Futures Plunge, Yields Roar Higher As Bear-Market Rally Slams Brick Wall On $2.1 Trillion Op-Ex

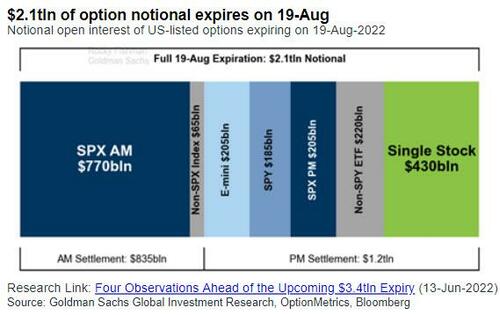

The combination of plunging bitcoin prices, the (latest) bursting of the meme bubble courtesy of Ryan Cohen’s historic pump and dump, rising Fed warnings that another 75bps rate hike is coming amid fears next week’s Jackson Hole meeting will be a hawkano, rising oil prices and TSY yields at the highest level in a month, and mix it all in on a day when there is absolutely no liquidity (one day after the lowest volume of the year) as $2.1 trillion in options expire…

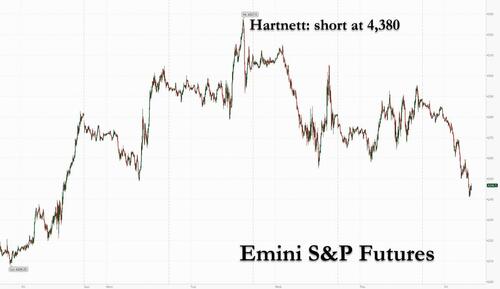

… and you get a perfect storm that has sent futures tumbling 40 points or 0.93%, but another confirmation that BofA’s Michael Hartnett is the best strategist on Wall Street (while his peers are nothing more than broken records).

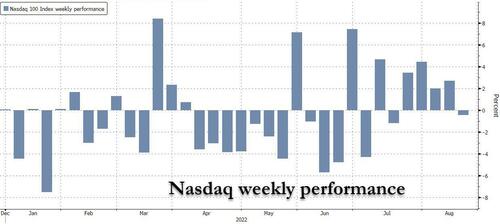

Nasdaq 100 futures slumped 1.2% by 7.30 a.m. in New York as the yield on the 10-year Treasury climbed about 5 basis points to 2.95%, the highest level in one month amid divergent signals from Fed officials over the size of the next interest-rate hike.

The tech-heavy index is set to end the week lower after four weeks of gains; the Nasdaq 100 underperformed this week in the face of rising bond yields as higher rates weigh on the present value of future profits, hurting growth stocks with the highest valuations. The dollar headed for the biggest weekly rally since June 2021 and bitcoin plunged by $2,000 overnight, crashing below $21,500.

In premarket trading, Bed Bath & Beyond shares crashed 45%, after plunging more than 20% during the regular session, after top investor Ryan Cohen pulled the biggest pump and dump in history. Cryptocurrency-exposed stocks like Coinbase and Riot Blockchain also slid amid a broad selloff across digital tokens. Coinbase (COIN US) fell 7%, Marathon Digital (MARA US) -11%, Riot Blockchain (RIOT US) -9%. Here are other notable premarket movers:

- Applied Materials (AMAT US) rose as much as 1.4%, with analysts positive on the chip equipment maker’s results, saying it saw a strong performance amid a tough macroeconomic backdrop, though some brokers nudged down their price targets.

- Morgan Stanley analysts cut their price target on Meta Platforms (META US), saying the social media giant’s shift toward Reels and declining user-engagement rates pose a risk to its revenue growth. The stock was down 1.7%.

- Bill.com (BILL US) surged 21% after fiscal 4Q results from the infrastructure software firm that analysts said were “perfect” alongside guidance that “blew away” expectations.

- StoneCo (STNE US) dropped 9% after the Brazilian payments firm reported adjusted net for the second quarter that missed the average analyst estimate.

Traders have also turned cautious toward risk assets ahead of the Fed’s annual symposium next week in Jackson Hole. Beyond that, inflation and employment figures will also be closely monitored before the central bank’s highly anticipated interest-rate decision in September. Additionally, on Thursday two Fed voting members – St. Louis’s James Bullard and Kansas City’s Esther George – emphasized that the US central bank will continue to raise interest rates until inflation eased back to its 2% target although their views diverged on how big the Fed’s September move should be.

