Winter Strikes Hamptons Housing Market As Sellers Forced To Slash Prices

We recently pointed out the “housing market peaked and home prices finally drop from record highs,” and home price growth just suffered one of the most significant monthly declines since the 1970s.” Evidence is mounting pandemic boomtown markets are rapidly cooling as a tsunami of price cuts has only just begun.

The wealthy enclave on Long Island, known as the Hamptons, is entering a new market phase as sellers are forced to lower their asking price by hundreds of thousands of dollars.

Bloomberg spoke with seller George Giacoia who listed his home for $1.695 million in May. He consulted with three real estate agents about the asking price and quickly found there was no demand:

“I had no response at all,” Giacoia said. “There was not a phone call, nor was there a person that came to any of the open houses.”

Desperate, the 70-year-old retiree was forced to lower the asking price by a whopping $400,000.

“Am I going to be lowering my price any more? No,” he said, who plans to move to Italy in October. He finally received an offer two weeks ago and, after some negotiation, the buyers agreed on the new asking price of $1.299 million. They’re currently finalizing the details of the offer. – Bloomberg

Price cuts in the Hamptons have become a new phenomenon after the pandemic boom: People who could suddenly work remotely flooded the luxury resort town on the southeastern end of New York’s Long Island two years ago. The influx of demand resulted in median home prices surging 88% between the second quarter of 2019 and the same quarter this year.

“Buyers have more negotiating power now than they did six months ago. The fervor that we were experiencing has subsided. The competitiveness for buying homes has waned,” said Drew Green, a broker in the Hamptons for Saunders & Associates.

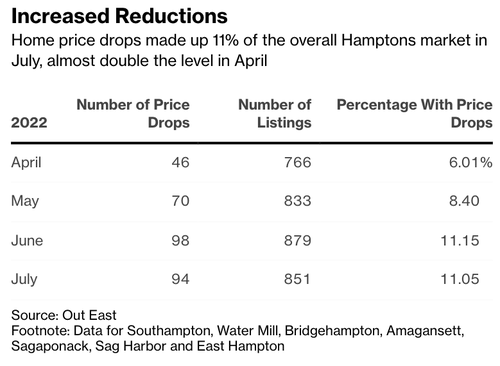

Housing data from Out East, an online marketplace for Hamptons real estate, shows that the number of listings with reduced asking prices has doubled between April and July, and inventory has increased.

There’s little doubt soaring mortgage rates, plunging stocks and crypto markets, slowing economic growth, and a so-called ‘technical recession’ have been some of the reasons for lackluster demand for homes.

Compass broker Jack Pearson, representing a mansion on 37 Huntington Lane, said price discounts are accelerating, though he said not all sellers are receptive to lowering asks.

“With the economy and with uncertainty in the world there are definitely people who think that prices will go down and they’ll wait,” Pearson said. “But it doesn’t mean that what they are waiting for, if it’s a prime property, it will be reduced by that much.”

Another seller was outraged by the response her $1.895 million home received on the market. Leslie Reese, 65, said her three-bedroom, two-bathroom home in Bridgehampton received an offer for $500,000 below list.

“I thought it was a fluke,” Reese said. “I guess they feel you’re in a desperate situation and feel like they can get a bottom price, but I have a budget.”

After two weeks on the market, she lowered the asking price by $250,000. The home on 17 Worchester Court is under contract for $1.5 million in an all-cash offer.

Here are other examples of homes in the Hamptons with price cuts this summer:

60 Harbor Dr., Sag Harbor

April 1 price: $2,995,000

July 28 price: $2,600,000

Reduction: $395,000

107 Stoney Hill Rd., Sag Harbor

April 8 price: $5,295,000

July 31 price: $4,795,000

Reduction: $500,000

16 McGregor Dr., Southampton

June 24 price: $1,995,000

Aug. 1 price: $1,795,000

Reduction: $200,000

17 Worchester Ct., Bridgehampton

July 22 price: $1,895,000

Aug. 6 price: $1,650,000

Reduction: $245,000

46 Cedar St., East Hampton

May 19 price: $4,500,000

Aug. 5 price: $3,950,000

Reduction: $550,000

26 Woodbine Pl., Southampton

May 29 price: $1,695,000

July 31 price: $1,299,000

Reduction: $396,000

320 Noyack Rd., Southampton

May 9 price: $2,695,000

July 27 price: $2,199,900

Reduction: $495,100

6 Joshuas Path, East Hampton

April 8 price: $3,350,000

Aug. 9 price: $2,995,000

Reduction: $355,000

68 Old Trail Rd., Water Mill

July 9 price: $2,495,000

Aug. 4 price: $2,290,000

Reduction: $205,000

16 Delavan St., East Hampton

May 13 price: $1,795,000

Aug. 8 price: $1,695,000

Reduction: $100,000

A seismic shift in the housing market is already underway as sellers in Hamptons missed the window of opportunity earlier this year and during the pandemic to unload their mansions at hefty premiums. Because of interest rate hikes and a downturn in the economy, buyers aren’t showing up, forcing sellers to cut prices. This is how housing markets reverse.

Tyler Durden

Tue, 08/23/2022 – 23:05

via ZeroHedge News https://ift.tt/LGIW9wB Tyler Durden