Authored by Jon Wolfenberger via The Mises Institute,

Cause of the Boom-Bust Business Cycle

The primary cause of the recurring “boom and bust” business cycle is central banks like the Federal Reserve creating money out of thin air. This was first explained by Austrian economist Ludwig von Mises over a century ago. His student F.A. Hayek won the 1974 Nobel Prize in economics for his work on this theory, which is now known as Austrian business cycle theory.

The basic outline of Austrian business cycle theory is as follows:

-

the government “central bank” (in the US, it is the Federal Reserve or “Fed”) creates money out of thin air (they effectively “print it,” although typically in the form of digital entries now), usually by buying Treasury bills or bonds from commercial banks, which then …

-

is deposited in commercial banks which, through the process of fractional reserve banking (where banks are legally allowed to keep only a fraction, such as 10 percent, of their deposits in cash reserves), create even more money out of thin air to lend to their customers, which then …

-

leads to lower interest rates than would prevail in a free market without a central bank and fractional reserve banks legally creating money out of thin air, which then …

-

causes businesses and consumers to borrow the newly created money to invest in long-term projects such as mines, factories, houses, etc., since the profitability of those investments appears higher now with a lower cost of capital, which then …

-

leads to the unsustainable “boom” phase of the business cycle where scarce capital is misallocated to unsustainable investments since the real resources of raw materials, equipment and labor needed to finish these long-term projects are not physically available; while paper money may literally grow on trees, the actual scarce resources needed to create goods and services do not (printing money does not create the goods needed for profitable investment—if it did, Zimbabwe would be the wealthiest country in the world and we could all stop working, saving and investing); then …

-

the higher money supply leads to higher price inflation, which raises production costs and usually causes the central bank to slow the growth rate of money supply and raise interest rates to try to lower inflation (if they do not, it will eventually lead to hyperinflation, which effectively destroys a functioning currency and economy), which then …

-

leads to the “bust” phase of the business cycle, where the unsustainable investments are proven to be unprofitable and must be liquidated to allocate capital to the most productive uses that meet consumer desires.

As this theory shows, the dreaded boom and bust business cycle is not inherent in a free market economy. It is caused by the legal privilege granted to central and fractional reserve commercial banks to create money out of thin air. As Mises summarized:

True, governments can reduce the rate of interest in the short run. They can issue additional paper money. They can open the way to credit expansion by the banks. They can thus create an artificial boom and the appearance of prosperity. But such a boom is bound to collapse soon or late and to bring about a depression.

Fed Panicked Over Covid

As a result of the stock market crash and global economic collapse caused by government covid policies in early 2020, the Fed panicked and aggressively increased the money supply by 40 percent, more than double the increase in the money supply in prior recessions, as shown below (which is the “Austrian money supply,” calculated as M2 less small time deposits and retail money market funds plus Treasury deposits at the Fed).

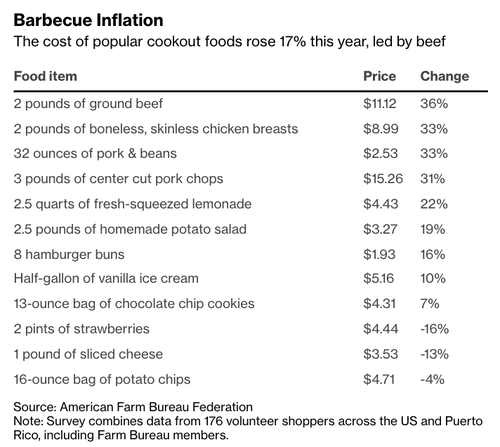

This massive money creation resulted in the highest inflation rates in over forty years, with the latest CPI report showing inflation at 8.6 percent, well above the Fed’s 2 percent target. And now that money supply growth has slowed substantially to only 7 percent —and the Fed-controlled monetary base (currency plus bank reserves at the Fed) is now declining 2.6 percent year over year — the economy is starting to slow.