This is notable since traders had continued piling into stocks and bonds, completely ignoring the Fed’s repeated jawboning and dismissing the risk of a more aggressive Fed as they expect it to ease the pace of rate hikes while inflation pulls back from its peak, according to Bank of America strategists. US stocks saw $9.2 billion of inflows in the week through Aug. 17 BofA’s Michael Hartnett wrote in a note.

“The Fed would, in order to get inflation down to the 2% target, have to crush the economy,” said Ann-Katrin Petersen, a senior investment strategist at BlackRock Investment Institute. In order to bolster growth, the Fed will at some point “accept to live with inflation. This dovish pivot is not likely in the very near term, in contrast to what markets seem to be expecting right now, but this dovish pivot may come in 2023,” she told Bloomberg Television.

In Europe, the Stoxx 50 fell 0.8%. FTSE 100 outperforms, dropping 0.2%, Travel, real estate and autos are the worst-performing sectors. Italy’s FTSE MIB lags, dropping 1.4%. after a right-wing coalition led by Brothers of Italy party was seen reaching 49.8% level in voting intentions for Italy’s lower house of parliament for September election, according to a Tecne poll on August 18. Center-left bloc at 30%; Five Star Movement at 10.2%; Centrist coalition at 4.8%; Other parties at 5.2%. Here are some of the biggest European movers today:

- Just Eat Takeaway shares soar as much as 38% in Amsterdam trading, the most ever, after the food delivery firm agreed to sell its 33% stake in iFood for as much as EU1.8b

- Holmen rises as much as 5.3% on 2Q earnings that beat consensus on adjusted operating profit, net sales and operating profit. The report was strong, but expected, Jefferies writes

- Kingspan gains as much as 8.6% after 1H results from the Irish insulation supplier that Goodbody says were ahead of expectations

- U-blox surges as much as 16% after the Swiss semiconductor company lifted FY revenue and Ebit outlooks that it previously raised in May, citing a record- high order book

- Mobilezone rises as much as 5.3%, the most intraday since March, as analysts note the Swiss firm’s robust 1H earnings and confirmation of guidance in the face of powerful FX headwinds

- Joules plunges as much as 41% after the UK apparel retailer forecast an FY adjusted pretax loss significantly bigger than market views. Liberum cut its rating on the stock to hold from buy

- Bachem drops as much as 3.9% after Baader published a note saying the company’s first-half results due on Aug. 25 may be a trigger for a downward revision to consensus

- Oponeo.pl falls as much as 12% after the Polish distributor of tires, tools and bikes reported a 70% y/y drop in 2Q net income due to higher costs and lower sales of tires

- Hypoport declines as much as 12% after Metzler downgrades to sell on a slowdown in growth for its Europace unit and as the company’s insurance application “fails to convince” at this stage

Earlier in the session, Asian stocks headed for their first weekly drop in five, as renewed concerns about growth in China — the region’s biggest economy — damped investor sentiment. The MSCI Asia Pacific Index retreated as much as 0.7%, set for a decline of more than 1% this week. Meanwhile, a gauge of China stocks listed in Hong Kong posted its worst week in August, losing 2%. Shares in South Korea and India were among the region’s worst performers Friday. Concerns about China’s growth resurfaced as the country planned more fiscal stimulus over a gloomy outlook and as banks were expected to lower borrowing costs next week. Goldman Sachs, Nomura and Citi further cut their growth estimates for China’s gross domestic product earlier this week as a power supply crunch adds more uncertainty to the outlook.

“Regulatory issues and sluggish economic recovery are behind the weak performance of stocks in Hong Kong as many of the stocks listed there are related to the real estate sector and regulations,” said Kim Kyung Hwan, a China equity strategist at Hana Financial Investment in Seoul. “There are lingering concerns that China’s economic fundamentals may take an L-shaped recovery and the government’s intervention in the property crisis may be delayed,” he added.

Improved appetite for haven assets was also reflected in the dollar, which rose to the highest in nearly a month following a Bloomberg News report that China’s President Xi Jinping and Russia’s leader Vladimir Putin will attend the G-20 summit in Indonesia later this year. All but two sectoral indexes declined in Asia’s key benchmark, with health care and financials the biggest losers. Samsung Electronics and NetEase were among the biggest drags on the measure, with the latter tumbling on profit-taking following earnings results. Caution also prevailed with next week expected to be the busiest period for quarterly earnings announcements from MSCI Asia Pacific Index members. Chinese tech giants Meituan and JD.com Inc. are among the more than 300 companies set to release results

