Futures Tumble As Market Braces For Jackson Hole Hawk-ano

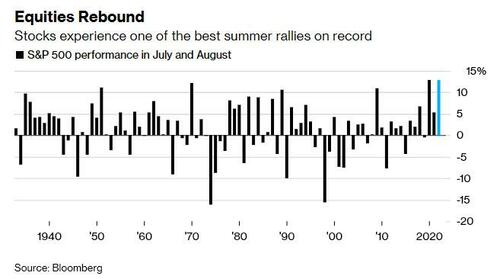

The staggering “most hated rally” melt-up, which we warned back in June would steamroll shorts, and which ended up being one of the biggest summery rallies on record, is officially over…

… with BofA superstar strategist Michael Hartnett proven correct again this morning, as stocks retreated further from the bear market peak he called at 4,328 last week, with US equity futures sliding more than 1% on Monday along with stocks in Europe as a risk-off mood took hold at the start of a critical week for global markets when central bankers gather at their annual Jackson Hole symposium starting on Thursday. Both S&P and Nasdaq futures slumped more than 1.1%, with spoos down 50 points to 4,180, as 10-year Treasury yields are little changed after briefly kissing 3.0%, while two-year yields rose about six basis points, deepening the yield-curve inversion that’s seen as a harbinger of a recession. The dollar spot index climbed to a five-week high, while gold and bitcoin slumped.

In China, banks lowered the one-year and five-year loan prime rates on Monday in the aftermath of a decision by the nation’s central bank last week to cut a key policy rate. The Chinese demand outlook has weighed on oil, which briefly sank below $90 a barrel in New York before rebounding and turning green. Traders are monitoring Iran nuclear talks that could lead to more supplies.

In premarket trading, GameStop and Bed Bath & Beyond led the declines in meme stocks as the latest frenzy in the cohort loses steam. GameStop -5.6%, Bed Bath & Beyond -8.6%; Fellow retail trading favorite AMC Entertainment Holdings was also down as the cinema theater operator’s preferred stock will start trading on the New York Stock Exchange under the ticker “APE” on Monday. Here are some of the biggest U.S. movers today:

- Signify Health (SGFY US) jumps 35% in premarket trading after reports of UnitedHealth (UNH US), Amazon.com (AMZN US), CVS (CVS US) and Option Care Health (OPCH US) vying to buy the health- care technology provider.

- Tesla (TSLA US) and fellow electric-vehicle makers fall amid worries over a hawkish Fed ahead of Jackson Hole symposium this week, and following data showing China EV registrations declined in July.

- Tesla drops as much as 2.7%; Rivian (RIVN US) -2.3%, Nikola (NKLA US) -2.8%.

- CFRA cut its recommendation on Netflix (NFLX US) to sell from hold, saying the stock may underperform the S&P 500 Index for the rest of the year after rallying 40% from mid-July lows.

- Netflix falls 2.2% amid a decline for Nasdaq futures.

- GigaCloud (GCT US) shares rally as much as 40%, before paring gains to trade around 12% higher. The Chinese e-commerce firm is on course for its third session of straight gains following its Nasdaq debut last week.

A huge squeeze in global shares from June’s bear-market lows, stoked by the market’s expectations for a pivot to slower rate hikes, is rapidly fizzling after repeated Fed policy makers warned that interest rates are going higher. This weekend’s Jackson Hole symposium gives Jerome Powell a platform to reset those bets, which are vulnerable to the possibility of persistently elevated price pressures even as economic growth stumbles. Investors are also waking up to the looming acceleration of the Fed’s balance-sheet reduction: quantitative tightening kicks into top gear next month, and will add to pressure on riskier assets which have benefited from ample liquidity.

“It is likely central bankers, including Fed Chair Powell, will remain hawkish in dealing with inflation albeit with a bit of caution creeping in given the emerging economic downturn,” Shane Oliver, head of investment strategy at AMP Services Ltd., wrote in a note.

