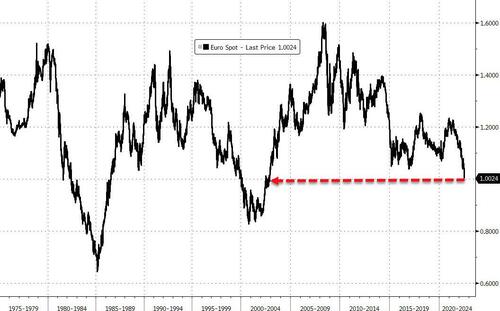

Euro Tumbles To Dollar Parity For First Time Since 2002

The Euro is trading at parity with the USDollar. Having tested lower on Monday and then rebounded (on the back of USD selling/Gold buying), the euro has slid once again overnight…

This is the weakest the euro has been relative to the USDollar since Nov 2002 (note the chart below is adjusted for the DM prior to the formation of the euro)…

“The USD is carrying a lot of momentum right now and it’s hard to argue against owing the USD with such an aggressive Fed posture and the myriad of issues in Europe,” said Brad Bechtel, foreign-exchange strategist at Jefferies LLC.

“Having said that it feels like EUR/USD is oversold on many technical measures and parity was such a target for so many people in the market that it wouldn’t surprise if we see a lot of profit taking down here and a short term bounce.”

The weakness of the single currency reflects concerns over European gas supplies from Russia and an economic slowdown.

“The worst case (total stop of gas flows) brings recession and probably another 10% fall by the euro from here,” Societe Generale chief FX strategist Kit Juckes wrote in a note.

If EU NatGas prices are a proxy for this ‘worst case scenario’, then the euro has further to fall…

A string of increasingly-large Fed rate hikes has supercharged the dollar, while Russia’s invasion of Ukraine has worsened the outlook for growth in the eurozone and pushed up the cost of its energy imports.

Rate-hike differentials suggest the euro has further to fall…

ECB Governing Council member Robert Holzmann said Friday that the central bank should increase interest rates by as much as 125bps by September if the inflation outlook doesn’t improve. That would be a dramatic shock given the market is expecting around 75bps of hikes by then (and some have been jawboning the usual dovish sentiment as spreads defragment and stocks stall).

Tyler Durden

Tue, 07/12/2022 – 06:06

via ZeroHedge News https://ift.tt/9FtDmyw Tyler Durden