Bonds, Stocks, & The Dollar Sink As Hawkish Hedges Dominate ‘Dovish’ Dismal Data

A lot of chaotic noise intraday for what looks on a close-to-close basis like a quiet continuation day for stocks and bonds.

Could be a lot worse though…

Who among us has not? pic.twitter.com/uaMokLl2im

— ZeroHedge⚙️ (@govttrader) August 23, 2022

Ugly PMIs, crashing new home sales, and a dismal Richmond fed print sparked a big push back into the “Fed Pivot” – which sent rate-hike expectations tumbling. But the anxiety into Friday’s Powell speech dominated the “but the economy’s in the shitter narrative and The Fed must save us” narrative by the close with rate-hike expectations trending higher and rate-cut expectations shifting hawkishly…

Source: Bloomberg

The ‘bad news’ was good news for stocks initially but all those “The Fed will ease and BTFD” gains were erased by the close. The Dow was weakest on the day while Small Caps actually held on to some gains…

Bonds were also choppy but all but the 2Y yield ended the day higher (after tumbling lower on the weak macro). Note that yields surge back higher after the ugly 2Y auction..

Source: Bloomberg

The 10Y yield found support at 3.00% today after breaking above it yesterday…

Source: Bloomberg

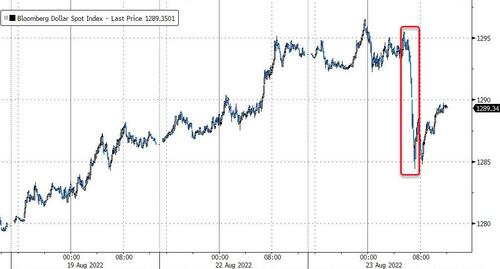

The dollar puked on the ‘dovish’ dismal data but saw some bounceback. We do note that while stocks erased their shift and so did bonds, the dollar did not…

Source: Bloomberg

Bitcoin was higher on the day, finding support at $21,000 once again…

Source: Bloomberg

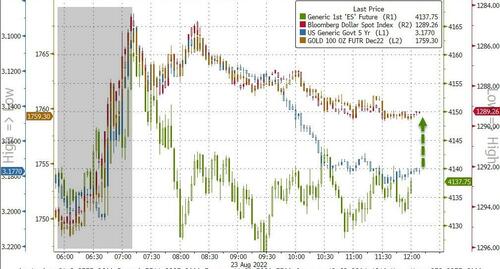

Gold and the dollar held on to most of their ‘dovish’ move while stocks and bonds gave it all back…

Source: Bloomberg

Oil prices spiked today after OPEC+ production cut headlines continued from yesterday

Gold rallied as the dollar dumped, with futures back above $1750…

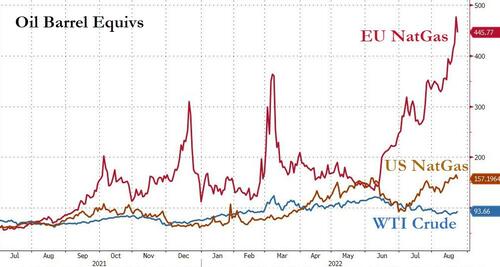

US NatGas topped $10 for the first time since 2008 early on but then news of the delayed reopening of Freeport’s LNG terminal sparked a sell-off in Henry Hub….

But EU NatGas will be pushed higher once again on this – back near $500/barrel oil equiv…

Source: Bloomberg

“The catastrophe is already there,” Thierry Bros, a professor in international energy at Sciences Po in Paris, said.

“I think the major question is when EU leaders are going to wake up.”

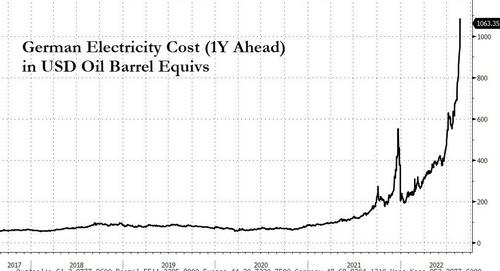

High gas prices means high electricity prices – how high? For context, German one-year-ahead power is trading over $1000 on an oil-barrel-equiv basis…

Source: Bloomberg

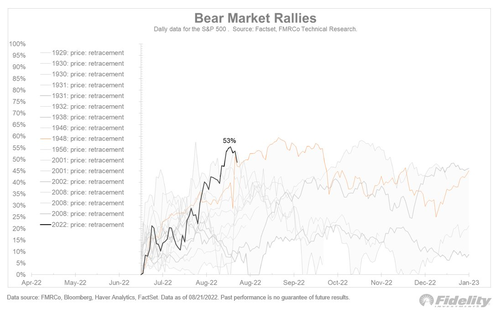

Finally, as Julian Timmer noted in a tweet today, the rebound rally is at a crossroads:

“The S&P 500 has retraced 53% of its decline, and this is as far as bear market rallies go…

That means that if the market continues to climb, technically speaking there will be no historical basis for concluding that this is not a new cyclical bull market.”

RIP Julian Robertson.

Tyler Durden

Tue, 08/23/2022 – 16:00

via ZeroHedge News https://ift.tt/NWHhYx6 Tyler Durden