Nomura: A Powell “Nothing-Burger” Tomorrow Risks Being Interpreted As “De Facto Dovish”

Jackson Hole has begun and the hawkish messaging is clear.

Kansas City Fed President Esther George said:

“It’s very important that we are clear in our communication about the destination we are headed… We have to get interest rates higher to slow down demand and bring inflation back to our target.“

Perhaps most notably, George stressed that:

“We want financial conditions to tighten along with the direction we are moving around policy.”

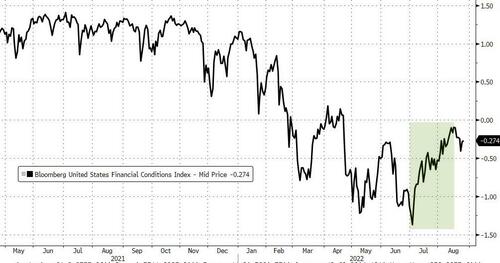

And as Nomura’s Charlie McElligott has been stressing recently, the market just isn’t acquiescing. In fact, since the start of July, despite all the hawkish FedSpeak, financial conditions have eased dramatically as traders price in the “Fed Pivot”…

Source: Bloomberg

In fact financial conditions are now easier that they were before The Fed started hiking rates…

Source: Bloomberg

This hawkish messaging was confirmed by ‘pause’-man himself, Atlanta Fed President Raphael Bostic, who warned in a WSJ interview that:

“I think it’s going to be really important that we resist the temptation to be too reactionary, and really make sure that we get inflation well on its way to 2 percent before we take any steps to increase accommodation in our policy stance.”

Ironically, this hawkishness is set against a tailwind of highly debatable / highly politicized global fiscal stimulus:

-

In US (farcical Student Loan relief & IRS ex post facto waving of COVID late fees -announcements yesterday…while overnight, we see a fresh directive from the White House’s budget office to stop weighing medical debt in Federal loan approvals);

-

Chinese fiscal stimulus (adds another 1T Yuan / $146B USD of special local govt bond funding and lending quotas last night targeting infrastructure spending, on top of other easings and stim since June and recent rate cuts); and

-

European fiscal stimulus / Energy subsidies for consumers (Bloomberg estimates $279B of “energy crisis rescue cash” from governments in total now—helping German IFO top consensus and seeing GDP revised marginally higher as well, largely thanks to said Energy price caps from the govt to shield consumers).

As McElligott warns, these ‘stimmies’ are likely act to incentivize short-term CONSUMPTION and DEMAND CONSTRUCTION, at a time when central banks are attempting to create DEMAND DESTRUCTION to re-gain control of the inflation spiral.

So, looking int tomorrow, the Nomura strategist warns that this already feels like yet another Jerome Powell “nothingburger” with low expected signaling output, where I’d assign a rather “SAD!” 90% prob that the Fed Chair can only disappoint versus purportedly “hawkish” expectations.

As a reminder, even Goldman questioned “did Powell really mean to be so dovish?”

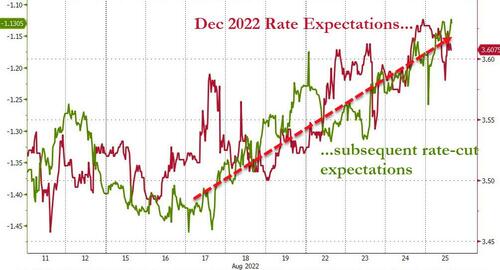

With the last two weeks seeing STIRs shifting significantly hawkishly…

Source: Bloomberg

McElligott exclaims that Powell SHOULD BE “leaning-in” hawkishly at this juncture in order to push-back against the following:

-

Easier FCI now than since the Fed hiked rates 75bps in July

-

A backdrop where global Energy prices are once-again reaccelerating higher (WTI $95, Brent $101.50, US Nat Gas highs since ’08, Asian LNG benchmark JKM LNG +17.6% on the day to a new record high, aforementioned new record highs in 1y fwd German and French electricity)

-

Still- overheating US Labor, with the US U-Rate at 50 year lows and Wage Growth at all-time highs

-

Services CPI (less Energy), Atlanta Fed Sticky CPI 12m, Cleveland Fed Trimmed-Mean CPI and Dallas Fed Trimmed-Mean PCE 1Y all still at their highs

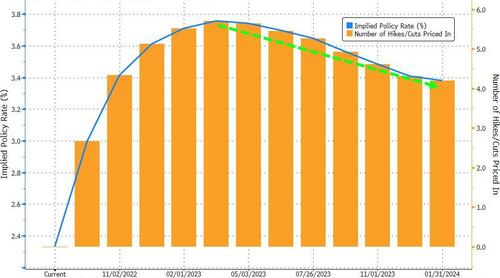

Accordingly, McElligott fears that Powell risks instead being interpreted as “de facto dovish,” because he will not do the one thing needed to tighten FCI from here, and that would be for him to increase “terminal rate” expectations – because:

1) he doesn’t have next month’s CPI or Jobs data yet – so he wont risk a “bad guide” now that they’re out of that business;

2) he will likely offset his “stay the course” inflation message by simultaneously mentioning “increased pain” in the economy as per recent US survey data, which various Fed staff has recently done in acknowledging rising recession risk; and

3) all with the potential that he too may have “weak” Core PCE Deflator and Personal Spending / Personal Income data in-hand after being released earlier Friday morning, which very well could continue to support the “past peak inflation” feel-good “comfort blanket” for markets.

“I know what they should do, which is they should not blink…”

“The Fed has to focus on inflation and has to do it in a more committed fashion than it has done it so far.”

So, the real question / the real danger moving forward, however, is not whether “inflation has peaked”, the question is “how sticky” will it be on the way down, especially with the unemployment rate this low and Wage Growth this high (trimmed mean and services remaining near highs and energy picking back-up, although we are getting inventory glut and supply chain easing in other spots, while areas like used cars continue to give back).

In other words, as McElligott concludes, this is a scenario where inflation tension is simply perpetuated even longer into the future, which also points to my buzzline “higher rates / more restrictive policy for longer,” then naturally increasing “hard landing” odds (hence EDM3-Z3 Jun23-Dec23 still pricing 35bps of CUTS for the back half of 2023).

This then brings me back to that idea I’ve been speaking too, where in 4Q22 or 1Q23, there is one last Equities scare, as growth is def slowing much more definitively (currently it’s “just” Housing and Surveys / Biz Cycle Indicators leading the data slowdown), but inflation remains problematically “sticky higher” than most anticipated – which is what I’ve termed the “now what?!” Stagflation scenario.

Perversely, McElligott notes that it is only once we begin seeing negative NFP prints that you can start getting constructive US Equities, because that will allow the Fed to move the goalposts back towards their dual-mandate of price stability AND full employment which will allow them to exit restrictive policy territory via “easing” and / or early cessation of QT likely in back part of ’23.

In other words, the news is not bad enough to be good enough for a sustained rally in stocks… yet!

Tyler Durden

Thu, 08/25/2022 – 12:05

via ZeroHedge News https://ift.tt/z06rRfM Tyler Durden