Of course, the irony would be if markets melt up again next week just as hedge funds aggressively reset shorts: “The expectation is still that Powell will reaffirm what he and his colleagues have been saying in public recently,” said Craig Erlam, a senior market analyst at Oanda. “The risk is that he says something dovish — intentionally or otherwise — after investors position for the opposite and triggers another risk-on rally in the markets.”

The selling also accelerate in Europe, where the Stoxx 600 index dropped to its lowest level in more than three weeks, with autos, chemicals and tech the worst-performing industries as all sectors fall. The DAX lags, dropping 2%. S&P futures slide 1.3%, Nasdaq contracts tumble 1.6%. Here are some of the biggest European movers today:

- Fresenius SE shares rose as much as 7.1% after the company said Fresenius Kabi CEO Michael Sen will replace CEO Stephan Sturm. Berenberg says the choice is sensible and expected

- EVS Broadcast Equipment shares jumped as much as 4% after the company announced a 10-year, $50m contract with a US-based broadcast and media production company on Friday

- Scandinavian Tobacco Group shares fell as much as 19% after the Danish cigar and pipe tobacco manufacturer published its preliminary 2Q numbers and lowered its FY22 guidance

- Deliveroo shares dropped as much as 6.8% amid a broader decline among European food delivery stocks. FY23 growth expectations for Deliveroo seem “stretched,” according to Morgan Stanley

- B&S Group shares slid as much as 13%, dropping to the lowest since April 2020, after the company reported interim results ING described as a “weak set” of numbers

- Intrum shares fell as much as 7.5%, their biggest decline since early May, after the board of the credit management firm replaced CEO Anders Engdahl with immediate effect

- Covestro fell as much as 5.9%, hitting lowest since May 2020, after Stifel slashed its price target to EU34 from EU53, citing “shaky prospects” for the company

- Dassault Aviation shares were down as much as 4.7% after French Transport Minister Clement Beaune said he wanted to regulate private jet use, according to an interview with Le Parisien newspaper

Earlier in the session, Asian stocks fell to more than a two week low as investors braced for a hawkish stance by US officials at the upcoming Jackson Hole symposium. The MSCI Asia Pacific Index declined as much as 0.7%, with the region’s tech giants TSMC and Tencent Holdings dragging down the measure the most.

MSCI Inc.’s Asia-Pacific share index fell for a third day with losses evident in most major markets except for some gains in China, where a move by banks to trimlending rates aided property developers.

Philippine stocks were the region’s biggest losers, sinking more than 2% as the central bank there signaled more hikes. Chinese equities advanced. Jerome Powell’s Friday speech at the central bankers’ gathering will be the highlight of the week, with markets expecting the Fed chair to reaffirm his determination to get inflation under control. Traders have already been paring back risky bets after Richmond Fed President Thomas Barkin said Friday that the central bank was resolved to curb red-hot inflation even at the risk of a recession.

“The bear market rally seems to be fading ahead of the Jackson Hole symposium this week, which may see the Fed pushing back further on easing expectations for next year,” said Charu Chanana, a senior strategist at Saxo Capital Markets. Equities in mainland China posted rare gains in the region after the nation’s banks lowered their borrowing costs in a bid to stabilize the property market. That gave a positive boost, said Banny Lam, head of research at Ceb International Inv Corp. But markets are still on a bumpy ride as the dollar’s rise extends the outflow of liquidity from Asian assets, he added. Other key issues on the radar include corporate earnings results. More than 340 members of the MSCI Asia Pacific Index, including battery heavyweight Contemporary Amperex Technology and e-commerce giant JD.com, are expected to release their financial results this week.

Japanese stocks fell as hawkish comments from a Federal Reserve official put investors on edge ahead of the Jackson Hole symposium later this week. The Topix Index fell 0.1% to 1,992.59 in Tokyo on Monday, while the Nikkei declined 0.5% to 28,794.50. Keyence Corp. contributed the most to the Topix’s decline, as the producer of sensors and scanners decreased 1.3%. Out of 2,170 stocks in the index, 1,123 fell, 924 rose and 123 were unchanged. “There is a bit of hawkishness coming out from the Fed as its seen trying to correct the direction of the market,” said Naoki Fujiwara, a chief fund manager at Shinkin Asset Management. “In the end, it’s profit taking as the market has gone up so far.”

