‘There Is No Pivot’: Never Forget The First Rule Of Watching A Central Bank…

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,.

“There is no spoon”

– The Matrix

“Ray, when someone asks you if you’re a god, you say YES!”

– Ghostbusters

After the July FOMC meeting the headlines were abuzz with this crazy notion that the Fed ‘pivoted’ off of tight monetary policy.

They say these things because this is what they want. It’s the world they want, not the world they’ve got.

For nearly three weeks credit spreads, equity, bond and currency markets tried to convince us that the Fed had indeed done something it hadn’t done.

The commentary from the financial Twitterati and the headlines from the regime-controlled media tried desperately to spin a 75 basis point hike into a dovish event.

Financial commentary and its incessant chasing the news cycle and Overton window manipulation leads people down blind allies. It leads them to forget the first rule of watching a central bank:

Respond only to what they do, not what they say.

The fact is the Fed raised rates for a second time by more than most people thought they would raise total in this cycle.

Jerome Powell didn’t say anything anyone could have possibly, under different circumstances, construed as ‘dovish’ during July’s presser. But that didn’t stop the ‘experts’ from taking the ECB’s side and talking their own hedge books.

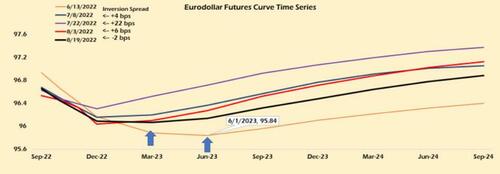

Eurodollar futures tried to blackmail the market into this false reality. Now it’s having to walk this back as the yield curve inversion has moved back to March from December. But, I want you to note the insanity of the Dec/Mar spread.

There is no pivot, folks. There won’t be a pivot anytime soon.

It finally took the FOMC minutes coming out confirming what Powell didn’t say to get markets to wake up to reality.

If you are confused about any of this just think about the sources of this ‘expert’ commentary and who they work for and then you tell me they aren’t talking their book by talking ‘pivot.’

If the FOMC minutes didn’t convince you that the Fed isn’t about to pivot in September, St. Louis Fed Head James Bullard came out yesterday and said he backs another 75 basis points in four weeks, taking the Fed Funds rate to 3.0%

Bullard, a voting member of the FOMC and one of the biggest hawks at the US central bank, told the Wall Street Journal in an interview published Thursday that he backed another 75 basis-point increase in September, arguing “we should continue to move expeditiously to a level of the policy rate that will put significant downward pressure on inflation.”

The basis for the pivot argument is that the Fed has always in the past blinked in the face of economic Armageddon, the pressures for which are certainly building. It’s a fair point and one I would normally share. I hate to be the guy to be having the Fed’s back here, but their actions and messaging have been very clear if you have had ears to listen for the past eighteen months.

That said, this situation is different than past iterations both economically and, more importantly, politically. There are stresses within the monetary system which weren’t present previously. The tremendous geopolitical stresses emanating out from Russia’s invasion of Ukraine weren’t present either.

And this is where most ‘experts’ try to hide behind the numbers and not stray out of their lane as opposed to leaning into a new paradigm. They are uncomfortable getting in the mud pit with the politicians and the oligarchs, preferring to stay in the world of CPIs, PPIs, and trade deficits.

These are ‘facts’ which can be pointed at to give the illusion of competence and expertise. But since we know that most of these numbers are basically so much government bureaucracy promulgated bullshit the entire analytic process is, in my view, foundationally flawed.

The better analytic framework is to assess the incentives and the motivations of the people setting policy, identify where they are in conflict and then see what picture emerges.

And, as I’ve tried to communicate in post after post, that picture is simpler than it looks while simultaneously challenging to the worldviews of so many.

It really does breakdown into two camps at this point, those who back the old European colonialists trying to leverage what’s left of their power using financial and kinetic warfare to grasp for the brass ring of global control (The Davos Crowd) and those who stand against that.

That second group is not formally united by anything long term or even organized. They just know that it’s finally time for humanity to stop giving credence to the wishes of a bunch of old, entitled Europeans and their White Man’s Burden.

The only question is whether there are those that have a positive incentive within the West’s power elite to oppose Davos and their dystopian desires. In discussion after discussion the biggest obstacle I encounter is presenting the Fed’s (and those the Fed represents) incentives as out of phase, or even orthogonal, to that of Davos.

It’s a simpler world to just think it’s all just one big club, and to quote George Carlin, “we ain’t in it!” But is it really?

Because if that were the case then the Fed wouldn’t be raising rates when the clear loser is the bedrock on which Davos’ power rests. They would meekly go along with the needs of Europe and European banks, who clearly do not want higher rates.

The entire Davos agenda is based on selling us this lie that we as a species have to create and spend hundreds of trillions of dollars to combat Climate Change and marry that with a Minority Report style, AI-driven, technocratic full surveillance state fueled by CBDCs.

The real hard sell is that this is necessary to control everyone’s behavior ensuring we don’t ever approach this type of Apocalypse ever again.

Too bad the whole thing is a bald-faced lie and anyone still believing in it is engaged in the biggest political cope of all time.

Under that rubric there is no need for a dominant central bank or reserve currency. The Fed itself is no longer needed, nor the banks who it ultimately serves.

Under that scenario, what do you think the Fed is capable of doing? If you think they aren’t capable of taking rates to 5% or 6% then you aren’t reading the room properly.

This late summer rally in stocks leaves them with plenty of ammunition from the perspective of the guys who scream about the Fed subsidizing the ‘Wealth Effect.’

The media’s obsession with not calling the current economic conditions a recession also support the Fed tightening further.

Keynesian dogma that the Fed Funds Rate should be higher than the projected inflation rate says the same thing.

So, while the Fed stays the course and refuses to knuckle under to pivot, because it would mean its destruction, the counter-move by Davos is to accelerate the tensions between the US and China/Russia on geopolitical terms.

If you’re confused why Ukraine is shelling the Zaporizhia Nuclear Power Plant or sabotaging ammo dumps in Crimea when they should be surrendering and trying to save lives at this point, now you know.

Nothing they tell you is the Real Story. Their allergy to the truth at this point is complete. You know they are lying because things are serious. They spoon feed us lies to keep us and the markets pacified, to keep relevant court stenographers at Bloomberg, CNBC, CNN and the War Street Journal.

The algorithms key off this and keep things levitating until a critical mass of players finally perceive the truth.

There is no spoon, there is only an insatiable monster lurking just behind the facade of the hot chick with too much makeup on.

I try to lay all of this out in my latest appearance on Palisades Gold Radio.

Tyler Durden

Sat, 08/20/2022 – 11:30

via ZeroHedge News https://ift.tt/CNMTIrl Tyler Durden