In FX, the Bloomberg Dollar Spot Index advanced for a third day and the greenback strengthened against all of its Group-of-10 peers. The pound fell to a one-month low while the euro was steady against the dollar. UK retail sales volumes unexpectedly rose 0.3% last month, but the cost of those sales increased more rapidly by 1.3%. UK consumer confidence fell to a record low as concerns about a recession increased and soaring inflation tightened a squeeze on household finances. GfK said its gauge of confidence declined 3 points to minus 44 in August. The New Zealand dollar was weighed by comments from RBNZ Governor Adrian Orr that the central bank would “retain optionality” over the pace of future rate increases. The yen is headed for its biggest weekly decline in two months as hawkish comments from Fed officials spurred bets for another outsized rate hike. Options traders are finally betting on a rise in the dollar-yen currency pair after staying bearish for two months, as they await cues from the next week’s Jackson Hole symposium by the Federal Reserve.

In rates, Treasuries held losses into early US session, leaving yields cheaper by up to 6bp across front-end of the curve, following wider gilt-led selloff after stronger-than-forecast UK retail sales figures in July. US yields cheaper by 6bp to 3.5bp across the curve with front- end led losses flattening 2s10s, 5s30s by around 1bp each; 10- year yields around 2.95%, trading 8.5bp and 7bp richer in the sector vs. gilts and bunds. Bunds and Italian bonds declined for a fourth day, the longest streak since June and July respectively, as 125bps of ECB hikes were briefly priced by year-end, or two half-point increases. Money markets ramped up ECB tightening wagers following hawkish Fed talk and stronger-than-forecast UK retail sales figures in July. Peripheral spreads widen to Germany with 10y BTP/Bund adding 2.3bps to 224.3bps.

WTI trades within Thursday’s range, falling 1.4% to trade around $89. Spot gold falls roughly $4 to trade around $1,754/oz. Spot silver loses 1.4% around $19. Most base metals trade in the red; LME tin falls 1.2%, underperforming peers. LME nickel outperforms, adding 0.8%.

Luckily, there is nothing on today’s calendar. Central bank speakers include Richmond Fed President Barkin, and earnings releases include Deere & Company.

Market Snapshot

- S&P 500 futures down 0.9% to 4,250.00

- STOXX Europe 600 down 0.6% to 437.98

- MXAP down 0.6% to 161.10

- MXAPJ down 0.5% to 524.13

- Nikkei little changed at 28,930.33

- Topix up 0.2% to 1,994.52

- Hang Seng Index little changed at 19,773.03

- Shanghai Composite down 0.6% to 3,258.08

- Sensex down 1.3% to 59,517.87

- Australia S&P/ASX 200 little changed at 7,114.46

- Kospi down 0.6% to 2,492.69

- German 10Y yield little changed at 1.18%

- Euro little changed at $1.0084

- Gold spot down 0.3% to $1,752.91

- U.S. Dollar Index up 0.19% to 107.69

Top Overnight News from Bloomberg

- China’s efforts to stomp out a lucrative carry trade by banks in the nation’s bond market and divert cash to the real economy is meeting with limited success. The spread between the 10-year yield and the overnight borrowing rate remained around 140 basis points, even though the latter rose for four straight days amid the central bank’s cash withdrawals. That means banks can still make a profit by funding from each other in the interbank market and purchasing government bonds

- A larger-than-forecast £4.9 billion ($5.8 billion) UK budget deficit in July took the total for 2022-23 so far to £55 billion pounds — £3 billion more than officials forecast in March

- Investors continued piling into stocks and bonds, dismissing the risk of a more aggressive Federal Reserve as they expect it to ease the pace of rate hikes while inflation pulls back from its peak, according to Bank of America Corp. strategists. Global equity funds attracted $7.9 billion in the week through Aug. 17, strategists led by Michael Hartnett wrote in a note, citing EPFR Global data

- The right-wing coalition led by Giorgia Meloni’s Brothers of Italy party neared a landmark level of support, registering 49.8% of voter approval for Italy’s Sept. 25 election, in a survey by the Tecne research institute

A more detailed look at global markets courtesy of Newsquawk

APAC stocks lacked firm direction despite the mild tailwinds from the US where sentiment was somewhat underpinned by mostly encouraging data. ASX 200 just about kept afloat amid outperformance in energy on recent oil price gains although the upside was limited by weakness in financials and amid another influx of earnings results. Nikkei 225 returned to flat territory beneath the 29k level after early momentum petered out. Hang Seng and Shanghai Comp were indecisive amid a lack of macro drivers and with newsflow dominated by earnings, while markets await a cut to the benchmark lending rates early next week.