Indian stocks fell for a second session on concerns the US Federal Reserve may remain committed to tightening monetary policy, which could impact foreign inflows to local equities. The S&P BSE Sensex declined 1.5%, its biggest drop since June 16, to 58,773.87 in Mumbai. The NSE Nifty 50 Index fell by a similar magnitude. Of the 30 member stocks of the Sensex, all but two declined. ICICI Bank Ltd. slipped 2.1% and was the biggest drag on the index. All 19 sectoral sub-indexes compiled by BSE Ltd. dropped, with a gauge of metal companies the worst performer. “While a correction was overdue for sometime after the recent upsurge, fresh concerns of a likely hawkish stance by the US Fed in its September meet and strengthening dollar index turned investors jittery and triggered a massive fall in banking, IT, metal & realty stocks,” Shrikant Chouhan, head of equity research at Kotak Securities Ltd., wrote in a note. Overseas investment into local stocks totaled $6.3 billion from end-June through Aug. 18, after record outflows since October. The Fed’s symposium at Jackson Hole, Wyoming this week will be key for markets for clues on how the central bank plans to tackle price pressures.

In Australia, the S&P/ASX 200 index fell 1% to close at 7,046.90, tracking Friday’s losses on Wall Street as investors weighed the Fed’s next steps. The benchmark posted its worst session since July 11 as all sectors declined in Australia. Adbri was the biggest laggard after reporting a drop in 1H underlying Npat and trimming its interim dividend. EML Payments gained after announcing a buyback. In New Zealand, the S&P/NZX 50 index rose 0.7% to 11,763.95.

In FX, the Bloomberg Dollar Spot Index advanced for a fourth consecutive day, to the highest level since July 18, while the greenback advanced versus most of its Group-of-10 peers. The euro fell to a seven-year low against the Swiss franc, extending losses as concerns about a global economic slowdown prompted demand for the safe-haven Swiss currency. Australia’s dollar gained for the first time in six days after Chinese banks cut their loan prime rates in an effort to bolster the struggling property sector. Aussie bonds extended opening declines. The yen slipped to its lowest level in nearly a month as higher US yields amid growing bets for a hawkish Federal Reserve stance weighed on sentiment. Bonds fell, tracking US Treasuries.

In rates, Treasuries were cheaper, the 10- year US yield rising as much as three basis points to 2.9997%, adding to Friday’s climb, before falling back. 2-year yields rose by around 5bps, inverting the curve further with losses led by front-end of the curve where two-year yields trade 6bp higher versus Friday’s close. Further out the curve, bunds and gilts both lag with notable bear steepening move seen across UK curve. US yields cheaper by 6bp to 1bp across the curve in bear flattening move which sees 2s10s, 5s30s spreads trade tighter by 6bp and 1.5bp on the day; 10-year yields around 2.98% after peaking at 2.9997% in early Asia session. Focus this week is on US auctions which kick-off Tuesday with $44b two-year note sale, followed by $45b five-year Wednesday and $37b seven-year Thursday. IG dollar issuance slate empty so far; issuance expectations are low for the week and dependent on market conditions with the Federal Reserve’s annual symposium in Jackson Hole, Wyoming, due to commence Thursday. Bunds and Italian bonds snapped four- day sliding streaks, with German debt gains led by the belly and Italy’s yield curve bull flattening as stock futures drop. Belgium sells five- and 10-year notes.

In commodities, WTI trades within Friday’s range, first falling as much as 1% before spiking and recovering all losses, with Brent jumping from a session low of $94.50 to a high of $96.90. Most base metals are in the red; LME copper falls 1%, underperforming peers. Spot gold falls roughly $15 to trade near $1,732/oz.

It’s a busy week for the calendar, but we kick off on a day quiet note, with the day at hand featuring the Chicago Fed’s national activity index and earnings from Zoom and Palo Alto Networks.