Recession Signs Are Mounting…

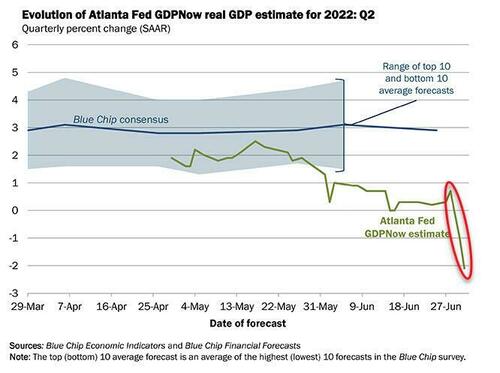

Economic growth has already weakened substantially. US gross domestic product fell 1.4 percent in the first quarter of 2022 and the Atlanta Fed is now estimating 0.0 percent GDP growth in the second quarter.

Real personal income is down 3.5 percent year over year, and was down 17 percent in March, the biggest decline in over sixty years. Real manufacturing and trade sales are now down 2.5 percent year over year. This broad sales measure only declines in recessionary periods, as shown below (recessionary periods are shaded gray).

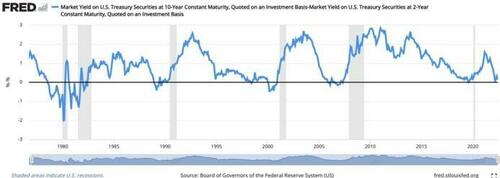

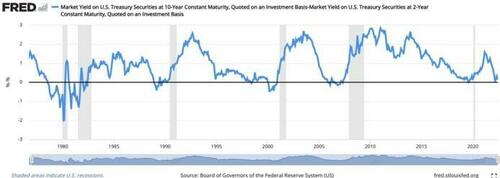

Interest rates have been skyrocketing due to high inflation and slower money supply growth. The ten-year Treasury yield increased from 1.19 percent last summer to 3.25 percent now, while the two-year Treasury yield increased from 0.13 percent last summer to 3.17 percent now. The thirty-year fixed mortgage rate has risen from 2.77 percent last summer to 5.78 percent now, which is causing a collapse in mortgage applications and homebuilder sentiment.

The “yield curve” spread between the ten-year and two-year Treasury yields has now flattened to only 0.08 percent. This spread “inverted” briefly a couple of months ago when the two-year yield rose above the ten-year yield. It could easily invert again soon. As shown below, a flattish or inverted yield curve spread between the ten-year and two-year Treasury yields has occurred before every recession in recent decades.

The spread between high-yield “junk” corporate bonds and Treasury yields has risen to the highest levels since the covid panic of 2020, as junk bond investors start to price in the risk of a recession, as shown below.

Copper is known as “Dr. Copper” for its ability to predict recessions due to its sensitivity to the economy. Copper prices have fallen 20 percent in the past three months.

Initial unemployment claims are the best leading indicator of employment. They have been rising steadily for the past three months, as shown below (weekly claims are the black line and the four-week moving average is the red line).

The University of Michigan Consumer Sentiment survey has fallen to the lowest levels in over forty years, as shown below.

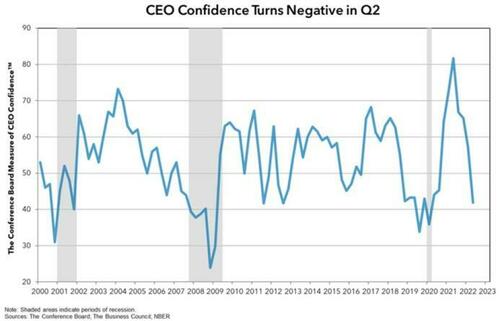

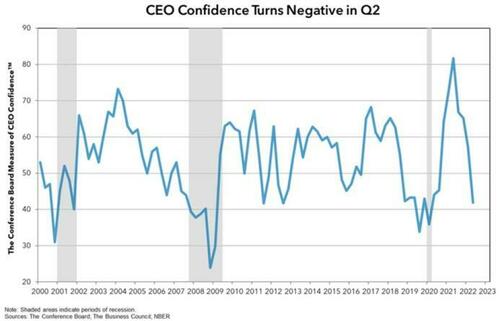

Similarly, The Conference Board CEO Confidence survey has fallen to recessionary levels, as shown below.

