Surging Dollar And The Jackson Jitters

By Jane Foley, head of FX strategy at Rabobank

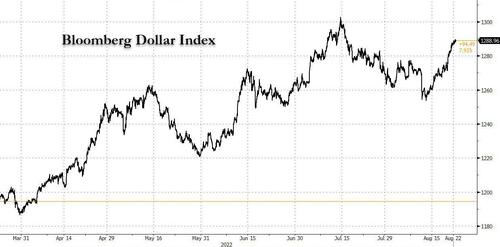

When the July US CPI inflation report posted a softer than expected reading in August 10, the market took that as a signal that US inflation may have peaked and that it may have over-estimated the number of Fed rate hikes that was priced in. This refreshed enthusiasm for US stocks and simultaneously knocked the USD lower. Last week, sentiment reversed. Stock market indices struggled, and the Bloomberg dollar index rose to a 1 month high, having climbed over 2% on the week.

The better tone in the USD was driven by several hawkish comments from Fed officials. This signalled that The Fed’s Jackson Hole Symposium at the end of this week may underpin a similar message.

Another driver of the dollar in recent sessions has been safe haven flow. This was sparked at the beginning of last week by a round of softer than expected Chinese July economic data. By Friday the CNY had slumped to its weakest levels in nearly two years vs. the USD encouraged by an unexpected rate cut by the PBoC for one-year medium-term lending facility loans to some financial institutions. CNY weakness vs. the USD continued this morning on the back of further support from Chinese policymakers. The PBoC has lowered the five-year loan prime rate by 15 bps to 4.30% and its one-year loan rate by 5 bps to 3.65%. This should bring down the cost of mortgages and has supported the shares of several Chinese property developers this morning. That said, falling house prices has impacted demand for loans.

Additionally, the market is cognisant that further lockdowns are possible in China which would undermine the outlook for broad economic growth. Weakness in the second largest economy is clearly not good news for global growth. Also, since China is the largest consumer of commodities in the world, news that its economy slowed in July was a worrying signal for producers of raw materials such as iron ore, copper, base metals and lumber, many of whom are emerging markets. These economies have already been strained this year by factors such as higher food and energy prices and by USD strength.

Given that this backdrop is set against mounting concerns about recessionary risks for the Eurozone, it is little wonder that the appeal of the safe haven USD is strong. European natural gas prices have extended gains again today on concerns about flows through Nord Stream 1. This morning, most Asian equity indices, except for China’s CSI 300, are in the red. European and US stock market futures are also trading lower.

Week ahead

While the Jackson hole symposium is the dominant market event this week, there are plenty of other factors that will also attract attention. It is already clear that the Eurozone economy could teeter into recession this winter dependent on whether energy stockpiles can last through the coldest months. Tomorrow’s round of August PMI data will provide a snapshot as to how the Eurozone economy is has been holding up recently. Germany’s July manufacturing PMI reading registered a 2-year low, signalling the acuteness of the headwinds already being felt. The release of Germany’s IFO survey later in the week is also expected to reflect further deterioration in business sentiment. Despite this, the ECB is expected to retain a hawkish tone in the face of strong price pressures. Although ECB President Lagarde will not be travelling to Jackson Hole this week, several members of the Governing Council will reportedly be there. Their remarks are likely to set the tone for the ECB’s forthcoming September 8 policy meeting.

Fed Chair Powell’s speech on Friday is expected to be the most watched of the symposium. A string of hawkish comments from various Fed officials last week has strengthened the perception that the FOMC, like almost all other G10 central bankers, is adamant that inflation must be forced back in its cage irrespective of the risks to growth. While the strength of the USD last week suggests that this is a popular market view, there are whispers that Powell will be more cognisant of the impact of USD strength on other economies and may therefore chose not to project an overly hawkish view. There will be a few interesting US data releases this week, which may colour the tone that Powell takes this week. These include August US PMI, July new homes sales, durable goods orders, a Q2 GDP revision and some inflation data. The Bloomberg market consensus sees little scope for an alteration from the shockingly soft Q2 GDP plunge of -0.9% q/q saar. The Fed’s favoured measure of inflation, the PCE deflator, is expected to show some moderation in price pressures. The market median stands at 6.4% y/y, down from a June figure of 6.8% y/y.

A notable event for the UK on Friday will be the announcement from Ofgem regarding how much average household energy bills are set to rise in October. In recent weeks, estimates have only been headed one way and are currently pointing to annual bills rising to around GBP3,600, with more increases to follow next year. Given the stark reality that energy bills will simply be unaffordable for some households this winter, Liz Truss, the favoured contender for the Tory party leadership, is now indicating that additional support could be at hand. Earlier this month she had announced that she did not believe in “giving out handouts”. On the back of the surge in the cost of living in the UK, workers at the port of Felixstowe, the biggest container facility in the country, have commenced an eight day walk out over pay. The impact is likely to enhance supply side issues for businesses around the country. Additionally, UK barristers are voting on proposals for an all-out strike next month as part of an ongoing dispute with government over pay and cuts to legal aid. Having broken below the GBP/USD1.20 level last week, cable is holding well clear of that level this morning.

Wednesday will mark 6 months of war between Russia and the Ukraine. The FT is reporting this morning that Moscow sees no possibility of a diplomatic solution to the end of the conflict, according to Russia’s permanent representative to the UN in Geneva. These comments are a blow to hopes that the recent agreement to allow grain exports from Ukraine’s Black Sea ports could have formed the basis for a broader solution.

Tyler Durden

Mon, 08/22/2022 – 09:51

via ZeroHedge News https://ift.tt/tsNSRnT Tyler Durden