Hello EU: A Eurosceptic Italian Government Is Coming In September

It was one of the most dramatic weeks ever for Italian politics, with Mario Draghi resigning after The League, Forza Italia (FI) and the Five Star Movement (M5S) made it clear that they did not want to continue supporting the government coalition. President Mattarella dissolved the parliament and the next elections are set for 25 September, in just over two months’ time.

What happens next?

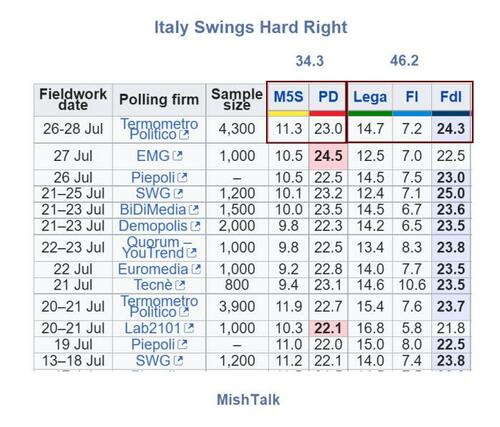

Well, as Mish Shedlock writes, Italian polls are often unreliable, but the results shown below are unusually clear and stable.

Political Parties

September Election Triggered

The September election was triggered when the Five-Star Movement (M5S) refused to support Prime Minister Mario Draghi, in Parliament. Draghi is a compromise technocrat rather than an elected leader.

Italy’s president, Sergio Mattarella, asked Draghi to reconsider his resignation, but Draghi refused, triggering elections. The Italian president is largely a political figurehead except in matters like these.

Insurmountable Lead

A 46.2 to 34.3 lead is insurmountable by Italian election rules. Bloomberg reports Italy’s Right Has an Orban-Style Super Majority Within Reach

An alliance led by Giorgia Meloni’s far-right Brothers of Italy, which includes Matteo Salvini’s League and Silvio Berlusconi’s Forza Italia, has a wide lead in opinion polls ahead of the September 25 general election. If other forces are divided, this might lead close to a two-thirds majority in both houses of parliament, according to an analysis by Youtrend/CattaneoZanetto & Co.

This result would see the right score similarly to Hungarian leader Viktor Orban, who won a large majority in 2010. But reaching a two-third majority would be difficult for the coalition and the study’s main scenario is for a right-wing coalition falling short of the two-thirds threshold.

Achieving a broad majority large enough to change the constitution would be unprecedented in Italy’s recent history and could have a profound impact on the country’s political system.

All three leaders of the right-wing alliance have called in the past for the president to be directly elected by Italian voters, instead of by lawmakers and regional representatives as is currently the case. This would require changing the constitution.

The right-wing bloc could get as many as 271 seats out of 400 in the lower house, and 131 out of 200 in the Senate. That’s in a scenario in which the center-left Democratic Party doesn’t ally with the populist Five Star Movement, or with groups such as Matteo Renzi’s Italy Alive. This scenario doesn’t take into account six senators appointed for life.

The survey maps a recent Quorum/YouTrend poll to recently-redrawn electoral districts. It highlights up to 67 swing seats in the lower house and Senate, which could prove decisive in turning a right-wing majority at the ballot box into a landslide victory in parliament.

Supermajority Math is Close

- 271 / 400 = 67.75 Percent

- 131 / 200 = 65.55 Percent

These numbers are close enough to make a super-majority very plausible.

Populists at the Gate

ForeignPolicy Magazine reports Populists at the Gates.

With Mario Draghi on his way out, Europe braces for the most radical right-wing government in Italy’s republican history.

Polls suggest that the post-fascist Brothers of Italy party has a good chance to come out on top in a general election slated for the end of September, with its leader, Giorgia Meloni, close to becoming Italy’s first far-right (and first female) leader since the end of World War II.

And she’s not alone. Meloni is running as part of an alliance with Matteo Salvini, the leader of the far-right League, and Silvio Berlusconi, the former prime minister and head of the conservative Forza Italia; the combined right-wing front is expected to snag about 45 percent of the vote—enough to secure a comfortable majority of seats in Parliament.

The prospect of a hard-right government in Rome with strong populist and Euroskeptic undertones comes as EU leaders seek to maintain cohesion of the 27-nation bloc, coordinate their response to the ongoing Russian invasion of Ukraine, deal with a looming energy crisis caused by Moscow, and tackle skyrocketing inflation.

The uncertainty over how exactly Italy’s right-wing coalition would position itself on all those issues has many in Brussels worried, said Arturo Varvelli of the European Council on Foreign Relations (ECFR). “There is great sorrow over the loss of Mario Draghi,” he said.

