Home Price Cuts, Rising Inventories Are Ominous Signs Of Top

The pandemic housing boom hit a peak and should start rolling over as rising inventory forces some home sellers to slash prices. The weight of soaring mortgage rates and increasing inventory are the possible markings of a top that has already led some sellers in major US cities to cut listing prices.

“The housing market is absolutely in need of a reset,” George Ratiu, senior economist at Realtor.com, told Bloomberg.

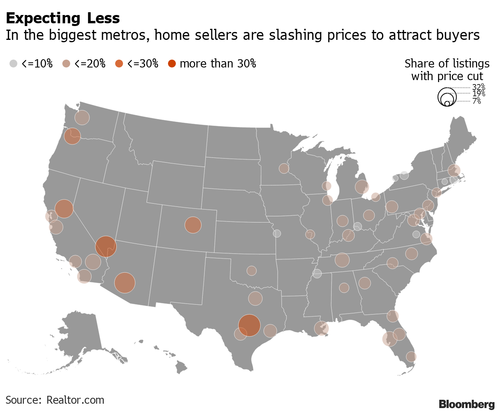

Realtor.com’s data showed almost a third of listings in June had price cuts in Austin, Phoenix, and Las Vegas metro areas. Price cuts are a growing national trend as higher rates triggered an affordability crisis, removing millions of new prospective home buyers.

Bloomberg spoke with Naples, Florida, real estate agent Jennifer DeFrancesco who advised her clients to drop listing prices as she believes the flood of demand from the Northeast has eased.

Carolyn Young, a broker associate with Christie’s International Real Estate Sereno in the San Francisco Bay Area, said demand for homes in a 55-and-over community in Brentwood had seen dramatic declines since many retirees were battered by awful performance in their stock and bond portfolios in the first half. She advised clients at Trilogy at the Vineyards to lower their listings by $50,000 to $100,000 because of faltering demand.

“For sellers, it’s devastating, especially if they bought something else earlier and paid too much for that,” Young said.

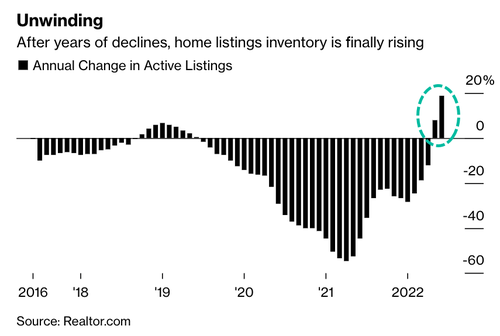

Price cutting comes as a flood of inventory enters a very tight market. Another Realtor.com report this week showed the number of active US listings soared 18.7% in June from a year earlier.

Danielle Hale, the chief economist for Realtor.com, said, “We anticipated that more inventory will eventually cool the feverish pace of competition.” The rise in inventory was more profound in Austin, Texas; Phoenix, Arizona; and Raleigh, North Carolina, which saw active listings more than double from a year ago. In Nashville, Tennessee, active listings jumped 86%, and 72% in Riverside, California.

Mortgage applications and pending home sales are down, which suggests the jump in the 30-year fixed-loan mortgage rate from 3% to over 6% this year (back in March, we warned coming rate explosion would trigger a housing affordability crisis) is quickly cooling the market. Next, we should first see price declines in areas that were red hot during the early days of the pandemic.

It’s only a matter of time before the Case-Shiller (newly minted S&P CoreLogic CS) home price index data turns.

Tyler Durden

Sun, 07/03/2022 – 15:25

via ZeroHedge News https://ift.tt/xJr8zyp Tyler Durden