FOMC Minutes Preview: Here’s What Wall Street Expects

There are a lot of irrational expectations surrounding today’s FOMC minutes.

On one hand the minutes are expected to detail the Fed’s dovish breakaway from forward guidance (as the Fed, like the BOE, finally admitted it has no clue what will happen next week let alone net year). On the other, the market is looking for clues on the rate path and the terminal rate… or in other words, forward guidance.

Sigh.

Then again, in a market as broken as this one, and where Powell cornered himself after he…

- classified 75bps as “extra ordinary” & highlighted the lagged effects of rate hikes

- spoke of growth slowdown and demand moderating rather than biggest focus on inflation

- referenced June SEP multiple times (i.e. not swayed by June’s CPI)

- spoke of terminal rate of 3.25-3.5% (mkt already there)

- moved to a data dependent outlook (forward looking not backward looking)

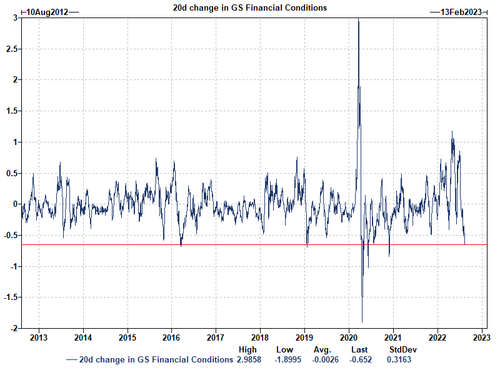

… it is hardly a surprise that we have seen one of the largest 20d easing in financial conditions on record, on par with the relief rally post the mid Feb 2016 lows (oil crash), on par with the rally post the Dec 24th crash in 2018, and almost as large as the post Pfizer vaccine news rally in November 2020.

The resultant surge in risk – which also sparked the latest meme stock meltup – prompted even Goldman to ask if this is what Powell really wanted.

So yes: the Fed Minutes have a lot to explain, although they probably won’t as the Fed is once again behind the curve this time in the latest market meltup, however since oil and gas prices are falling for now, we don’t expect any emergency intervention by Powell.

With that in mind, this is what Wall Street expects, courtesy of Newsquawk

- JULY OVERVIEW: The FOMC lifted rates by 75bps to 2.25-2.50%, as was expected, taking rates back to neutral for the first time since 2019. The only major tweak to the statement was its reassessment of the economy; the Fed now acknowledges that “recent indicators of spending and production have softened” (recall, it previously said that “overall economic activity appears to have picked up after edging down in the first quarter”). This change was to be expected given the softening in many key macro indicators.

- SEPTEMBER: The statement offered no clues about what the Fed will do at its September meeting and during the press conference Fed Chair Powell abandoned concrete forward guidance and said decisions will be dependent upon data and taken upon a meeting-by-meeting basis. We will look at the minutes to see if any participants were in favor of more stern forward guidance, but that seems unlikely given plenty of Fed speakers have spoken since and called upon the data-dependent approach. However, it is clear that appetite is currently between another 75bps hike or a slower 50bps hike (market pricing is now leaning towards 50bp after the latest CPI and PPI reports, but the minutes will not incorporate that data, so there is a risk of the minutes sounding more hawkish, but it also will not incorporate the hot July jobs report).

- RATE PATH: Governor Bowman had suggested rate hikes of a similar magnitude should continue until inflation returns to target, which SGH Macro’s Duy says “This could be a clever way to keep 75bp on the table without it really being on the table”. At the press conference, Fed Chair Powell was quizzed on the rate path, and he suggested the Fed wants to get to “moderately restrictive territory” by year-end, which to him implies a rate of 3.00-3.50%. Since then, other speakers have been maintaining their rate forecasts with Evans in line with Powell suggesting a rate of 3.25- 3.50%, while Kashkari leans more hawkish seeing rates at 3.9% by year-end – in fitting with Bullard who sees rates between 3.75-4.00%. Given the hot jobs report and cool CPI since the latest meeting, the minutes may be deemed quite stale given the Fed’s data-dependent stance. Nonetheless, any views on the outlook will be key, particularly on the terminal rate view after Powell noted it has evolved for all participants – but did not provide much clarity. Analysts at Credit Suisse expect the minutes to note, “officials expect the pace of rate hikes to slow unless inflation continues to run at extremely elevated levels”. Adding, “Officials likely discussed the recent slowdown in growth data but refrained from the possibility of a rate cut next year”.

Tyler Durden

Wed, 08/17/2022 – 12:51

via ZeroHedge News https://ift.tt/j9nPoWp Tyler Durden