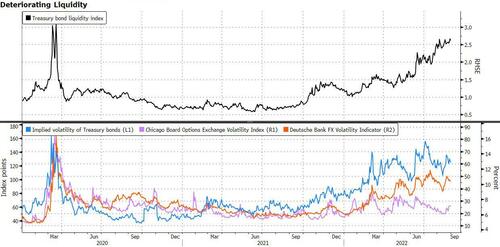

Treasuries’ Worsening Liquidity Points To Broader Market Turmoil

By Masaki Kondo, Bloomberg Markets Live commentator and reporter

Deteriorating liquidity in Treasuries points to turbulence across various assets.

A Bloomberg liquidity index that measures deviations of yields from their fair value climbed to the highest level since March 2020 this week.

Such “noise” in the US bond market suggests a general lack of arbitrage capital and tightening of liquidity in the overall market, according to a research paper from the National Bureau of Economic Research.

The apparent decline in arbitrage capital may be a result of persistently hawkish stance by the Fed and other major central banks amid historic inflation that’s at the same time fanning concern over a global recession.

The shortage of risk takers could create a one-way move in asset prices, especially when they are falling. Looking at implied volatility, the equity market seems to be most under-pricing such liquidity risks.

Tyler Durden

Wed, 08/31/2022 – 18:00

via ZeroHedge News https://ift.tt/hXLH2yM Tyler Durden