Fed Minutes May Reveal Less Than Actions Thousands Of Miles Away

Authored by Bloomberg News’ Ven Ram,

Treasuries traders will be parsing the minutes of the Fed’s meeting last month, due later Wednesday.

Perhaps they should plough through what the New Zealand central bank said and did earlier Wednesday with as much keenness.

The Reserve Bank of New Zealand was among the first of central banks in the developed world to start raising rates in the current cycle.

Since it began its campaign in October last year, it has increased its benchmark cash rate by an emphatic 275 basis points — including a 50-basis point punch earlier in the day.

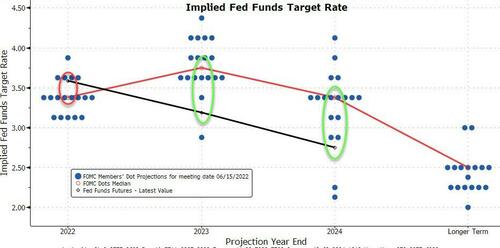

Yet, inflation in the economy is still resistant, and if anything, inflation expectations have accelerated. If that’s the challenge for a central bank that began raising rates well before the Fed, maybe there’s a thing or two for interest-rate traders in the US who are busy reading star signs and alignment to divine what they think may be the end of the Fed’s tightening cycle. Never mind that speaker after Fed speaker has pointed out in recent weeks that the monetary authority doesn’t have rate cuts in mind for 2023.

Yes, US inflation decelerated in July, but one swallow doesn’t a summer make. And even if we are past peak inflation, that doesn’t equate to 2% inflation. The Fed’s benchmark rate isn’t even in neutral territory yet, what to say of reaching the restrictive zip code, and it would be foolhardy to conclude that the central bank would leave its inflation battle unfinished because the economy may be losing momentum. You only need to look at a simple gauge to assess the progress the Fed is making.

Taming the worst inflation nightmare in decades has its costs, and the Fed has told us sufficient times that it needs convincing evidence that its 2% goal is well within sight. As of now there is little evidence that such is the case.

Tyler Durden

Wed, 08/17/2022 – 11:25

via ZeroHedge News https://ift.tt/Ev8qoL1 Tyler Durden