ECB Preview: First Rate Hike In 11 Years, And Another Major Policy Mistake

Submitted by Newsquawk

Summary:

- ECB policy announcement due Thursday 21st July; rate decision at 13:15BST/08:15EDT, press conference from 13:45BST/08:45EDT

- The ECB is set to finally pull the trigger on rates; discussion will be over 25bps or 50bps

- Policymakers are expected to unveil details of the anti-fragmentation tool

OVERVIEW: After standing pat on rates in June, the ECB is finally set to pull the trigger and commence its rate-hiking cycle for the first time since June 2011 (when it sparked a sovereign debt crisis and cut rates three months later). This particular rate hike will be an even bigger policy error as it comes just as Europe’s economy slams the breaks into a big recession and ahead of what will be a freezing winter.

Up until this week, analysts had been near unanimous in their view that the hike would be by 25bps given the explicit nature of the June statement. However, recent reporting has suggested that policymakers will now discuss the possibility of a 50bps move. Accordingly, markets now assign a 60% chance to such a move vs. around 33% at the start of the week. If policymakers opt for a 25bps move this time around, the statement will likely reaffirm the pledge to raise rates by a larger increment in September, depending on the medium-term inflation outlook.

The July meeting will also likely see the Governing Council present details of its new anti-fragmentation tool – Transmission Protection Mechanism (TPM). It remains to be seen how much in the way of details the ECB will provide on its new tool as policymakers might prefer to use a “whatever it takes” approach rather than tempt bond-sellers with a specific number. Furthermore, the issue of conditionality will also be key when assessing the efficacy of such a tool, particularly in lieu of recent events in Italy whereby domestic politics has seen the IT/GE spread widen; something which Northern nations will likely impress is not as a result of ECB monetary policy.

PRIOR MEETING: As expected, the ECB opted to stand pat on rates whilst announcing its intention to tighten by 25bps at the July meeting. Beyond July, policymakers stated they will consider larger increments if the medium-term inflation outlook persists or deteriorates. On the balance sheet, as expected, the Governing Council announced its decision to end net asset purchases under the APP as of July 1st. Note, the policy statement offered no fresh guidance on how it could deal with the issue of market fragmentation as it commences its rate hiking cycle. The 2022 inflation outlook was upgraded to 6.8% from 5.1%, with 2024 inflation seen above target at 2.1% vs. prev. view of 1.9%. At the accompanying press conference, President Lagarde was pressed further on how the Bank intends to deal with fragmentation, to which she noted that it can utilise existing tools, such as reinvestments from PEPP and, if necessary, deploy new instruments. Later in the press conference, Lagarde noted that there is no specific level of yield spreads that would be a trigger for an anti-fragmentation policy. From a more medium-term perspective, the President was questioned about where the Governing Council judges the neutral rate to be, however, she remarked that this issue was deliberately not discussed.

RECENT ECONOMIC DEVELOPMENTS: June’s Eurozone inflation metrics saw headline Y/Y CPI rise to 8.6% from 8.1%, whilst the core (ex-food and energy) reading ticked higher to 4.6% from 4.4%. In terms of market-based expectations, the Eurozone 5y5y inflation rate has fallen to around 2.09% vs. 2.26% seen at the prior meeting. On the growth front, Q2 GDP metrics will not be released until 29th July. However, in terms of timelier survey data from S&P Global, June’s PMI figures saw the EZ-wide composite metric slip to 52 from 54.8 with the report noting that the data suggests “that risks have increasingly tilted towards the economy slipping into a downturn at the same time that inflationary pressures moderate, but remain elevated”. On the employment front, the unemployment rate continues to decline with the May print easing to 6.6% from 6.7%. Also of note for the Eurozone economy has been the performance of the EUR with EUR/USD falling from a 1.13 handle at the start of the year to just below parity (briefly) last week; a decline of roughly 12.5% peak-to-trough. From a broader perspective, the ECB’s nominal effective exchange rate (NEER) has fallen around 3.9%.

