“The Only Way We Are Getting Big Rate Cuts Next Year Is Alongside An Economic Collapse The Pushes Us Off A Cliff”

By Michael Every of Rabobank

‘Head like a Hole’ like J-Hole in the head

This Daily repeatedly warned inflation wasn’t ‘transitory’: it wasn’t. It warned lower rates would be higher: they are. It also warned ‘lower for longer’ would be ‘higher for longer’ as the markets implied ‘Fed pivot!’ Jackson Hole confirmed all three of our views. However, there was a hole in the Hole on why we are here and so what the implications are.

A day flight from Australia to Asia left me a ‘hole’ lot of time to muse ahead of Powell’s speech. On TV, I watched the billionaires in Billions ‘saving the world’…for profit. I couldn’t find the music I wanted, Pink Floyd – but read that Wall Street wants to buy their back catalogue: sing along, kids and Pigs: “Come in here, dear boy, have a cigar…. Everybody else is just green; Have you seen the chart? It’s a helluva start; It could be made into a monster; If we all pull together as a team. And did we tell you the name of the game, boy; We call it ‘riding the gravy train’” I read déjà-vu of “economic war = higher inflation and rates”; an anti-Semitic rant from Pepe Escobar cheering Western poverty and Russian riches; and The American Mind arguing ‘Finance Means Betting on People – Not Numbers’ using Marxist arguments –“Live vs. dead credit” is “productive vs. fictitious capital”– and savaging global markets for failing: “both to stimulate wealth creation and even to control risk when it becomes detached from the ultimate aim of allocating credit to people who will use it to create more wealth… Allocators look for “safe” investments insulated from the messy world of entrepreneurial risk-taking… Best of all… is anything with a government guarantee…even [in Silicon Valley] a large share of capital goes into copycat ideas, zero-sum battles, or financial businesses with a thin tech veneer.” How relevant to J-Hole!

Indeed, we have a hole where productive investment needed to be to prevent our crisis, as food prices soar, European energy hits mind-blowing highs, France’s Macron says it is “the end of abundance”, Germans stockpile toilet paper, and Belgium’s PM warns of the next TEN European winters being difficult. Clearly, we are close to banana republic stagflation – without the bananas. Do we get a Western energy price cap, as France is hinting? When you see the 10x energy price hikes SMEs are facing, it must surely be a death blow to neoliberalism’s “because markets”. Yet that would mean Western demand won’t fall, and out-bid emerging markets freeze and/or starve: and Pepe Escobars are elected all over. Such a move would ironically also make DM look like EM, as a sub-dollar parity EUR is already warning. Yet not capping energy prices would make DM look like EM in terms of crashing real incomes and social and political unrest.

Would J-Hole address the failures of ‘Billions’ as a political-economy model? After all, 90% of Australia’s fuel supplies will dry up if the South China Sea sees fighting, with only two weeks of inventory: neither the state nor the private sector built any oil refineries at normal or low rates because ‘dead credit’ goes into housing. Relatedly, the US Energy Secretary who laughed at the idea of increased fossil fuel production just sent a letter to oil refiners stating: “Given the historic level of US refined product exports, I again urge you to focus in the near term on building inventories in the US… It is our hope that companies will proactively address this need… If that is not the case, the Administration will need to consider additional Federal requirements or other emergency measures.“ So, US export bans ahead? More of an energy crisis abroad, if so.

Would J-Hole note the crisis goes far beyond energy? After Covid PPP failures, we also see the RBA couldn’t retain a local auto sector to spill-over/convert to the military in a crisis, as it holds a hurried strategic defence review. The Fed couldn’t retain the US industrial base needed to carry the load of a major war: it won’t have the Navy it needs for many years. Europe has industry convertible to military needs – but not with these energy prices. What good is monetary policy when it leaves us behind this national-security curve? Central banks were created to fight wars, not inflation and “National security remains the irreducible function of the state.”

Would J-Hole note trends against their neoliberal worldview? An Aussie government minister declaring the ‘gig economy’ a “cancer” on the economy; my Aussie taxi-driver with a degree in engineering and thermal dynamics who can’t get a job due to off-shoring and HR departments run by young apparatchiks who value social media skills over being able to manage sulphuric acid pumps; the Aussie Greens calling for a two-year national rent cap and a 2% cap on rises after that; UK Tories imploding for NOT shaking the status quo up more, and just 6% of 18-24 year olds planning to vote blue; and MAGA now being “semi-fascism”, apparently.

So to J-Hole and its title of ‘Reassessing constraints on the economy and policy.’ How apt! What larger constraints on monetary policy are there than knowing that raising rates ruins the unproductive parts of the economy but doesn’t incentivise the productive parts we desperately need, and lowering rates only incentivises socio-economic necrosis? Not a word of this was mentioned by Powell in his keynote eight and half minute speech.

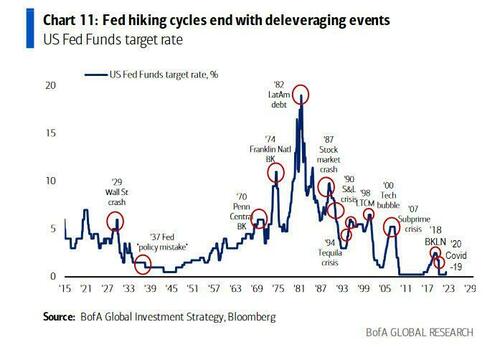

Powell said rates will go up and won’t come down in a hurry: “Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance… [it] will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.” As Philip Marey covers here, we will likely see another 50bps in September, November, and December, taking Fed Funds to 4%.

