Gilts Wake Up With A Scream After CPI, Have More Tears To Shed

By Ven Ram, Bloomberg markets live commentator and reporter

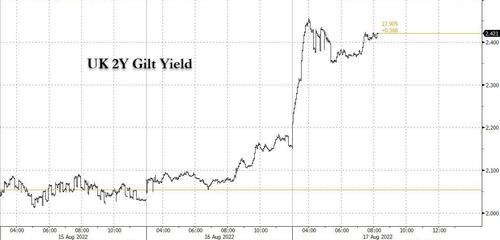

Those higher-than-forecast inflation numbers out of the UK are spurring interest-rate traders to firm up pricing for next month’s Bank of England review.

Every one of the key inflation measures for July came in higher than forecast, with retail-price inflation accelerating to 12.3% from 11.8% in June. (And you can only imagine what the numbers will be in the fourth quarter when we may have a new cap on energy prices.)

News of faster inflation comes just a day after the domestic labor market added more jobs in July than anyone thought. Little wonder that overnight indexed swaps are now fully pricing in a 50-basis point increase from the BOE when it meets next on Sept. 15.

With the BOE’s policy rate still not yet in neutral territory at a time when inflation is running amok, the BOE has little reason to balk away from another 50-basis point increase especially with the economy proving this resilient. Even though the BOE is essentially chasing the clock having lost valuable time earlier in the cycle by not having moved emphatically on rates to align demand in line with supply, it still has a narrow window to act before things go completely pear-shaped.

All these factors mean there is little solace in sight for front-end gilts, and what it heralds for curve inversion as Mark Cranfield says. As for those looking at the risk-reward equation on receiving meeting-dated swaps for next month, suffice to say that the BOE will find it hard to look away when inflation is burning all around.

Indeed, after pressing the snooze button incessantly, front-end gilts have at last woken up with a sense of dread about missing their tryst with destiny. It’s about time.

The writing has been on the wall for some time now, and those inflation prints from this morning have proved to be the immediate catalyst for today’s selloff at the front end. If inflation is running at more than a double-digit pace and the economy had the wherewithal to cope with rate hikes all this while, why would your policy rate be at less than neutral?

That’s why former BOE official Andrew Sentance reckons the BOE’s benchmark rate needs to climb to as much as 4%. While that may look daunting considering we are just at 1.75%, by moving in baby steps earlier on in the cycle when it ought to have gone faster, the BOE has to go faster later in the cycle to catch up.

Those factors mean that this year’s selloff in front-end gilts is far from done.

Tyler Durden

Wed, 08/17/2022 – 08:20

via ZeroHedge News https://ift.tt/xq7CdRo Tyler Durden