WTI Spikes After Huge Crude Inventory Draw, US Crude Exports Hit Record High

Despite hopes of an imminent Iran nuke deal (and the subsequent supply), oil prices are higher this morning after the new head of OPEC said gobal oil markets face a high risk of a supply squeeze this year as demand remains resilient and spare production capacity dwindles.

“We are running on thin ice, if I may use that term, because spare capacity is becoming scarce,” OPEC Secretary-General Haitham Al-Ghais said.

“The likelihood of a squeeze is there.”

In the meantime, all eyes are on the official US data for signs of lagging demand (or not as gas prices have dropped).

DOE

-

Crude -7.06mm – biggest draw since April 2022

-

Cushing +192k

-

Gasoline -4.64mm

-

Distillates +766k

After 2 weeks of builds, US crude stocks crashed over 7 million barrels last week – the biggest draw since April. Cushing inventories rose for the 7th straight week and gasoline stocks also tumbled…

Source: Bloomberg

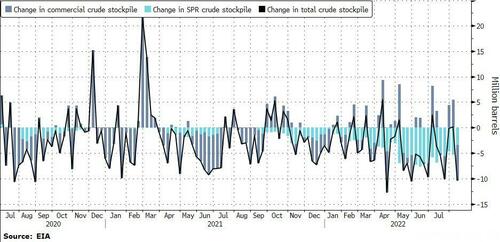

The headline draw in crude stockpiles was boosted by the withdrawal of another 3.4 million barrels from the SPR last week. Total nationwide oil inventories — including commercial stockpiles and oil held in the SPR — fell by 10.46 million barrels in the week to August 12. That’s the biggest total crude draw since May.

Source: Bloomberg

Additionally, US crude exports set a new record at 5M b/d. That’s from all the replacing that European refiners have been making to offset Russian oil.

Source: Bloomberg

Gasoline demand rose once again last week and is now back near the year’s highs…

Source: Bloomberg

US crude production dropped modestly last week as the rig count has stabilized…

Source: Bloomberg

WTI had rallied up to around $88 ahead of the official data and surged higher on the big draw…

Al-Ghais offered more hope for the bulls:

“China is still a source of phenomenal growth,” he said.

“We haven’t seen China open up exactly — there’s a strict Covid Zero policy — I think that will have an impact when China gets back to full steam.”

“We’ve demonstrated time and time again in the past that we’re willing to do whatever it takes to do what the market really requires,” Al-Ghais said.

Tyler Durden

Wed, 08/17/2022 – 10:36

via ZeroHedge News https://ift.tt/9PYRSzE Tyler Durden