Market Snapshot

- S&P 500 futures down 1.1% to 4,183.75

- STOXX Europe 600 down 1.1% to 432.35

- MXAP down 0.6% to 159.83

- MXAPJ down 0.9% to 518.65

- Nikkei down 0.5% to 28,794.50

- Topix little changed at 1,992.59

- Hang Seng Index down 0.6% to 19,656.98

- Shanghai Composite up 0.6% to 3,277.79

- Sensex down 1.2% to 58,934.14

- Australia S&P/ASX 200 down 0.9% to 7,046.88

- Kospi down 1.2% to 2,462.50

- Gold spot down 0.7% to $1,735.45

- U.S. Dollar Index up 0.18% to 108.36

- German 10Y yield little changed at 1.20%

- Euro down 0.3% to $1.0006

Top Overnight News from Bloomberg

- European gas prices surged after Moscow’s move to shut a major pipeline ramped up fears of a prolonged supply halt, leaving Germany once again guessing as to how much Russian fuel it can count on this winter

- About 2,000 dockers at the Port of Felixstowe began an eight-day walkout on Sunday, halting the flow of goods through the UK’s largest gateway for containerized imports and exports

- Federal Reserve Chair Jerome Powell will have a chance — if he wants to take it — to reset expectations in financial markets when central bankers gather this week at their annual Jackson Hole retreat

- A sober warning for Wall Street and beyond: The Federal Reserve is still on a collision course with financial markets. Stocks and bonds are set to tumble once more even though inflation has likely peaked, according to the latest MLIV Pulse survey, as rate hikes reawaken the great 2022 selloff

- New Zealand’s central bank is open to the possibility of raising its benchmark rate as high as 4.25% amid uncertainty over the amount of tightening needed to regain control of inflation, Deputy Governor Christian Hawkesby said

- Swedish kronor bonds tied to environmental, social and governance goals are helping keep the country’s waning issuance market afloat this year

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mostly lower after last Friday’s declines in stocks and bonds across global markets in the aftermath of red-hot PPI data from Germany which rose by a new record high and stoked inflationary concerns, while the region also digests the PBoC’s latest actions on its benchmark lending rates. ASX 200 was pressured with all sectors subdued and as the influx of earnings continued. Nikkei 225 declined at the open as it took its cue from global peers and following reports that PM Kishida tested positive for COVID-19, although the index clawed back around half of the losses with help from a weak currency. Hang Seng and Shanghai Comp were mixed with early indecision as participants reflected on the PBoC’s rate actions in which it cut the 1-Year LPR by 5bps to 3.65% and reduced the 5-Year LPR by 15bps to 4.30% vs expectations for a 10bps cut to both, while the reduction in the 5-Year LPR which is the reference for mortgages, also followed recent measures to support the construction and delivery of unfinished residential projects through special loan schemes from policy banks. This provided some early support for developers although the broader sentiment was restricted amid the extension of factory power cuts in Sichuan.

Top Asian News

- China’s Sichuan extended its factory power cuts to August 25th, according to Caixin.

- Japanese PM Kishida tested positive for COVID-19 and is recuperating at his official residence, according to NHK.

- Singapore PM Lee announced to reduce mask requirements as the COVID-19 situation stabilises with masks to only be required for public transport and healthcare settings with everywhere else optional. PM Lee also confirmed that Deputy PM Wong has been chosen to be the next leader and said authorities will soon announce new initiatives to attract talent, according to Reuters

- Aluminum Up as China’s Worsening Power Shortages Tighten Supply

- Debt Audit, Constitution Change on Angolan Opposition’s Agenda

- Shanghai United Imaging Jumps 65% in Debut Post $1.6 Billion IPO

- China Province Extends Power Cuts on Worst Drought Since ‘61

European bourses are under pressure, Euro Stoxx 50 -1.8%, amid Nord Stream 1 maintenance. Updates that sparked a continuation of Friday’s downbeat price action and has caused particular downside for the likes of Uniper (-10%) while defenisve sectors outperform slightly. S futures are in-fitting both in terms of direction and magnitude, ES -1.3%, amid global recession and inflation fears. Panasonic (6752 JT) is to increase prices on 17 products from September 1st due to increasing material and manufacturing costs, hike will range between 2-33%.