Proven leading economic indices have weakened to recessionary levels. The Economic Cycle Research Institute’s Weekly Leading Index, which leads the US economy by at least six months, has declined from a high of around +28 percent last year to –6.3 percent now. This highly regarded economic forecasting firm has recently gone public with their forecast for a coming recession.

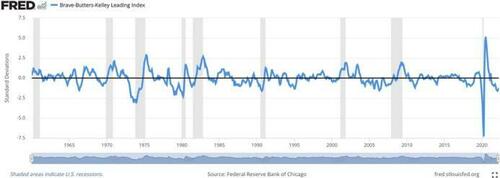

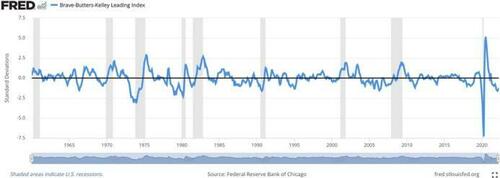

The Brave-Butters-Kelley Leading Index has fallen well below the –1 threshold that signals with 86 percent accuracy that a recession is likely to start within eight months, as shown below.

Now the Fed Is Trying to Crash Financial Markets and Cause a Recession

Normally, the Fed would be slashing interest rates and printing money to try to prevent a recession and stock bear market at this point, which they tried and failed to do in the early 2000s Tech Bust and 2008–09 Great Recession.

But instead, the Fed is being forced to hike rates aggressively to try to bring inflation down. They already hiked the Fed Funds rate to 1.50 percent to 1.75 percent and will need to hike at least 1.50 percent more to catch up to the two-year Treasury yield.

The Fed is explicitly saying they want to lower bond, stock and housing prices and raise unemployment. They say they can do all of that without causing a recession. That is clearly a fantasy.

As Bill Dudley, former president of the New York Fed and vice chairman of the Fed’s Federal Open Market Committee, has said in recent months:

The Fed’s application of its framework has left it behind the curve in controlling inflation. This, in turn, has made a hard landing virtually inevitable….

To create sufficient economic slack to restrain inflation, the Fed will have to tighten enough to push the unemployment rate higher….

Getting inflation down will be costly, in terms of jobs and economic growth….

Investors should pay closer attention to what Powell has said: Financial conditions need to tighten. If this doesn’t happen on its own (which seems unlikely), the Fed will have to shock markets to achieve the desired response. This would mean hiking the federal funds rate considerably higher than currently anticipated. One way or another, to get inflation under control, the Fed will need to push bond yields higher and stock prices lower….

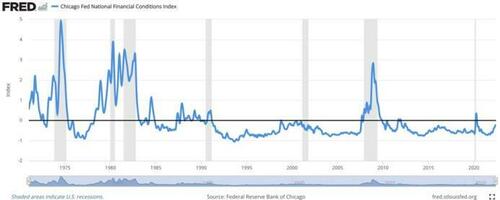

So far, financial conditions really haven’t tightened very much….

The Fed has to push up the unemployment rate, when the Fed has done that in the past, it has always resulted in a recession….

It is very unlikely that a year from now we will be at this level of bond yields this low and this level of stock prices this high.

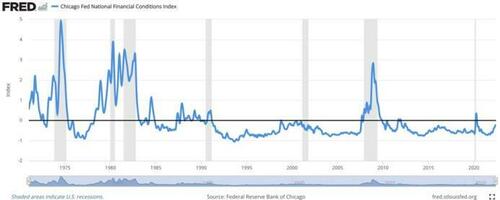

As shown below, despite the stock and bond bear markets, financial conditions remain very easy, according to the Chicago Fed National Financial Conditions Index.

Conclusion

If the Fed succeeds in tightening financial conditions enough to try to maintain their reputation as an “inflation fighter” (i.e., trying to lower the inflation they created in the first place), this will likely be the biggest government-caused economic catastrophe since the Great Depression, as we predicted here last year.