Russia And Saudi Arabia Are Battling For Oil Market Share In Asia

By Cyril Widdershoven of Oilprice.com

After months of increased Russian crude oil and petroleum product volumes heading to Asian customers, mainly China and India, Russian oil is now facing stiff competition. The first signs of a potential reversal of Moscow’s luck in Asia are showing as media reports that Russian crude oil volumes to India have fallen for the first time since March (the start of the Russian invasion of Ukraine). Indian refiners are reported to have lifted more term supplies from Russia’s main rival, Saudi Arabia, as Aramco’s price setting strategy has made its crude more attractive as Russian prices increased due to robust demand. The growth of India’s crude oil imports from the Kingdom in July came at the same time that Saudi Arabia increased its supplies. Industry reports showed that India imported 877,400 bpd of oil from Russia in July, a decrease of 7.3% compared to June. For India, Iraq is still the largest supplier, and Russia is second.

India, the world’s 3rd largest oil importer and consumer, imported 3.2% less oil in July than a month earlier. Total volumes in July were reported to be around 4.63 million bpd. The main reason given for the decline is planned refinery maintenance in August. Reports also stated that Saudi Arabia supplied 824,700 bpd (25.6%) in July, which is the highest level in three months. A possible driver behind this change is that Aramco lowered the official selling price (OSP) of its oil in June and July. Most of the Indian refiners have term contracts with Saudi Arabia so they can adjust volumes slightly but they cannot cut drastically.

India’s total crude oil import volumes from the Middle East declined slightly last month. The main country hit was Iraq, which saw its volumes cut by 9.3% in July, bringing Iraqi export volumes below the 1 million bpd mark for the first time in 10 months. Until now, Russia still holds strong, mainly due to Indian demand for Russian ESPO grades (diesel rich), putting pressure on West African producers at the same time.

In the coming months, all eyes will be on India as international pressure builds on Delhi to change its pro-Russian oil policies. The Biden Administration has been very deliberate in its approach, putting pressure on Delhi to minimize its import of Russian oil and petroleum products. European countries seem to be following Washington’s lead, trying to coax India away from its addiction to Russian oil. The first reactions from the Indian government, however, would suggest there is no real inclination to comply with this pressure as most politicians are worried about high energy and food bills.

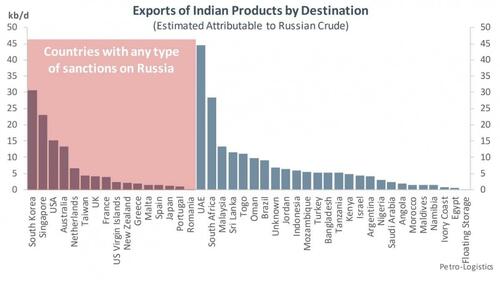

Recurring reports that Russian crude and petroleum products bought by India are finding their way to Western markets have been causing a stir. Western politicians, especially in NW Europe, will have to confront India on these issues if they don’t want it to become a domestic problem. As the Petrologistics graph above shows, Russian-Indian oil is still reaching Western markets.

Meanwhile, Saudi Arabia is slowly getting into the swing producer game in Asia. While the Kingdom hasn’t shown any real determination to aggressively regain market share in Asia, Riyadh is always eager to beat a competitor. By increasing its official production volumes in June by 218,000 bpd to hit a level of 8.79 million bpd, the Kingdom is slowly putting pressure on others. On a year-on-year assessment, Saudi Arabia’s oil exports increased by 20.1% or by 1.47 million bpd in June 2022. Month-on-month, Saudi crude exports increased by 146,000 bpd to 7.2 million bpd in June. The total increase doesn’t mean a full-scale production increase, as Saudi Arabia’s oil inventory (crude oil and products) dropped by 1.01 million bpd in June, although that is a relatively minor dropped compared to the 234.7 million barrels that remain.

In the coming months, markets will be watching not only India’s oil import strategies and China’s economic market conditions but also a possible internal OPEC+ market share conflict. While Riyadh and Moscow are still very much allies, internal differences and opportunities to cut into the opponent’s market share are appearing. The impact of the latest EU oil sanctions may be slow, but it will force Russian oil volumes to already constrained markets. Possible Western sanctions on 3rd parties, especially India and possibly China, would open up even more opportunities for the Kingdom. Whether Aramco or its compatriot ADNOC will take advantage of such a move remains unclear, but the world’s swing producer still has some oil production to play with. In contrast to Moscow, the financial reserves of Saudi Arabia are filled to the brim, giving it some space to play with OSPs if needed.

Tyler Durden

Sun, 08/28/2022 – 08:10

via ZeroHedge News https://ift.tt/6ft1uyY Tyler Durden