Top European News

- Cineworld Says It Considers Filing for Bankruptcy in the US

- Vodafone Agrees to Sell Hungary Unit for 1.8 Billion Euros (1)

- Borealis Curbs Fertilizer Output for Economic Reasons

- UK Trial Lawyers Vote to Strike Indefinitely Over Fees

- Biggest Rate Hike in Decades Is in Play in Israel: Day Guide

FX

- DXY sees a firm start to the week as the index extends gains above 108.00, topping Friday’s peak.

- EUR/USD has again dipped under parity amid jitters over a potential supply disruption as Russia is to shut the Nord Stream 1 pipeline.

- The Antipodeans are the relative outperformers but have waned off best levels amid the broader deterioration in sentiment.

- The JPY has climbed its way up the ranks having experienced mild losses in APAC trade owing to widening yield differentials alongside losses in broad APAC FX.

- Turkey’s Central Bank revised rules for Lira government bond collateral for FX deposits in which it raised the RRR for credit from 20% to 30% for bond collateral, according to Reuters.

Fixed Income

- A session of pronounced two-way action for fixed benchmarks as energy and inflation vie for the limelight.

- Initial upside (Bunds tested 152.85 Fib of Friday) occurred as sentiment deteriorate on Nord Stream 1’s unscheduled maintenance announcement.

- However, this then swiftly retraced with core benchmarks modestly negative at worst, perhaps as attention pivoted to the associated inflation implications.

- Stateside, USTs have been moving in tandem though the move lower was somewhat more contained as participants look to Jackson Hole at the tail-end of the week.

Commodities

- WTI and Brent October contracts have continued trending downwards in a resumption of Friday’s action.

- The main focus of this morning has been on European gas prices surging on news that Russia’s Gazprom will shut down the Nord Stream 1 pipeline for three days.

- Dutch TTF October surged over 18% whilst European coal for the next year rose over 5% to a new record.

- Metals markets are hit by the firmer Dollar with spot gold losing further ground under USD 1,750/oz while LME copper eyes USD 8,000/t to the downside

- Libya’s NOC said oil production was running at 1.211mln bpd, while the Waha Oil Co said gas output from the Faragh field increased to 149mcfd on Sunday from 95mcfd on Saturday, according to Reuters.

- Caspian Pipeline Consortium suspended oil loadings from two of three single mooring points at its Black Sea terminal for inspection, while CPC exports continue from the third mooring point and August loadings are currently unaffected, according to Reuters sources. Subsequently confirmed

- Turkey has increased its imports of Russian oil to over 200k BPD so far this year (vs 98k BPD in the same period last year), according to Refinitiv data.

- Norway Prelim. July production: Oil 1.646mln BPD (vs 1.298mln BPD in June); gas 10.9bcm (vs 10.0bcm in June), according to the Norway Oil Directorate.

US Event Calendar

- 08:30: July Chicago Fed Nat Activity Index, est. -0.25, prior -0.19

DB’s Tim Wessel concludes the overnight wrap

The annual plenary of the global central bank cognoscenti kicks off in Jackson Hole this week. The main macro dish of the deep dog days of summer – where this year’s theme is “Reassessing Constraints on the Economy and Policy” – will be highlighted by Chair Powell’s remarks due on Friday morning. Global production data will serve as suitable hors d’oeuvres throughout the week, while US PCE data on Friday will be a side dish commanding ample attention. Elsewhere, we receive the second estimate of 2Q US GDP; will the poor aftertaste of two consecutive quarterly retractions continue to overwhelm the otherwise supportive ingredients that comprise near-term growth?