Brussels has already been dealing with right-wing governments in Budapest and Warsaw that have challenged the bloc’s legitimacy and sparked increasingly bitter showdowns over the judiciary, rights, and democracy. Meloni, while rejecting the far-right label, seems birds of a feather with the Hungarian and Polish leaders. Her party has strong links with Italy’s post-fascist tradition, and her views include securing borders against “mass immigration,” defending Europe’s “Christian roots,” and battling the “LGBT lobby.” Meloni also wants the EU to stop interfering with the “sovereignty of the peoples” and has sided with Poland and Hungary in their ongoing row with Brussels over their democratic backsliding. Salvini has long railed against “Brussels bureaucrats,” while Berlusconi famously shocked the European Parliament when, in the middle of a plenary, he suggested that its future president, Martin Schulz, was fit for a movie role as a Nazi death camp guard.

Forza Italia has pledged to raise pensions, while the League has promised an early retirement scheme and a wide tax amnesty.

Huge Political and Economic Considerations

This setup has huge political and economic potential consequences.

With a super-majority the upcoming government could change the constitution. This could also mean a change towards how the president is picked or even leaving the Eurozone. A Eurozone breakup would be catastrophic for the Euro and even worse for the Italian Lira fallback.

Alternatively, threats from Italy could push Germany into supporting debt comingling. But that would require a change in the German Constitution. At a minimum, a government led by Giorgia Meloni will be another big thorn in the side of the EU.

At the expected percentages, this government rates to be very stable, an unusual setup for Italy.

Draghi 2012 Flashback

Mario Draghi’s famous speech as prior head of the ECB is back in play.

“Within our mandate, the ECB is ready do whatever it takes to preserve the Euro. And believe me it will be enough,” said Draghi as ECB head.

Q: What did he do?

A: Nothing

The statement alone was all it took to end the peripheral eurozone bond crisis. Bond yields in Greece, Italy, Portugal, and Spain crashed.

“Super Draghi”, as he was soon called, is super no more.

Statements alone will not work this time. Greece and Italy are orders of magnitude different in importance. So, what will ECB president Christine Lagarde do for an encore?

Market reaction

For a look at how markets could react we go to a note from SocGen’s Jorge Garayo titled appropriately “‘La dolce vita’ was good while it lasted”, in which he writes that “for outsiders like us, Italian politics never fail to surprise. M5S is probably the least prepared for the upcoming election, with lots of internal divisions and its lowest vote intention figures on record. Salvini’s League has also been on a downward trend and is far from the popularity it enjoyed in late 2019. By contrast, the opposition BoI (Brothers of Italy, led by Meloni) has had a meteoric rise and is neck and neck with Letta’s PD (Democratic Party) at the top of voting intention polls. Two months can be a long time in Italian politics, but current polls point to victory for the right-wing bloc (BoI, League and FI) with 45% of the votes and BoI holding the largest portion of that.

Markets do not like BoI’s historical position on public deficits and immigration policy, nor its clashes with the EU on the supremacy of Italian law over EU law. The League has also historically been critical of the EU, although it recently relaxed its rhetoric and even set aside its historical pro-Russian stance. Unless there is a softening of BoI’s stance, markets will be worried at the prospects of an ‘Italy first’ attitude from the new government, especially if it means higher deficits and listening less to the reform agenda proposed by the EU.”

Any model for BTP-Bund spreads should incorporate a dummy variable for ‘political stress’; otherwise, it is impossible to explain widening episodes like in 2018 or 2016. But even without politics, BTP-Bund spreads should be wider than today’s levels. The ECB intends to push rates decisively higher, and the outlook for global credit spreads is quickly deteriorating. In our models, these inputs justify 10y BTP-Bund in the 270-300bp range by the end of the year. Add political stress and a worsening of the Russian gas situation (which accounts for 12% of Italy’s total energy consumption) and we could go to much wider spreads. A collapse in growth at a time of rising interest rates will bring the spectre of debt sustainability to the fore, with debt levels likely to rise. A fiscal response to such a crisis would likely mean higher deficits, and any perception that Italy might find it difficult to get NGEU disbursements could add to this pressure (even if funding needs this year are lower than we initially projected).

Given the proximity of new elections, we could see a quicker widening of BTP spreads and more risk aversion from non-domestics in the summer months. BTPs have enjoyed ‘la dolce vita’ since the summer of 2020, with low yields and low spread vol. The arrival of NGEU and the arrival of Mario Draghi were certainly important, but implementing reforms was never going to be easy. The uncertainty of the election outcome makes things more difficult and could keep investors at bay. Admittedly, the ECB could fight against a rapid widening of spreads. While PEPP reinvestments may find their way to BTP purchases as a first line of defence, we don’t think they will be enough to contain spreads at current levels.

The possibility of activating the newly minted ‘TPI’ does not appear to be imminent (did anybody really buy into the ECB being prepared to deploy this?), so we are happy to recommend shorts in 10y BTP-Bund with the spread below 260-270bp (at 227bp currently).

Tyler Durden

Sun, 07/31/2022 – 08:45

via ZeroHedge News https://ift.tt/X41h6El Tyler Durden