Nomura Warns “Apocalyptic” German PPI Triggers “Unclench” From “Gamma Gravity” Into OpEx

US futures are down hard overnight, erasing all the week’s gains, following a stunning German PPI print overnight. Nomura’s Charlie McElligott described the 5.7% MoM surge (and 37.2% YoY) as “apocalyptic”…

…as the energy crisis impact sparks full-blown economic carnage domestically…

…, and knocks-into global Central Bank hike expectations, Rates, FX and Vol.

With Euro now being devalued daily due to the energy crisis on fwd growth being doomed—and all into a priced “impulse tightening” ahead in coming months from a “behind the curve ECB” who can do nothing about “supply” and only “demand” (big “ooof”), the spill-over is a global financial conditions surge “tighter / more restrictive,” as the US Dollar “wrecking ball” is again screaming higher—and that’s a negative for global risk-assets

Like I have been messaging over the past few weeks, the near-consensus “buy-in” to the “past peak inflation” story is at risk of being caught flat-footed by ongoing “fits and starts” of structural “supply-side” inflation issues which cannot be solved by CB policy, despite the comfort which has been provided locally by the recent roll-over in Commodities / Goods, as well as forward “survey” data

Simply-put, inflation is not going to roll-over in a smooth, linear-fashion…and likely stays “sticky higher” above target, keeping CB’s in the uncomfortable “restrictive for longer” territory required

And bigger-picture, this is another reminder that even a seemingly idiosyncratic or isolated situation (UK inflation Wednesday, today’s German PPI) can elicit a “butterfly effect” impact: flapping its wings locally, but risk causing a chaotic “tornado” outcome elsewhere, in a future state

As the Nomura strategist notes, this horrific escalation of the EU / UK energy disaster in recent days as a knock-on “Vol catalyst” potential elsewhere, and how critical this could be with the concurrent timing of the Equities Op-Ex “window for Vol expansion,” as we see a large amount of $Gamma set to drop-off today, which then allows for resumption of broader distribution of price-outcomes thereafter…

But, as McElligott notes, for a larger market “price shock,” this needs to occur against the “right” conditions – so not just getting that required macro “Vol catalyst(s),” but against market-structure conditions which can allow for movement – which is where today’s Op-Ex can come into play.

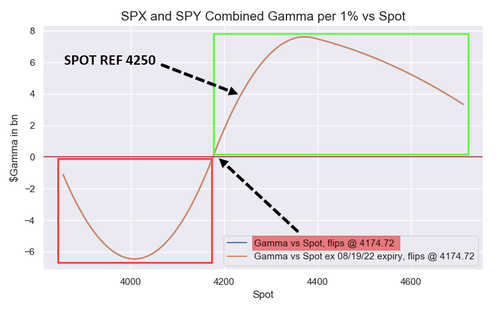

SPX “Gamma Gravity” now the key at holding this market near the whopping 4250 strike line ($3.51B total $Gamma there, $1.47B front-expiry) into the a.m. expiration, because this line is in-particular is loaded with front-week Options set to expire—which, in-turn, means a “Gamma Unclenching” thereafter which can open us to a wider distribution of outcomes / broader range of prices, as the prior Dealer hedging barriers are suddenly diminished by nearly half

42% of the 4250 line’s $Gamma set to drop-off today, and similarly lumpy amounts from overhead strikes, which can then “expose” a lower-end to the range if broken

Obviously, losing the prior “barrier” which has pinned / supported the market this week can be a “big deal” now that we have a macro / rate vol / central bank policy “butterfly flapping its wings” catalyst which is reminding us that we are not out of the woods at all yet, as it relates to structural inflation “supply-side” issues trying to be solved-for by “demand” levers

IF we were to convincingly break through 4250 to the downside….technicals become more important then to see a further and sustained move lower:

-

Walter Burke sees today’s weakness in ES as breaking below the bottom of the mid-July bull channel and latest breakout level at 4202

-

4200 has about $2.1B of $Gamma after today’s expiration as a support below

-

But it’s the “Gamma Flip” level down at 4174 which should mark the real risk of acceleration LOWER, as that is the location we see Dealer Gamma pivoting “Short,” which means that instead of their hedging flows acting as a counter-cyclical buffer…that they can then instead begin to feed into the move LOWER, have to sell more futures the lower we go, in order to stay hedged against Puts they’re Short to clients

Simply put: Negative Gamma regimes allow for Vol Expansion and unstable movement—so a flip “Short Gamma vs Spot” territory would be our first real downside acceleration risk seen since mid-June.

Tyler Durden

Fri, 08/19/2022 – 08:47

via ZeroHedge News https://ift.tt/NxzdrID Tyler Durden