RECENT COMMUNICATIONS: Since the prior meeting, President Lagarde said she expects the ECB to raise the key ECB interest rates again in September after a 25bp hike in July, adding that the calibration of the September hike will depend on the updated medium-term inflation outlook. On fragmentation, Reuters sources suggested that the President told EZ Finance Ministers that the goal of anti-fragmentation is not to close spreads. but to normalise spreads. In terms of the hawk-dove divide at the Bank, Germany’s Nagel warned the ECB against lowering borrowing costs for the Eurozone’s southern members, stating that the focus should be on fighting off inflation, which may require more rate hikes than now projected. Nagel is of the view that the anti-fragmentation tool should only be activated in exceptional circumstances with narrowly defined conditions and duration. Latvia’s Kazaks has suggested that a 25bps hike in July and 50bps in September is the base case, but it is worth looking at 50bps in July. At the other end of the spectrum, Italy’s Panetta has continued to stress that normalisation should be gradual, adding that the surge in inflation does not reflect excess demand in the Eurozone. Furthermore, Panetta notes that the anti-fragmentation tool is needed for the ECB to hit its mandate. Elsewhere, Greece’s Stournaras has stated that he sees no signs of second-round effects in the Eurozone. On the FX rate, France’s Villeroy has stated that the ECB watches the EUR closely as it is important for prices, adding that it is not the EUR that is weak, but the USD that is strong. These comments (13th July) were later followed up by a statement from an ECB spokesperson noting that “we are always attentive to the impact of the FX rate on inflation, with our mandate for price stability. ECB does not target a particular exchange rate”.

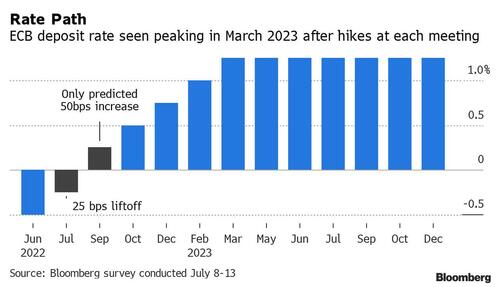

RATES: Analysts surveyed by Reuters (8th-15th July) look for the ECB to hike the deposit, main refi and marginal lending rates by 25bps to -0.25%, 0.25% and 0.5% respectively. In terms of the breakdown of analyst views for the deposit rate, all 63 analysts expect the Bank to move on rates with 62/63 looking for a 25bps hike and just one looking for a larger hike of 50bps. This view appeared to be relatively well cemented given how explicit ECB comms had been over the possibility of a 25bps move for the upcoming meeting. However, source reporting by Reuters and Bloomberg has revealed that policymakers are now set to debate the possibility of a 25bps or 50bps hike at the upcoming meeting. In terms of market pricing, at the start of the week 33bps of tightening was factored in, which implied that a 25bps hike was fully priced with a 32% chance of a 50bps hike. Following the aforementioned reporting, this has now risen to a 60% chance. Reporting has suggested that the Governing Council could be granted cover to shift away from its prior guidance given comments by President Lagarde on June 28th that there are “clearly conditions in which gradualism would not be appropriate”. That said, it remains to be seen whether or not there is sufficient support for a 50bps move on the Governing Council. Some desks suggest that a 50bps move would make sense given that the Bank is already clearly behind other major central banks in their effort to tame inflation and a 25bps hike seems relatively minor compared to the magnitude of some of the ECB’s peers. ING believes there is a small chance of a 50bps move this week given that some members already wanted to commence the hiking cycle in June. Furthermore, by the time of the September meeting, policymakers could be “looking a recession into the eyes”, which would be an unconventional time to increase the pace of hikes. Also, the recent weakening of the EUR could bolster the case for a 50bps move, albeit Rabobank is of the view that it is doubtful whether such a move would provide much in the way of support for the EUR at this current juncture. Rabobank also makes the point that if the ECB does unveil its ‘Transmission Protection Mechanism’ this month, it could move by 50bps to get the hawks on board. However, Rabo believes that the ECB would prefer to wait and see how its new instrument is received by markets before moving by larger increments. Looking beyond the upcoming meeting, a 50bps hike is fully priced in for September with the year-end deposit rate seen rising to 1% which would imply 75bps of tightening beyond September.

