back to 1946.

(via @bespokeinvest) $SPX pic.twitter.com/0BQVK3BxSM

— Carl Quintanilla (@carlquintanilla) June 30, 2022

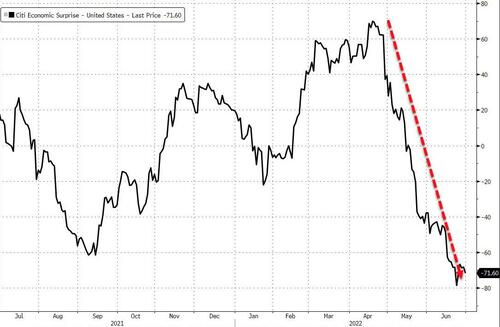

The US economy saw false hopes of recovery in Q1 of 2022, only to have that slapped in the face of optimists in Q2 as May and June saw macro data collapse…

Source: Bloomberg

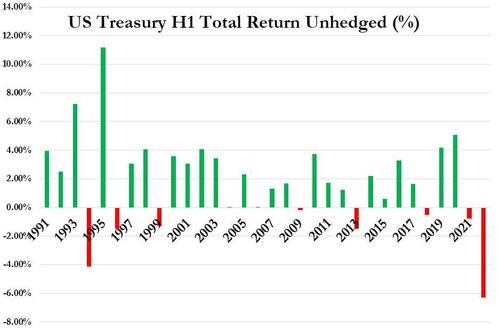

US Treasuries suffered their worst first half of a year ever…

The Short-end of the curve was the hardest hit, with 2Y rising 220bps in H1 and 30Y up 123bps…

Source: Bloomberg

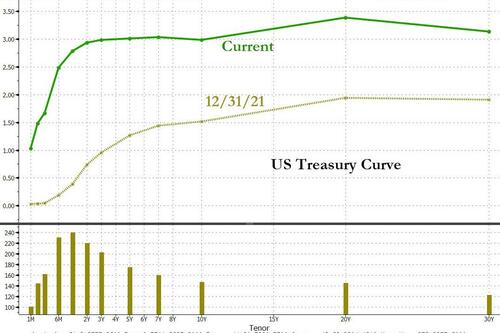

For a different perspective on this shift, here is the before and after of the US yield curve…

Source: Bloomberg

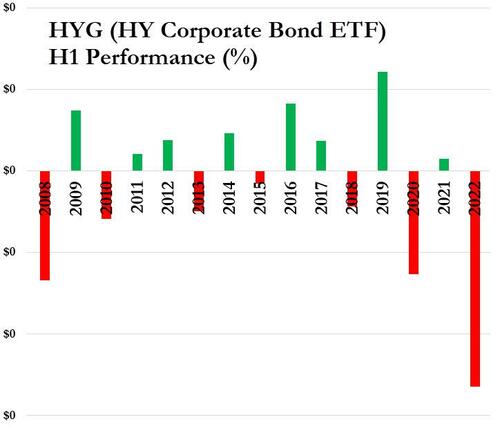

The credit side of the bond market was also a bloodbath with HYG suffering its worst H1 losses ever…

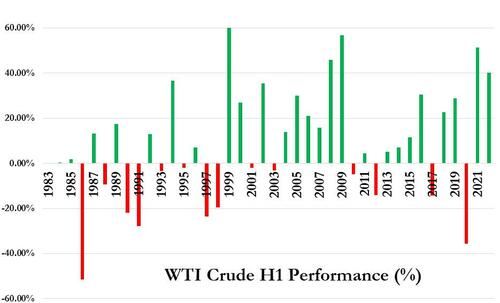

Commodities, broadly speaking, were up 18% in the first half of 2022 (but we note they were up 22% in the first half of 2021 – which is weird because we are pretty sure that Putin didn’t invade Ukraine in 2021).

Oil prices soared 40% in the first half of 2022, but that is less than the surge to start 2021…

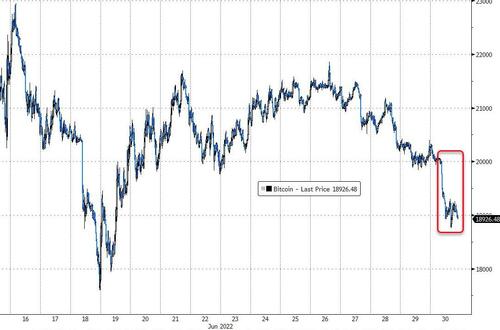

Crypto was carnage as Bitcoin fell 59% in the first half of the year – that is the worst start to a year ever for the crypto currency (worse than the 57.99% drop in 2017). Ethereum was worse, falling 72% YTD…

Source: Bloomberg

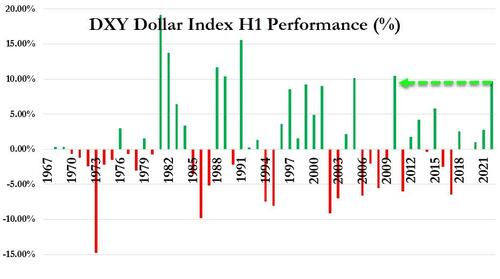

The Dollar soared in the first half of the year, up almost 10% – its biggest start to a year since 2010…

So having got all that off our chest, let’s focus back in on this week…

Stocks rollercoastered today, weakness overnight and then dumping early on in the cash session led to a bid into and across the European close which managed to get the majors back to unchanged on the day… only to see selling return in the afternoon

Interestingly, today’s dead-cat-bounce managed to get stocks up to last Friday’s cash open level before stocks went panic-bid into OpEx…

