Germany’s Largest Refinery Slashes Output Due To Rhine’s Low Water Levels

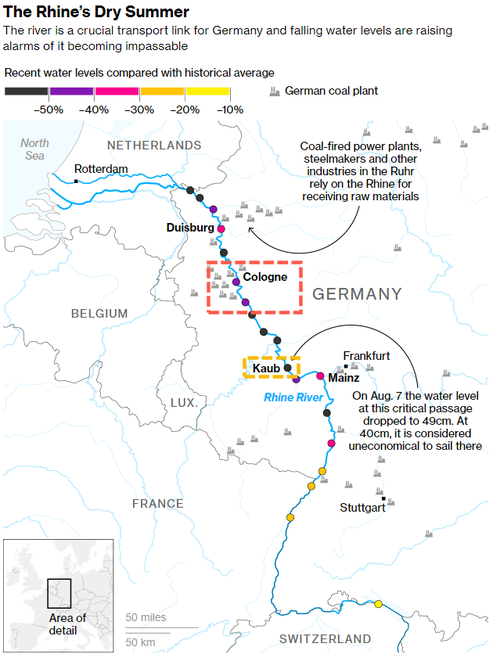

The current water levels on the Rhine River, a major inland infrastructure transit artery across Germany, are exceptionally low and have made certain parts of the river impassible by barge. Falling waters have already disrupted the flow of commodities and are exacerbating Europe’s energy-supply crunch.

The alarming lack of water is contributing to a possible oil supply shock at Germany’s largest oil-processing complex located on the banks of the Rhine, which is operated by Shell Plc.

“Due to the low Rhine water level, we have reduced the capacity of Shell Energy and Chemicals Park Rhineland. The situation regarding supply is challenging but carefully managed,” the company said in an e-mailed statement to Reuters.

Shell didn’t reveal how much output it cut at the refining facility, which makes fuels, heating oil, and petrochemicals. However, data shows that the refinery can process upwards of 17 million tons of crude oil per year, or approximately 345,000 barrels a day.

The refinery and chemicals plant is located on the Lower Rhine and outside Cologne. It’s downstream from the highly monitored Kaub chokepoint that is at 35 centimeters (13.8 inches) — water levels below 40 centimeters (15.7 inches) indicate shippers find it uneconomical to operate barges past the point to Upper Rhine.

Shell’s production cut underscores the severity of dropping water levels on the waterway, amplifying an energy crisis due to Europe’s sanctions on Russia.

We outlined last month how falling water levels on the Rhine would make things worse for the largest economy in Europe. Supplies of crude products are running low across the country. Austrian oil and gas firm OMV AG warned two weeks ago that Germany saw a run on diesel and heating fuels.

There is some good news. Rhine water levels are set to increase to 67 centimeters (26.4 inches) by Aug. 22, according to German government data. Also, a fleet of crude tankers carrying diesel is headed to Europe.

Tyler Durden

Fri, 08/19/2022 – 06:00

via ZeroHedge News https://ift.tt/pextrKy Tyler Durden