Top Asian News

- Indonesia May Impose Nickel Export Tax in 2022, Jokowi Says

- H.K. Home Prices Could Fall 10% After HSBC, StanChart Hike Rates

- Hong Kong Monetary Authority Deputy CEO Edmond Lau Resigns

- Moody’s Reviews Huarong AMC’s Ratings for Downgrade

- Some Country Garden, CIFI USD Notes Set for Record Weekly Gains

- Modi to Be Challenged by Local Leaders in 2024 India Elections

European bourses are under modest pressure, Euro Stoxx 50 -0.6%, in a session of limited newsflow with focus on continuing hawkish price action. Stateside, given the hawkish action, NQ -1.0% is the incremental underperformer ahead of commentary from 2024 voter Barkin. China’s CPCA forecast shows August passenger car sales lifting MM to 1.88mln (prev. 1.77mln), latest COVID outbreak is expected to have a relatively limited impact on the auto market. Deere & Co (DE) Q2 2022 (USD): EPS 6.16 (exp. 6.69), Revenue 14.1bln (exp. 12.78bln); FY view Net 7.0-7.2bln (prev. 7.0-7.4bln, exp. 7.1bln).

Top European News

- Gas Heading for Another Weekly Rise Intensifies Europe’s Pain

- Germany’s Drive to Replace Russian Gas Can’t Rely on Canada

- Germany Risks a Factory Exodus as Energy Prices Bite Hard

- Food Banks for Pets Show UK Inflation Reaching Cats and Dogs

- Londoners Wake to Transit Headaches as Strike Hobbles City

FX

- Dollar continues to reign as risk sentiment sours again and yields ratchet higher, DXY up to 107.930 and close to mid-July high just shy of 108.000

- Euro remains relatively resistant amidst further EGB retracement and strong Eurozone inflation data, EUR/USD sub-1.0100, but above 1.0050.

- No retail therapy for Sterling as wider UK economic worries weigh on the Pound, Cable under 1.1900 and EUR/GBP eyeing 0.8500.

- NZ trade data fails to give Kiwi a lift as deficit remains wide, NZD/USD hovering above 0.6200.

- Yen shrugs off Japanese CPI as UST-JGB spreads widen further, USD/JPY touches 136.76 before waning.

- Loonie and Nokkie undermined by softer oil prices as former awaits Canadian retail sales for independent impetus, USD/CAD 1.2950+, EUR/NOK around 9.8500

- Yuan retreats as Moody’s joins list of those downgrading forecasts for Chinese growth this year, USD/CNY over 6.8100 and USD/CNH almost 6.8300 overnight.

Fixed Income

- Only dead cat bounces in debt as hawkish Central Bank and hot inflation vibes persist.

- Bunds through trendline support to 152.61 and 10 year yield above 1.15% Fib resistance.

- Gilts probing 113.00 vs 113.45 at best and T-note towards base of 118-11/118-29+ range .

Commodities

- Under broad pressure given USD strength with crude curtailed as it awaits another JCPOA response; benchmarks lower by circa. USD 1.50/bbl, vs USD 7/bbl ranges for the week.

- Spot gold clipped by the USD, though only by just over USD 5/oz compared to weekly parameters of over USD 50/oz; broader metals in-fitting in limited newsflow.

- China’s daily coal output +19.4% YY, between August 1st and 17th, via the Energy Administration.

US Event Calendar

- Nothing major scheduled

DB’s Tim Wessel concludes the overnight wrap

Filling in again from Stateside much like the rumored involvement of yank Elon Musk in the English product Manchester United. The metaphor does not have much life beyond that, however. Despite what you may have heard, I am not a billionaire nor do I have any designs on going to space, while on the product side, the EMR has a chance of success this year.

Taking the developments by time zones. In Europe, yields crept slightly higher on the now familiar formula of tighter expected ECB policy and concerns about energy pricing. On the former, in a Reuters interview, the ECB’s Schnabel said that “The concerns we had in July have not been alleviated… I do not think this outlook has changed fundamentally.” She also said that “I would not exclude that, in the short run, inflation is going to increase further”. The ECB’s Kazaks also echoed this, saying that “we will continue to increase interest rates” so as to prevent inflation becoming entrenched. Markets continue to fully price in another 50bp move at the next meeting in September, with 52bps currently priced in, so some probability of an even larger hike. On the energy front, price pressures continue to get worse, where natural gas futures closed at a record high of €241 per megawatt-hour, with year-ahead German power registering a fresh record of their own, closing at €540 per megawatt-hour. In line with what we’ve covered, Germany is offering fiscal support to alleviate price pressures, as German Chancellor Scholz announced a temporary VAT cut on natural gas from 19% to 7%, which will apply for 18 months from October 1. It’s worth plugging our team’s latest gas supply monitor again, link here to stay on top of the latest.