Back to Jackson Hole, as the market looks for direction on the uncertain economic outlook and Fed reaction function, Chair Powell’s remarks are one of the key events that can jolt US policy expectations from their recent range, along with inflation and employment data preceding the September FOMC. Indeed, since the day of the July CPI print, 2yr Treasury yields are on net less than a basis point lower, while pricing of the September rate hike has oscillated in a narrow range that effectively has placed equal probabilities on a 50 or 75bp hike, as conviction around the terminal rate and intervening path of policy is low until the market can assess which way inflation (and the Fed) is breaking. The Chair will likely strike an imposing tone against the inflationary scourge, all the more given his remarks last year noted the bout of inflationary pressure was likely to be a transitory phenomenon (important to keep in mind how much the policy outlook can evolve over a 12-month time frame, let alone when uncertainty is this high here). While the Fed has taken to emphasizing two-way risks around the tightening cycle, most visibly in the minutes at the July meeting, the easing of financial conditions since the July meeting may force the Chair to re-orient expectations away from the balance of risks back toward the primary objective of bringing inflation lower.

Executive Board member Schnabel will be the highest profile ECB speaker at the gathering, where focus is on calibrating the ECB’s next policy action, which our team takes careful measure of, here, preserving another 50bp hike as their base case. Before Schnabel, due on a panel Saturday, the ECB’s account of the July meeting’s 50bp hike will provide yet more detail into the super-sized kickoff to the ECB’s tightening cycle. Elsewhere in Europe, the looming energy crisis will remain top of mind. German Chancellor Scholz and Vice Chancellor Habeck are in Canada to try and plug the energy gap left by dwindling Russian gas supplies. Along with alternative imports, the government is still weighing whether to extend the life of heretofore condemned nuclear facilities if sufficient supplies cannot be secured.

Asian equity markets are trading in negative territory at the start of the week amid a broad strength in the US dollar coupled with a potentially tighter Fed policy path. The Kospi (-0.78%) is the biggest underperformer across the region followed by the Nikkei (-0.46%) and the Hang Seng (-0.45%). Over in mainland China, markets are reclaiming earlier losses, with the Shanghai Composite (+0.43%) and CSI (+0.60%) both in the green after the People’s Bank of China (PBOC) surprisingly slashed its benchmark lending rates yet again to shore up an economy battered by a worsening property slump and a resurgence of Covid-19 cases.

The PBOC slashed the one-year loan prime rate (LPR) by -5bps to 3.65%, the first reduction since January while the five-year LPR (a reference for mortgages) was cut by -15 bps to 4.3% at the central bank’s monthly fixing. This move comes after a raft of data released last week indicated that the world’s second largest economy slowed in July.

US stock futures point to continued losses after ending last week on the downbeat, with the S&P 500 (-0.38%) and NASDAQ 100 (-0.51%) edging lower. Elsewhere, crude oil prices are trading lower in Asia trading hours with Brent futures -0.98% down at $95.77/bbl.

Turning to a brief wrap of last week, the S&P 500 retreated -1.29% on Friday to bring the index -1.21% lower on the week, its first weekly decline in a month. The sharp decline Friday came absent any material data or policy developments; instead, it appeared programmatic selling and large options expiries concocted headwinds that were too hard for the index to overcome, where health care (+0.27%) and energy (+0.02%) were the only sectors to escape the day in the green, and only just. The STOXX 600 also fell over the week, retreating -0.80% (-0.77% Friday).

In rates, 10yr Treasuries gained +14.1bps over the week, +9.0bps of which came on Friday, though, as mentioned, the net move in 2yr Treasury yields was smaller, having fallen -0.08bps over the week (+3.6bps Friday) as we await further direction from the Fed or from the data. 10yr bund yields increased each of the last four days of the week to end +24.3bps higher (+12.8bps Friday), as the inflationary impact of the energy crisis gripped markets. For their part, OATs climbed +26.1bps (+12.8bps Friday) and BTPs were +43.0bps higher (+17.1bps Friday). Of course, European energy prices from natural gas (+18.65%, +1.47% Friday) to German power (+21.42%, +4.02% Friday) rose to record highs as crisis binds the continent.

The week kicks off on a day quiet note, with the day at hand featuring the Chicago Fed’s national activity index and earnings from Zoom and Palo Alto Networks.

Tyler Durden

Mon, 08/22/2022 – 08:01

via ZeroHedge News https://ift.tt/Go175wu Tyler Durden