Markets Are Turmoiling

A combination of macro reports and geopolitical headlines – along with a renewed anxiety over The Fed’s reaction function – has sparked serious turmoil in what are already super-illiquid markets this morning.

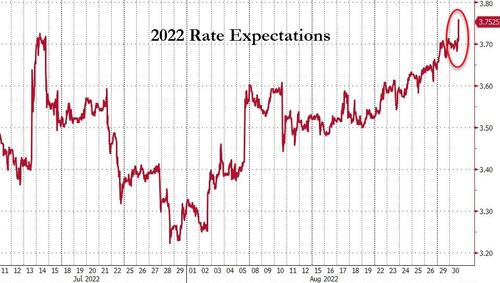

Fed rate-hike expectations have spiked this morning with Dec 2022 now at 3.75% – its highest during the cycle…

All the overnight gains in stocks are gone…

The Nasdaq is now down over 6% since Powell’s speech began…

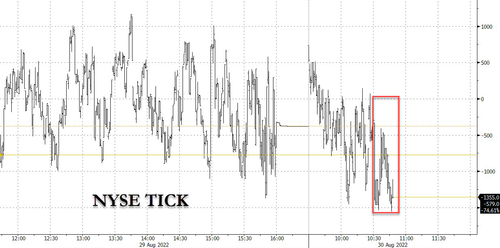

The selling pressure has been relentless…

All the US majors have tumbled to or broken below critical technical support levels….

…And if you think it’s over… it’s not yet…

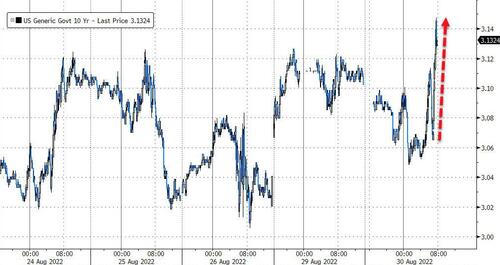

Initial safe-haven flows from the Taiwan-China troubles were quickly wiped away by ‘good’ news macro data which is now very much bad news for bonds and stocks in a hawkish-Powell world…

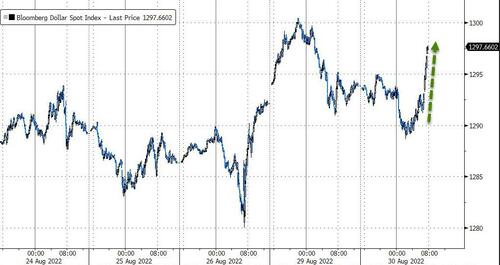

The dollar spiked on the hawkish-encouraging data (and again safe-haven flows)…

Bitcoin was smashed back below $20,000…

Gold is also losing steam…

And oil is getting clubbed like a baby seal (presumably on Iraq output reassurances)…

This is the ‘pain’ that Powell is waiting for.

Tyler Durden

Tue, 08/30/2022 – 10:56

via ZeroHedge News https://ift.tt/FXBWefJ Tyler Durden