Is This The End Of The Yuan As We Know It?

Authored by Simon White, macro strategist at Bloomberg,

The yuan will increasingly be used as a lever to fend off growth risks from capital outflows and a heavy debt burden.

The recent fall in the currency has much further to go, with the mounting risk China abandons its fixed exchange-rate regime altogether.

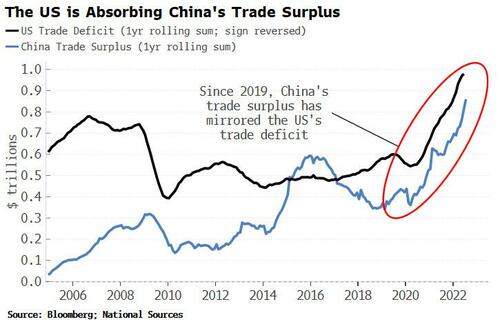

It might seem odd that the yuan has been weakening against the dollar while China’s trade surplus has been ballooning.

But this gets to the heart of China’s problem — and why a potentially weaker yuan is likely to be part of the solution

Since the pandemic, China’s trade surplus has risen sharply, increasing by almost half a trillion dollars, closely mirrored by the increase in the US’s trade deficit. This is now a monumental global imbalance that will have ongoing ramifications

That’s down to the different policies pursued by China and the US in the wake of the pandemic. While the bulk of US support was aimed at supporting jobs and the consumer, China focused on the export-facing SOE sector

A cornerstone of China’s growth model since it entered the WTO in 2001 has been to orientate the economy toward the export sector to the detriment of the household sector. Households have been indirectly supporting the export sector in various ways, such as artificially low deposit rates

As a result, household consumption’s share of GDP fell to lows rarely seen in any country in the modern era. The share had started to increase, but since the pandemic it has been falling again

While globalization was still on the march and wages in China remained highly competitive, gains to the export sector outweighed losses to the household sector and, with the help of debt, GDP growth stayed strong

But now the household sector is being repressed on three fronts:

-

financially, through transfers to the SOE sector;

-

socially, through Covid lockdowns; and

-

residentially, through a plunge in property prices — imperiling debt values along the way

The fallout is now outweighing the gains in the export sector, leading to weaker GDP.

Moreover, the trade imbalance is worsening on two fronts: not only are exports rising, but imports are stagnating due to falling household demand

That is putting immense strain on the nominally-closed capital account, intensified by the increasing amount of foreign capital leaving China as global tensions mount

In a managed-exchange-rate regime such as China’s, capital outflow causes credit to contract, exacerbating the growth slowdown. An easy lever to reduce some of this pressure is to allow the currency to weaken

That is what China has been doing, allowing the yuan’s dollar fixing to rise (it’s been been fairly stable against the CFETS FX basket), and cutting key lending rates

Thus the size of China’s trade surplus now betrays the extent of the economy’s weakness, not its strength, and that’s why more yuan weakening is on the way

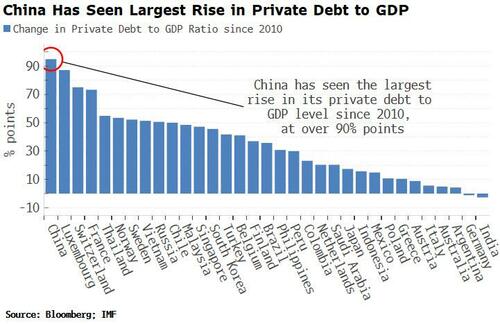

But slowing growth is exposing an even bigger weakness: the heavy debt burden. China has long been a candidate for a debt-driven bust. The country has seen the largest rise in private debt-to-GDP ratio of all major economies since the GFC

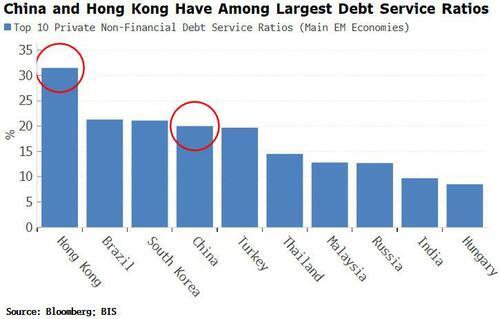

Steady growth can keep a lot of boats afloat, but when it slows, the huge debt pile becomes problematic. Russell Napier of Orlock Advisors argues that China is at risk of falling into a debt trap. I would agree. He notes that the private-sector debt-service ratio in China is now over 20%, normally taken as a danger level; a level of 18.4% was enough to tip the US into a debt crisis in 2008

Alarmingly, China — and Hong Kong — have the among the largest debt-service ratios in the world

The situation is worsening as the property slump gathers steam, foreign capital leaves and growth slows. A weaker currency will become one of the few options to alleviate what would be the disastrous consequences of a debt trap

In Napier’s view, this will eventually force China to drop its fixed exchange rate altogether and pursue an independent and reflationary monetary policy.

Again, I am inclined to agree

Allowing the yuan to weaken more or float freely has global implications, and many risks –- not least more capital flight –- but in China’s eyes this may soon become the lesser of two evils

Tyler Durden

Thu, 08/25/2022 – 17:40

via ZeroHedge News https://ift.tt/FgdqEVw Tyler Durden