Market Starting Down The Abyss Of Contraction

Two days ago Nomura’s Charlie McElligott laid out the market’s pernicious recession/non-recession feedback loop as well as the conditions tracked by traders to gauge if the “all-clear” has arrived, to wit:

A flush down to 3300-3400 is the perceived “all-clear” on the valuation case for Equities, with the whole world seemingly bid “out loud” down there for size, which means it either, i) it doesn’t happen and we don’t trade low enough, or conversely, or ii) we do trade down there, but the supposed size demand doesn’t materialize, and we get the puke through 3k.

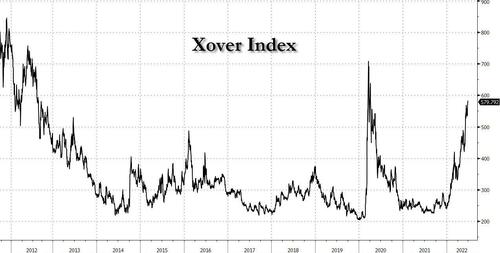

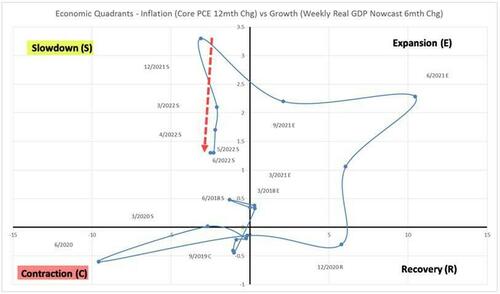

Today, McElligott doubles down with some “gory details” on how the quad diagram shows the economy careening into contraction (more below) starting with European inflation which continues its escalation, perversely increasing the likelihood of an “accident” there against a still-toiling ECB who risks a “catch-up” hiking spasm into a hard recession—and accordingly EUR Credit markets are staring into the abyss, with Xover earlier printing through 600bps for the first time since “peak COVID” stress

Well, as we have been saying for months, Charlie notes that the market “gets the joke” on Central Banks being incapable of address “supply side” issues — so they pull the only lever they have on the “demand” side, hence “Recession” gap-risk repricing hard and fast.

And this, according to Elligott, is the brutal truth (something we have been saying since 2020):

in the absence of being able to print oil and gas, refinery capacity, very large crude carriers (VLCCs), fertilizers, grains, rare earth metals for EVs etc…Central Banks are really left with no choice but to drive economies into recession in order to curtail “demand” -pressure on prices, even though they’re a much smaller attributing factor to inflation.

Indeed, with “Demand” the only “lever” they can pull here, since governments (particularly due to their ‘pie-in-the-sky’ aspirational climate goals, but without viable energy transition alternatives in the meantime) and industry (burned in the past from overzealous cash-burning overbuilding and overcapacity, into a future state where western governments are actively seeking to erase them) are unable to come to terms on addressing “supply” side dynamics. So it is a “pick your poison” trade:

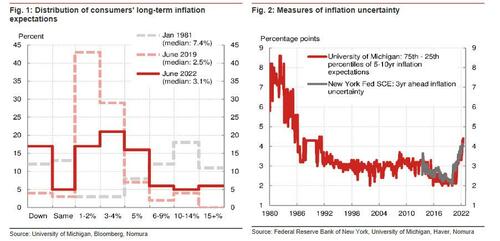

Stomp inflation from the “demand” side while global economies still show a remaining semblance of “juice,” but cause a recession and loss of employment—because the alternative case of “unanchored” forward inflation is being painted as an even uglier long-term economic outcome.

As an aside, Biden “punishing” Putin for unleashing global commodity hyperinflation by sending the US economy into a recession and starting a harrowing bear market and the worst tech crash since Lehman is so… 2022. As for a recession with mass layoffs being uglier than inflation, well… we give Biden’s handlers a few more days before they completely change their mind on this once the violent protests break out.

This slide into recession is manifesting itself across recent destruction in Cyclicals, Commods and Inflation Breakevens (which have collapsed to 2018 levels), along with resumption of widening in Corp Credit despite the Equities bounce off the cycle lows over the past 2 weeks

To this point, Nomura’s Economics team “upped the ante” regarding the risk of unanchored inflation and again, increases the risk of Fed tightening induced “accident” (in a note titled “The Fed’s Inflation Expectations Angst Grows” available to pro subscribers).

