Oil Surges As Supply Takes Center Stage

Oil’s recent rebound has the potential to run further as traders will turn their focus to the upcoming OPEC+ meeting now Jackson Hole is out of the way, Bloomberg’s Sungwoo Park writes.

Crude is sharply extending gains on Monday, suggesting oil is now focused more on supply dynamics following the recent Saudi pivot than on a hawkish Powell. Indeed, the medium-term outlook for crude has improved since the Saudi energy minister’s comments on potential supply curbs last week, with more OPEC+ members aligning themselves with the kingpin.

These add key support to the positive backdrop on the supply side amid a prolonged energy crisis in Europe, along with the prospect of renewed exports from Iran getting undermined lately (just as we have been warning all along for the past year).

OPEC+ will no longer tolerate the idiotic “imminent” Iran nuclear deal headlines

— zerohedge (@zerohedge) August 22, 2022

That should help overshadow bearish factors, especially fears about demand destruction amid recession risks. Oil’s timespreads remain in backwardation (which is of coursebullish).

With OPEC+ taking the driver’s seat again, crude can get a fresh impetus if the alliance delivers what the oil bulls want to hear – or a surprise beyond expectations – at the Sept. 5 meeting.

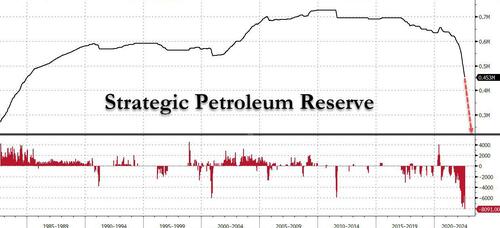

Finally, a reminder that perhaps the main reason why oil prices haven’t exploded even higher is the weekly drain of ~5 million in oil from the SPR. However, all that is ending in two months at which point the SPR will shift from a tailwind to a headwind for lower energy prices. It’s also why, in what appears a sheer act of desperation, the IEA’s head Fatih Birol just blurted out confirmation to what Zoltan Pozsar said, namely that a commodity supply panic is imminent, saying that a further SPR releases is “not off the table.”

Not off the table? Does he plan on taking it negative?

Tyler Durden

Mon, 08/29/2022 – 10:39

via ZeroHedge News https://ift.tt/bYaAI3r Tyler Durden