BALANCE SHEET: After offering no fresh guidance at the June meeting on how it could deal with the issue of market fragmentation as it commences its rate hiking cycle, the ECB was forced to carry out an ad-hoc meeting to address the matter. At which, policymakers decided to flexibly reinvest redemptions from PEPP whilst mandating staff to accelerate the completion of an anti-fragmentation tool. In the aftermath of the meeting, reporting via Reuters suggested that the bond scheme would come with loose conditions and aimed at bringing yield spreads back into line with fundamentals. It was also later reported that officials were unsure whether or not the size or duration of such a bond-buying scheme would be announced. One argument for announcing the size would be that it could help show the ECB’s commitment to avoiding fragmentation, whilst not being seen as giving governments a blank cheque. That said, if the number underwhelmed, it could place pressure on bond markets. Note, any purchases under such a tool would likely be sterilised whereby the scheme could be paired with auctions aimed at draining cash from the banking system. On July 7th it was reported that the new tool would be named the Transmission Protection Mechanism (TPM), however, a lot of

work was still yet to be done and it was uncertain if it would arrive in time for July. More recently (19th July) reporting from Reuters has suggested that conditionality for the tool could “include the targets set by the Commission for securing money from the European Union Recovery and Resilience Facility as well as the Stability and Growth Pact”, whilst some wanted involvement from the ESM, but this option was now likely discarded. Note, it remains to be seen whether or not the tool will be announced at the upcoming meeting with President Lagarde reportedly “redoubling efforts to get a deal done”. Should the tool be unveiled at the upcoming meeting, analysts at ING highlight that the main issues would be “how to define a ‘neutral’ or ‘economically justified’ spread, the size of such a tool and the degree of conditionality”. However, a mere “whatever it takes” pledge could present optics that “such a commitment when starting a rate hiking cycle is like hitting the brakes and the accelerator simultaneously“. From a rates perspective, it is likely that hawks would try and negotiate a more aggressive hiking cycle if the conditionality of the TPM is seen to be generous to southern nations. On which, investors will be mindful of the recent political turmoil in Italy, which, at the time of writing could see current PM Draghi leave government and possibly trigger early elections. The prospect of such an outcome has seen the IT/GE 10yr spread widen to in excess of 230bps from sub-200bps levels at the beginning of the month. Given the clear impact of domestic politics on the spread in this instance, there is likely to be increasing tensions between southern and northern nations on the conditionality and implementation of the tool than there otherwise would have been. If the conditionality is perceived to be too strict as a result, it may fail to act as a deterrent for spread-widening.

Finally, in terms of the market reaction, ING writes markets – by a small majority – exect policymakers in Frankfurt to deliver the previously announced 25bp rate hike on Thursday and leave the door open for a 50bp increase in September (although it wouldn’t be a shock if the ECB goes all the way with 50). The overnight index swaps market is pricing in 30bp for this week and nearly 200bp of tightening by June 2023. The Bank’s message may fall slightly below market expectations, and trigger some dovish re-pricing across the EUR curve.

The deployment of the anti-fragmentation tool will be all the more interesting as the recent Italian political crisis has increased the chances of a sharp re-widening of Italian sovereign spreads. Here, the details about the conditionality to access the anti-spread tool will be key and may drive part of the market’s reaction.

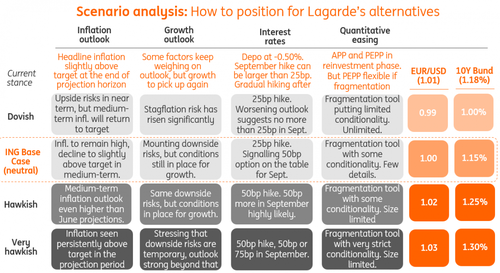

ING identifies four different scenarios (with the second being its base case) and include its estimated impact on EUR/USD and German 10Y yields.

The bank notes that while there is no doubt that the ECB is unhappy with the recent weakness of the euro – not only against the dollar, but on a trade-weighted basis – recent hawkish surprises by the ECB have, however, failed to offer sustained support to the euro, and a larger-than-expected move (a 50bp rate hike) or more hawkish-than-expected forward-looking language may fail to generate enough lift to the euro, a view shared by JPMorgan (which writes that gas supply concerns will undercut the euro, even if the ECB hikes interest rates by 50 basis points Thursday, as developments on Nord Stream 1 are likely to be “the single most important issue for FX markets this week” and A 50bp ECB hike wouldn’t support the common currency if it’s followed by curtailed gas supplies).

This is especially due to the mounting downside risks in the eurozone, mostly related to the threat of a gas supply crunch in the coming months (or during winter) and more recently about Italy falling back into political uncertainty.

Tyler Durden

Wed, 07/20/2022 – 22:20

via ZeroHedge News https://ift.tt/oSypIzW Tyler Durden