Powell And Negative Gamma Leave Market Exposed

By Simon White, Bloomberg markets live commentator and reporter

Higher short-term real rates and falling gamma leave stocks exposed in the short term.

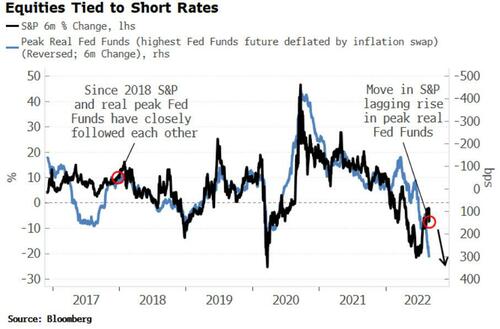

The jury was definitively in and Powell did what was broadly expected, renewing the Fed’s hawkish vows. This leaves equities exposed in the next few weeks as they continue to be heavily tied to short-term rates. Specifically, the real peak Fed Funds has a very tight relationship with the S&P. Real peak Fed Funds has risen lately, including 21 bps on Friday with Powell’s speech –- but the S&P has lagged the move so far, suggesting more equity downside is in the cards.

However, positioning in equities overall remains very short, increasing the risk of a squeeze. Sentiment has been improving, while internals such as the advance-decline line, the net number of stocks making new 52-week highs and the number of stocks trading above their 200-day moving average are constructive.

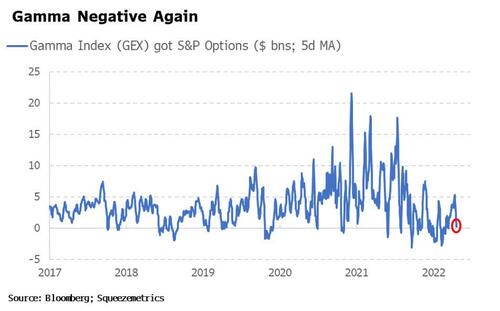

Nevertheless, we remain in a bear market, meaning there is a wide range of potential outcomes. Adding to the instability, net gamma is now negative, meaning a greater potential of more short-term follow-through on the downside.

As the market falls, short expiry, close-to-the-money calls see their delta rapidly fall to zero, while puts struck further out of the money that dealers are short of see their delta rise. This means dealers switch to having to sell after the market has moved lower, increasing the risk that downward moves are reinforced.

Volatility should thus remain supported. The VIX stood out as an attractive Jackson Hole hedge, and it has since risen, outperforming the move expected based on the fall in the S&P.

Tyler Durden

Tue, 08/30/2022 – 11:40

via ZeroHedge News https://ift.tt/z4hrlZd Tyler Durden