Credit markets are breaking bad and signaling significantly more pain ahead for stocks…

Source: Bloomberg

Treasuries were bid today with the short-end outperforming (5Y -14bps, 30Y -9bps) and the belly continues to outperform strongly into the quarter-end…

Source: Bloomberg

This pushed the 10Y Yield back below 3.00%, back below the CPI-spike lows on June 10th…

Source: Bloomberg

Global inflation expectations are starting to really tumble with US 10Y Breakevens at their lowest since Sept 2021. Japanese inflation expectations have fallen the least…

Source: Bloomberg

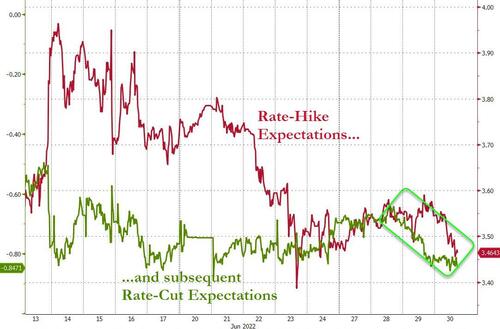

Rate-hike expectations fell further today and subsequent rate-cut expectations rose as recession fears rise…

Source: Bloomberg

And stagflation is here…

Source: Bloomberg

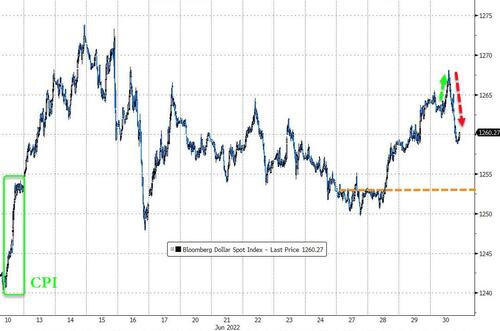

The Dollar had a big month, quarter, and half; surging back to near COVID safe-haven spike highs…

Source: Bloomberg

On the day, the dollar was lower but still up on the week (and notably higher since CPI on June 10th)

Source: Bloomberg

Bitcoin fell back below $19,000 and then hovered around there today…

Source: Bloomberg

Commodities crashed today, falling down towards pre-Putin levels…

Source: Bloomberg

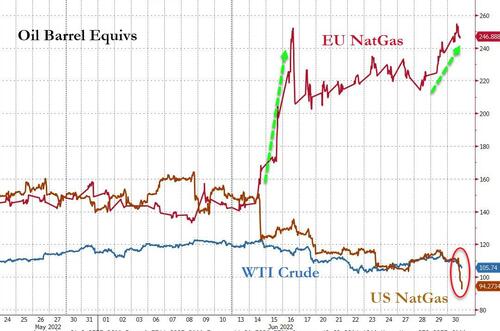

US Nat Gas tumbled further today on another bigger than expected storage build, plunging to 3-month lows…

Notably this smashed US NatGas below WTI (on an oil barrel equivalent basis) and the widened the spread to EU NatGas dramatically…

Source: Bloomberg

Oil suffered its first monthly decline since November…

Gold extended the week’s losses back down towards $1800 with every bounce getting monkeyhammered to a new low…

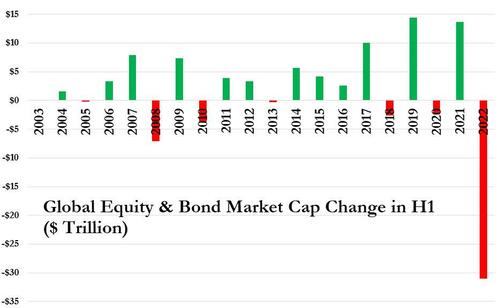

Finally, we note that global equity and debt capital markets lost a stunning $31 trillion in the first half of the year…

Source: Bloomberg

…a record by a massive margin…

Source: Bloomberg

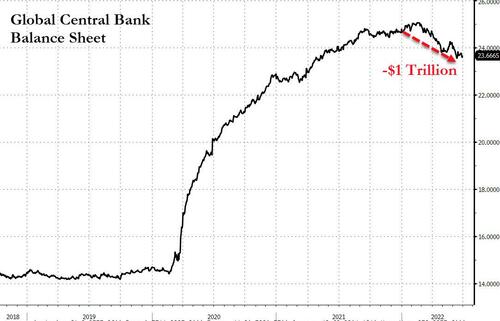

And that was triggered by just $1 trillion drop in global central bank balance sheets…

Source: Bloomberg

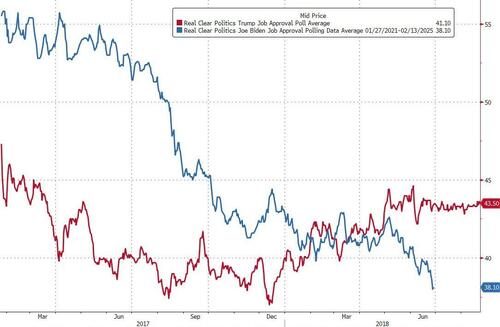

The Biden Bloodbath!

And it could get worse…

⚠️ What’s the opposite of “animal spirits”?

Confidence indicators across major economies are pointing to a synchronised global downturn… and one that’s potentially as a big as the GFC $SPX $USD pic.twitter.com/oheqtm9zlH

— Viraj Patel (@VPatelFX) June 30, 2022

Tyler Durden

Thu, 06/30/2022 – 16:00

via ZeroHedge News https://ift.tt/NXbagRW Tyler Durden