However, he didn’t mention the crumbling global architecture driving inflation higher, or propose any solutions beyond driving demand down. Central bankers who love to talk outside their policy remit are quiet, as if the inflation and war they didn’t see coming, like the GFC, happened in a vacuum, and will decline in a vacuum.

To be fair, the IMF and World Bank heads both made clear that the supply-side backdrop was going to make monetary policy much harder for at least the next five years, as we face the most challenging backdrop in decades (read: the 70s). However, Singapore’s leaders are telling their public to “get real”; that the country must be able to stand on its own two feet; the atmosphere is like that before WW1; and the population needs to psychologically prepare itself for the risk of regional conflict. Watch this video and ask why we can’t all have this kind of brave leadership from central banks and the IMF and World Bank too.

Friday’s equity drop showed some were in denial: many still hope data will ‘save’ them. Yes, the latest PCE inflation was marginally weaker than expected, but CPI will not come down until geopolitical crises are resolved. Low demand growth does not mean low supply-side inflation. Epitomising this, Bloomberg just raised their terminal prices by 10% when many funds face terrible returns this year! As it stands, surely the only way we are getting big Fed rate cuts next year, at least without larger hikes to follow, is alongside an economic collapse that will push us not just into a hole, but off of a cliff.

[ZH: which, incidentally, is precisely what we have been saying all along is bound to happen]

If J-Hole produced brave and intellectually honest assessments it would have said rates are only part of the solution to this economic war, which the IMF and World Bank implied. Moreover, if we have a 2% CPI target, why can’t we have a median wage target; a productivity target; a target for the % of GDP accounted for by industry; for spare capacity in critical areas; share of imports in key sectors; and trade concentration? (Of course, you won’t hear any of that!)

Logically, we need sustained higher rates to: crush dead/fictitious credit/capital; push down the price of commodities paying for the other side’s war-machine and claiming to back new dollar rivals; and to suck Western capital out of rival economies to pump it into more geopolitically-friendly alternative destinations. This will blow up the dead/fictitious credit/capital without incentivising investment in what we most need: many important things *lose* money, but we all lose without them. ‘Billions’ won’t do that job, and if ESG could we wouldn’t be worrying about boiling, freezing, starving, or the inability to do any fighting.

Assuming nobody will pay higher taxes –because the rich won’t, and the poor can’t– then that logically leaves only two paths.

- First is MMT, yet even that theory says don’t print when inflation is high. The American Mind article added, “we know what happens when we allow the boundless desires of politicians to become the basis of credit creation.” And President Biden just gave students debt relief of $10-$20,000 owed to rich, rentier private universities specialised in the dead/fictitious because of a “

MidtermCovid emergency”: even the Washington Post calls it “a regressive, expensive mistake [which] will provide a windfall for the upper-middle class and wealthy – with American taxpayers footing the bill.” Yet MMT **only** into live/productive credit/capital areas such as agriculture, energy, industry, infrastructure, and defence , and into local/bloc supply chains not imports, might work, even if it means more inflation now. That is de facto industrial policy and Bretton Woods-era credit rationing to reallocate scarce resources and maintain social stability, if central banks read their own history. (And isn’t the ECB starting down this path with its anti-fragmentation policy? All it needs it state supply-side spending now.) - Second is to force private capital to do the things society desperately needs by narrowing its horizons. That means: telling banks what to do; high tariffs; capital controls; credit rationing; and moral suasion like under China’s “Common Prosperity”. Any Western takers?

Both paths lead to a bloc/values-based neo-mercantilism: thus the IMF and World Bank silence. Both are inflationary short-term and mean higher base inflation long-term. Today the Financial Times says “A post-dollar world is coming”. I will take the other side of that bet, while agreeing the can-still-soar-higher-than-this US dollar won’t be used in certain balkanized parts of the world ahead – and good luck to them with their choice of replacement.

On this note, the US Justice Department has blocked Maersk selling its box manufacturing unit to the Chinese because it would have combined two of the world’s four suppliers of refrigerated shipping containers, further concentrated the global cold supply chain, and consolidated control of over 90% of insulated container box and refrigerated shipping container production in Chinese SOEs or state-controlled entities. Somebody sees we are ‘in deep ship’ on the supply side. (Then again, the SEC signed a deal over audits of China’s US-listed firms: now to make them comply.)

J-Hole showed little intellectual honesty because it has a hole where an ideological “-ism” to frame what we are ‘allowed’ to do in this economic war should be. As Solzhenitsyn said: “Ideology – that is what gives evildoing its long-sought justification and gives the evildoer the necessary steadfastness and determination.” The Pepe Escobars clearly have theirs nailed down.

While we try to agree on one, it is clear that what the West needs like J-Hole in the head is Nine Inch Nails’ ‘Head Like a Hole’: “God money, I’ll do anything for you; God money, just tell me what you want me to; God money, nail me up against the wall; God money, don’t want everything he wants it all; No you can’t take it; No you can’t take it; No you can’t take that away from me; Head like a hole; Black as your soul; I’d rather die; Than give you control; Bow down before the one you serve; You’re going to get what you deserve.”

Tyler Durden

Mon, 08/29/2022 – 10:15

via ZeroHedge News https://ift.tt/efqYmhr Tyler Durden