And accordingly, the STIRs market is anticipating this “breakage” due to the final throes of this “tightening into a Contraction” dynamic then leading to a 4Q22 recession and 2023 policy reversal: EDZ2EDZ3 (Dec22-Dec23) now shows 53.5bps of CUTS priced in the US for next year, where even Z2H3 (Dec22-Mar23, aka Q1 2023 ) shows a -5bps inversion as of today…

… and the H3M3 (Mar23-Jun23) inversion goes to -15.5bps; while H3H4 (Mar23-Mar24) extends to -60bps vs -44.5bps Tuesday

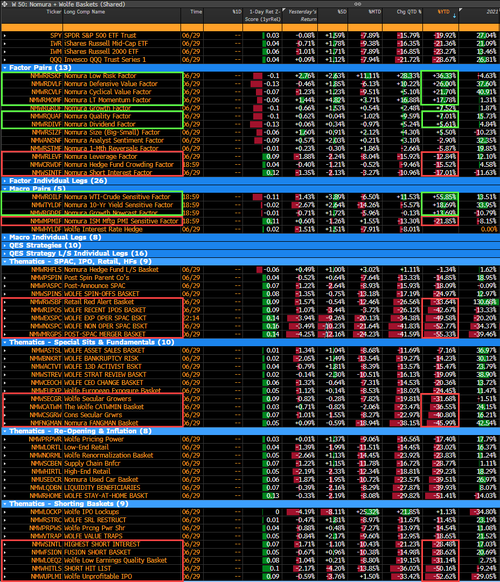

Looking at markets, equities risk-premia continues to trade this “recession” dynamic as currently expressed by “Momentum,” “Defensive Value,” “Low Risk,” “Quality” and “Dividends” leadership, versus renewed moves lower this week in the prior YTD “losers” of “High Short Interest,” “Leverage,” “Hedge Fund Crowding” and “ISM Manufacturing PMI” (weak balance sheet / high realized vol / unprofitable / low quality / growth sensitive -stuff).

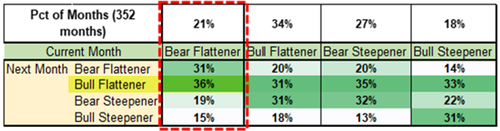

This also matches the current economic quadrant trajectory (see above) which shows us “careening into Contraction” from what is an already embedded “Slowdown” phase…

… which then too corresponds with historical precedent for the next Yield Curve phase-shift into a likely “Bull-Flattener.”

Meanwhile, as discussed earlier this week, equities also now too feeling that “next shoe to drop” of the long-overdue “negative earnings revisions” transition, which is finally kicking-off with a bang as the Street suddenly spasms into taking down estimates in a number of key sectors / industries.

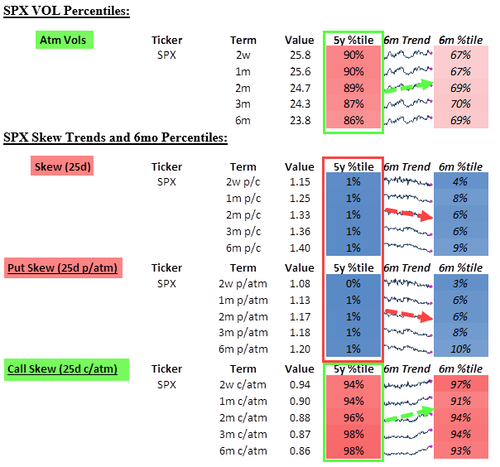

Nonetheless from the Vol side, there remains almost no demand for new “Crash” here (hence VVIX sub-90), as with fund exposures so low, clients are more worried about missing the “right tail” (e.g. some sort of “dovish pivot” scenario from the Fed) than “left tail.”

As such, a part of the “extreme flat Skew” dynamic is wingy Calls looking relative to wingy Puts, and that is “skewing Skew” (and Put Skew) to look so incredibly, historically low / flat, despite SPX ATM Vols remaining historically high.

Finally and tactically with Equities, McElligott reminds us that today is the roll of the infamous JPM Put/Spread Collar which is “gonna be fun” – per Nomura index trader Jordan Farkas, the new structure should look like them selling 42k 6/30 4285 Puts to buy 42k 9/30 3000-3575-3875 PS Collar. This will sell a massive 16mm Vega and will buy 4.7B of Delta, but they will structure the trade such that its neutral at time of trade and will shift Delta to MOC

Tyler Durden

Thu, 06/30/2022 – 14:45

via ZeroHedge News https://ift.tt/7mnWcZK Tyler Durden