All told, the yield move was rather modest, with 10yr bunds +1.9bps higher, outpacing increases in OATs (+1.7bps) and BTPs (+0.4bps), which helped support risk assets on the day. For their part, equities also posted a modest gain, as the STOXX 600 climbed +0.39%, the DAX gained +0.52%, and the CAC increased +0.45%.

In the US, it was another day of mixed, but supportive data on balance. Initial jobless claims fell to 250k (vs. 264k expected). Continuing claims, which our US econ team has identified as one of the best leading indicators for recessionary risk, also came in below expectations at 1437k (vs. 1455k). Reminder, our team has found that when the rolling 4-week average of continuing claims increases around 11% above the last year’s nadir, near-term recession risk increases. That warning level would be around 1456k, still some ways above the 4-week average of 1413k. Indeed, one need go back to the first week of April to find any individual print, let alone moving average, that has breached 1456k, and that was as claims were still falling, only to hit their lows in late May. Elsewhere in data, the Philadelphia Fed Business Outlook surprised to the upside at 6.2, versus expectations of -5.0 and a prior print of -12.3. On the downside, housing activity continued to be strangled by Fed tightening, with existing home sales falling to a 4.81m pace (vs. 4.86m expectations), their lowest since the summer of 2020’s stilted homebuying season.

There was a suite of Fed officials on the tape yesterday. Across speakers, they still sounded a resolute tone around current inflationary ills, but offered different prescriptions for the path of policy going forward. On one end, San Francisco Fed President Daly expressed support for a 50bp hike to the fed funds target range at the September FOMC, with policy rates getting “a little” above 3% by then end of this year, reserving the right to go higher if the data call for that. St. Louis Fed President Bullard played the customary foil, preferring to hike rates 75bps in September, getting policy closer to 4% by year-end. Bullard noted that the Fed “shouldn’t drag out process of raising rates”. Splitting the difference, Kansas City President George noted it was too early to declare victory over inflation, so the case for continued hikes remained strong, even if the Committee had to be mindful of what the lagged impact of tightening may look like, echoing the July meeting minutes. Finally, Minneapolis President Kashkari was ambivalent about the prospects of a soft landing, saying he didn’t know if the Fed could bring inflation back to target without a recession given he couldn’t count on supply side expansion, particularly in the labor market. Like other speakers, he re-emphasized breaking inflation’s back was urgent.

In short, nothing explicitly new from Fed speakers, so it holds that Chair Powell’s Jackson Hole remarks next Friday, August 26, (confirmed by the Fed yesterday), along with the inflation and employment data before the September FOMC are the key events for policy over the near-term.

Yields on 2yr Treasuries fell -8.8bps, while increased +2.7bps, while 10yr yields were -1.5bps lower, driving the 2s10s yield curve to its steepest level in more than two weeks at -32bps. Like their European counterparts, US equities were similarly subdued, with the S&P 500 gaining +0.23%. Energy shares climbed +2.53%, following a +3.14% increase in Brent crude oil, but otherwise sector dispersion was rather narrow between Tech gaining +0.49% and Real Estate lagging at -0.75%.

On the war in Ukraine, talks with President Zelenskiy, UN Secretary General Guterres, and Turkish President Erdogan were staged in Lviv. Following the meeting, Turkey is set to evaluate the talks with President Putin, cementing Turkeys status as the key interlocutor between Ukraine and Russia. Reports from the meeting suggested diplomatic progress seemed possible, and our team took it as a positive that both sides appeared to be open to indirect communication, though much work remains.

Asian stock markets are mixed this morning following a quiet US session. The Nikkei (+0.10%) and the Hang Seng (+0.46%) are trading in positive territory while the Shanghai Composite (-0.28%), the CSI (-0.27%) and the Kospi (-0.10%) are trading lower. US equity futures are likewise sleepy, with the S&P 500 (-0.08%) and NASDAQ (-0.08%) flitting around zero.

Japan’s headline inflation rose +2.6% y/y in July, in line with market expectations and against a +2.4% rise in June, edging past the Bank of Japan’s 2% inflation goal for a fourth straight month. The increase in core CPI (+2.4% y/y from +2.2% in June) was the sharpest in about seven and half years.

To the day ahead now, and data releases include UK retail sales and German PPI for July. Central bank speakers include Richmond Fed President Barkin, and earnings releases include Deere & Company.

Tyler Durden

Fri, 08/19/2022 – 08:02

via ZeroHedge News https://ift.tt/ab85M40 Tyler Durden